IT'S A "MOSH PIT" FOOD FIGHT TO GRAB & CREATE THE NEXT ETP INDEX OR ETF

--EXTRACTED & Condensed from CAPITAL EXPLOITS -- "A Gift From the Oldies" -

Global institutional pension fund assets in 22 major markets stood at US$36.4 trillion at year end 2016, amounting to 62% of global GDP.

That is a staggeringly large amount of money. Pension & Institutional funds are big cumbersome dumb money. And they're all allocated in equally dumb indexes, passive strategies, and bonds.

The passive bubble is growing bigger as I write this because this beast is fueled not just by all Street but more and more by the average investor getting back into the market. Like this recent New York Times article "Signs Of The Peak Former Target Manager Makes Millions Day Trading Volatility From His Bedroom"

Bloomberg just ran a piece:

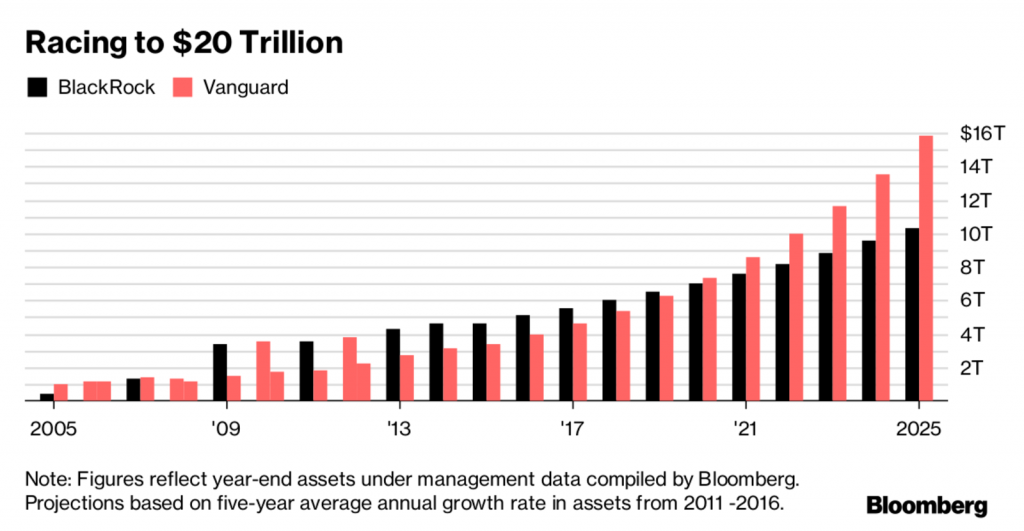

BlackRock and Vanguard Are Less Than a Decade Away From Managing $20 Trillion

Two towers of power are dominating the future of investing.Dominating indeed. Here's how come the pointy shoed crowd can afford Tom Ford suits.

Investors from individuals to large institutions such as pension and hedge funds have flocked to this duo, won over in part by their low-cost funds and breadth of offerings. The proliferation of exchange-traded funds is also supercharging these firms and will likely continue to do so.

These behemoths don't do battle in the little unloved sectors or with stocks that don't make it into an index. They can't because they're too big.

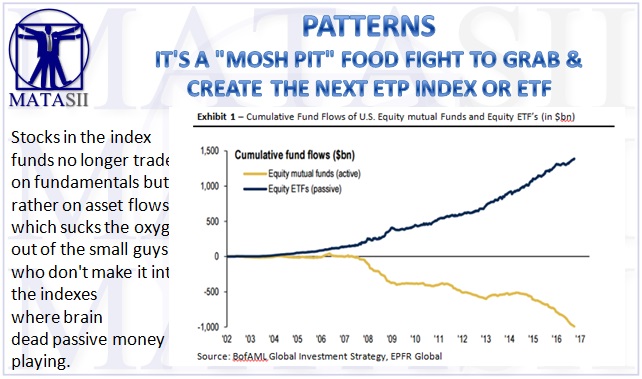

Here's your competition in active with the accompanying passive.

Right now, it's a mosh pit food fight to grab and create the next index or ETF so that more capital can be attracted, earning more fees, buying more suits.

This is all well and good.

Markets do what markets do, and I'm not here to grumble about it. I'm here to make money. And indeed if I was in the passive business, I'd be enjoying the steady stream of fees and hoping like hell the market keeps going up.

QE more? Yes, please.

Stocks in the index funds no longer trade on fundamentals but rather on asset flows, which sucks the oxygen out of the small guys who don't make it into the indexes where brain dead passive money is playing.

But what happens when pensioners start drawing down on their funds?