SII

BONDS & CREDIT

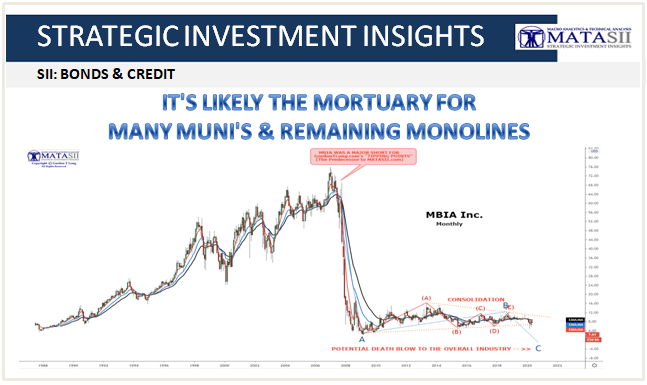

IT’S THE MORTUARY FOR MANY MUNI’S & REMAINING MONOLINES

SITUATIONAL ANALYSIS

- MUNI-BONDS: To backstop states and other municipal issuers, the Federal Reserve announced on April 9 that it will buy up to $500 billion of muni bonds from states, counties with populations of at least two million residents, and cities with at least one million residents. Only 10 cities and 16 counties nationwide are big enough to qualify, but states may use the proceeds from purchases by the Fed to support counties and cities as well.

- Earlier, on March 20, the Fed had previously announced that it would expand its purchases of municipal bonds to include those with maturities inside of one year. A few days later, on March 27, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act which authorized the Fed to buy municipal bonds of any maturity. The CARES Act also appropriated $274 billion to muni issuers, including state and local governments, health care systems, transit systems, and educational institutions.

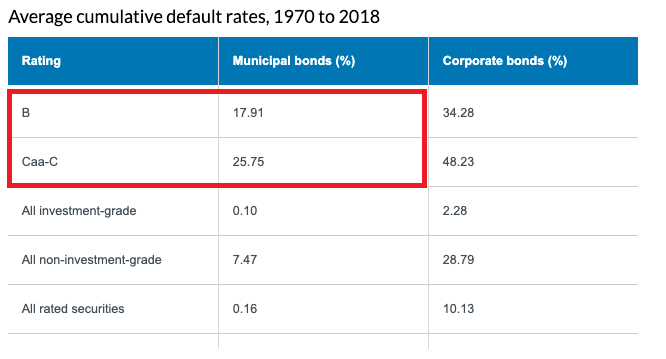

- Municipal budgets still face significant challenges due to lower tax revenues that result from widespread shutdowns of businesses. The passage of the fixed income market support provisions in the CARES Act are helping to stabilize the operations of the fixed income marketplace, and the liquidity facilities announced by the Fed on April 9 is a net positive for the municipal fixed income market but is still orders a magnitude short of what will eventually be required!

- The Fed has done a great job of identifying the liquidity bottlenecks in the market and of being proactive in addressing them however it fails to address the central issue of insufficient revenue and exploding costs.

