JUNE AUTO INCENTIVES AVERAGE 11% - FORCED TO MARCH HIGHER

--SOURCE: 07-03-17 Automotive News -- "Incentives continue march higher as U.S. sales stall" --

Incentives represented 11% of average transaction prices in June

Automakers are steadily increasing incentive spending, as U.S. light-vehicle sales continue to slow heading into the second half of 2017.

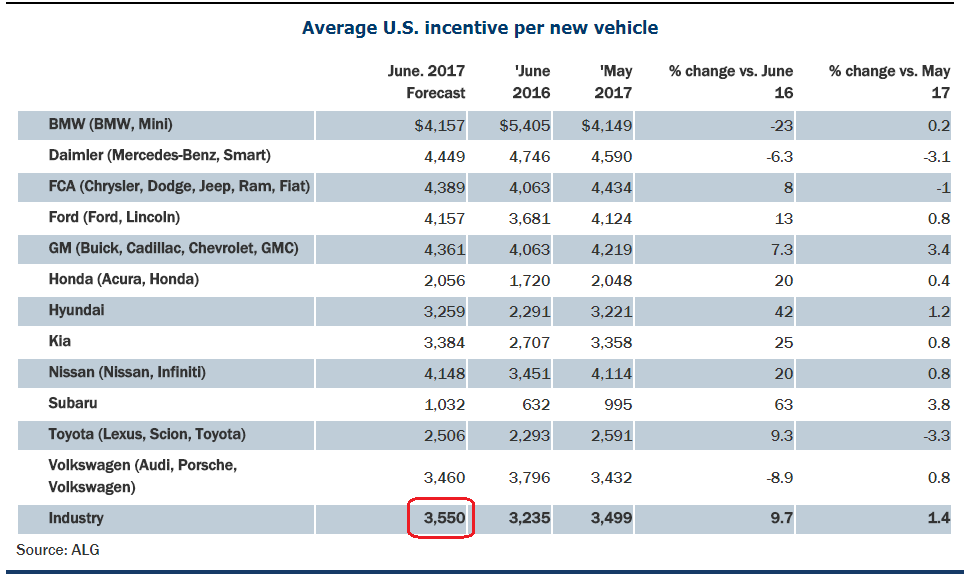

ALG reports automakers spent an average of $3,550 per new vehicle sold in June, up 9.7 percent from a year ago. The average discount is expected to account for 10.8 percent of the average transaction price of vehicles sold last month -- marking the 11th time in the past year that incentive spending has accounted for 10 percent or more of the sale price, according to industry forecasters.

"Despite a significant increase in the number of incentive programs going into the long July 4th holiday, many automakers held down incentives for much of June as they were getting inventory levels under control," said Brad Korner, general manager of rates and incentives at Cox Automotive. "One trend we're seeing is that automakers are committing incentive money directly to dealers. While it is not guaranteed cash for buyers, it should help dealers create the best deal scenarios for individual buyers."

With the U.S. auto market set to post a sub-17 million unit selling rate for the fourth month in a row, even as incentives rise, "nerves are being tested," Jeff Schuster, senior vice president of forecasting at LMC Automotive, said in a statement last month.

Schuster said the primary driver of the decline in U.S. sales -- down 2 percent through May -- is a pullback in fleet sales, which are projected to be down 8 percent for the first half of 2017. He noted, however, that retail sales during that same time period are projected to slightly decline even with the higher incentives.

Autodata Corp. says average incentive spending heading into June was up 15 percent to $3,516 per vehicle sold. Despite weakening demand for cars, incentive spending for light-duty truck increased 16 percent compared to 13 percent for light-duty passenger cars during the first five months of the year.

American automakers, which continue to offer the most cash on the hood, matched the industry average for incentive spending, up 14 percent through May, while average discounts at Asian brands increased 19 percent and deals at European automakers rose only 3.9 percent.

ALG reported Subaru, Hyundai and Kia experienced the largest increases in incentive spending in June compared with a year ago. Average discounts at Subaru -- the lowest spender in the industry -- increased 63 percent to $1,032; followed by Hyundai, rising 42 percent to $3,259; and Kia, with an increase of 25 percent to $3,384.

ALG reports the industry average for incentive spending last month was $3,550, up 9.7 percent from June 2016.

In terms of incentive spending as a percentage of average transaction prices, Nissan and Kia last month led the industry, with spending equaling 15 percent of their sale average sale price. Hyundai came in a close third at 14.4 percent, followed by the Detroit automakers between about 12-13 percent.

BMW Group, including Mini, is the only automaker heavily cutting back on incentives. ALG expects the German automaker pulled back incentive spending on average by 23 percent last month to $4,157 per vehicle sold.

Daimler and Volkswagen also were expected to have cut back incentives last month, however their rollbacks remained in the single digits.