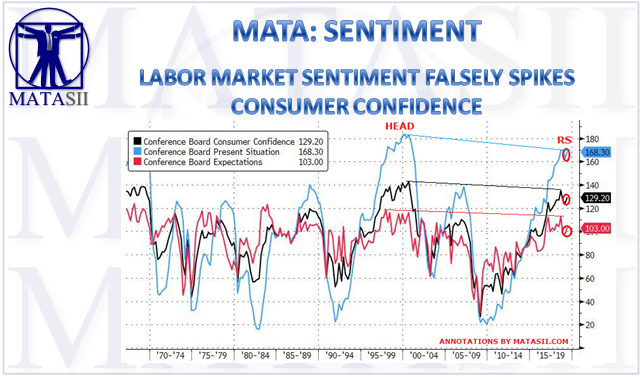

LABOR MARKET SENTIMENT FALSELY SPIKES CONSUMER CONFIDENCE

- The Conference Board reported that April Consumer Confidence rebounded from 124.2 to 129.2, a sharp beat to the 126.8 expected.

- The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – increased, from 163.0 to 168.3.

- The Expectations Index – based on consumers’ short-term outlook for income, business and labor market conditions – increased from 98.3 last month to 103.0 this month.

This followed several disappointing economic reports, including a continued slump in nationwide home prices and a crash in the Chicago PMI

WHY?

- Respondents' assessment of the labor market was more upbeat, with those stating jobs are “plentiful” increased from 42.5%to 46.8%, while those claiming jobs are “hard to get” decreased from 13.8% to 13.3%.

- As a result, the difference between the two series rose to 33.5, just shy of the highest print this cycle, and approaching levels last seen just before the dot com bubble burst.

“Consumer Confidence partially rebounded in April, following March’s decline, but still remains below levels seen last Fall." Franco noted that "the Present Situation Index, which had decreased sharply last month, improved in April, as did consumers’ short-term outlook. Overall, consumers expect the economy to continue growing at a solid pace into the summer months. These strong confidence levels should continue to support consumer spending in the near-term." -- Lynn Franco, Senior Director of Economic Indicators at The Conference Board

RESULT:

The small upward squiggle on the right side of the chart below (which we have circled):

[SITE INDEX -- MATA - SENTIMENT]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: SENTIMENT

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

Abstracted from: 04-30-19 - - "Consumer Confidence Spikes As Labor Market Sentiment Approaches Record High"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.