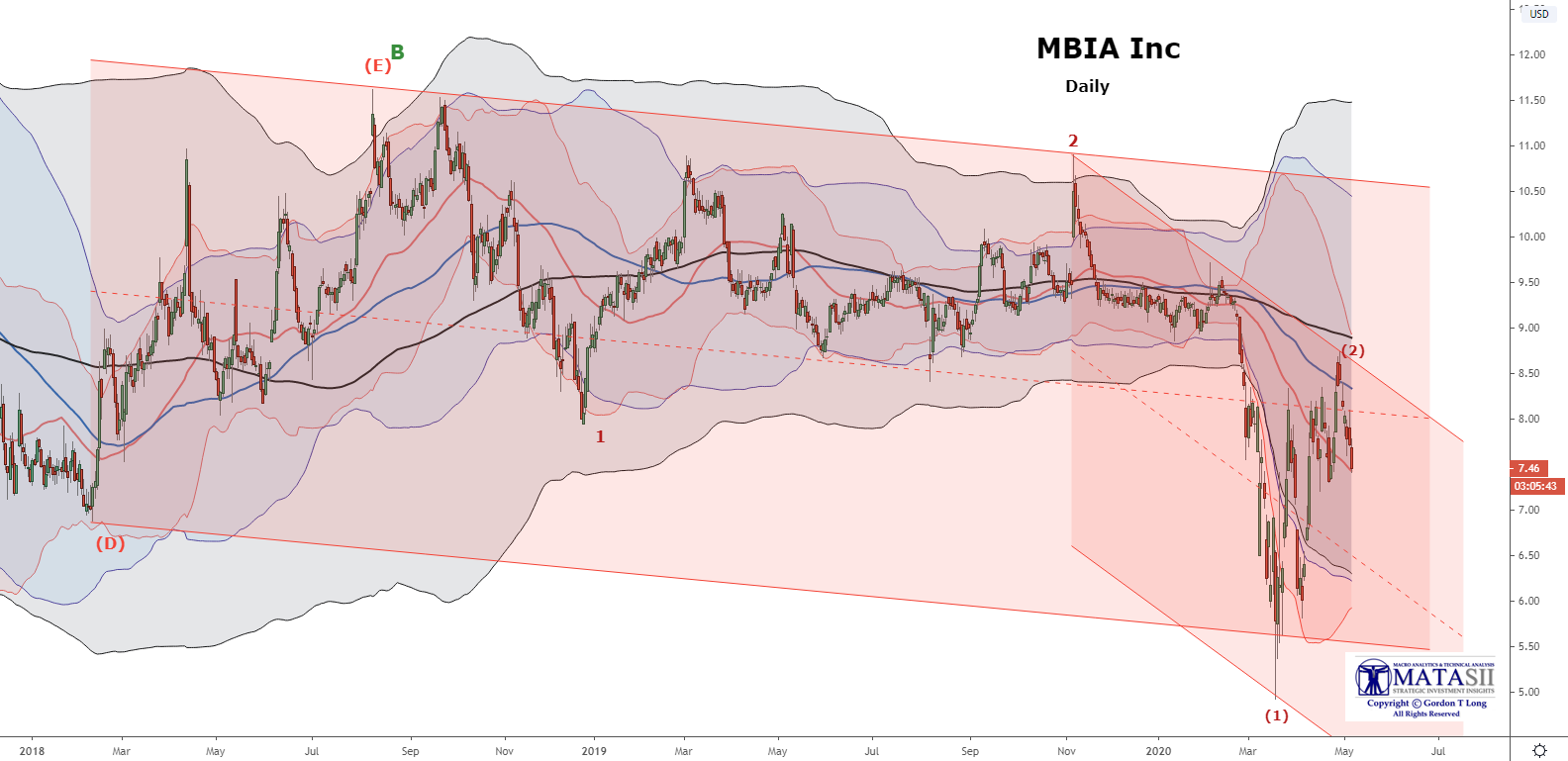

The 2008 Financial Crisis had a devastating effect on the monoline bond insurance industry as the industry shrunk dramatically and the seeds for future troubles became clearer.

Two major changes came out of the financial crisis that continue to threaten the health of this important industry that is critical to the Muni Bond market:

- The first was that interest rates declined to where the insurance fees dropped as much as 80 percent.

- This is because bond insurance had traditionally been structured to be of no cost to the issuer, i.e. the fees were based of the savings in interest expense due to the bonds being rated AAA versus the issuers rating which were usually A- or BBB.

- In theory, this ignoring of traditional underwriting principles was justified on the assumption that the insurer was writing coverage to a zero losses standard. This was, of course, a stretch in logic but was supported by Moody’s and Standard & Poor’s so long as they could get a piece of the fees on each deal for rendering their AAA imprimatur.

- The insurance fee structure was furthermore negatively impacted when S&P, and eventually the other rating agencies, downgraded the United States from AAA to AA+. This led to then downgrading the monoline bond insurers as well as the credit enhancement they actually could render. Along with the decline in interest rates, this proved to be a massive hit to the industry’s fee structure. Still, they forged on, but failed to convince bond buyers that their insurance was worth more than the credit enhancement differential which had become miniscule. This of course was reflected in minuscule yield differentials

- A second negative event for bond insurers since 2008 has been a redefining of just who is being insured.

- The financial problems of states and municipalities have been growing for decades as unfunded obligations for pensions and health care have ballooned in anticipation of a crisis sometime in the future.

- The pandemic has accelerated that crisis point.

We are seeing numerous municipalities assuming that, since they paid for the bond insurance, they are entitled to its benefits. Hence, there are an increasing number of instances of municipalities refusing to make their contractual debt service payments thereby requiring the bond insurers to step up and pay. Puerto Rico has gone so far on its insured issues that it now collects the interest payments as they come due from the insurer, and keeping the money rather than pay out interest to bondholders! The presumption in such actions by the municipal bond issuer is ludicrous, but defensible with taxpayers. Bondholders have yet to be heard from.

- We see the extraordinary actions taken so far at the federal level by both the Federal Reserve Bank and the Federal Government.

- Some of these municipalities only have enough cash to either pay employees or to make interest payments. Their choice is obvious. Will the Fed or Washington intercede, probably, but this is far from certain.

For monoline bond insurers the future choices are clearer. For too long, bond insurance has been treated as a credit enhancement tool. It has become a true insurance product.

- It’s time to treat it and price it as such or face possible ruin.

- One solution is to focus on selling insurance to the bondholders rather than the issuers.

- This concept has been tried in the past with very limited success since it could not compete with the low fees and higher costs from the credit enhancement approach.

- Now is the time for change IF THEY ARE TO SURVIVE AT ALL!.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.