LANCE ROBERTS: SELL THE RALLIES!

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

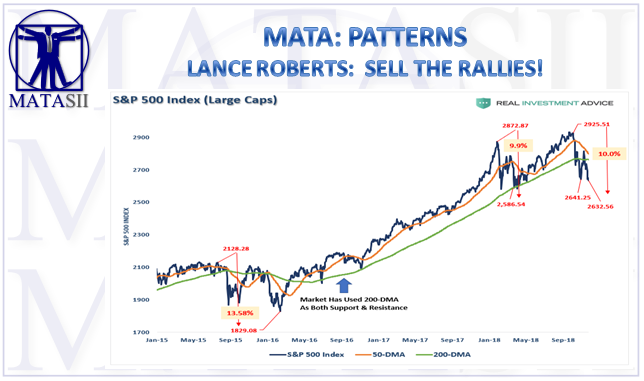

MATA: PATTERNS

11-25-18 - RealInvestmentAdvice.com Lance Roberts - "Oil Sends A "Crude Warning"

MATASII TAKEAWAYS:

- With the 50-dma sloping sharply lower and the 200-dma following suit, the backdrop of the market has turned decidedly “bearish.”

- On a rally to the 200-dma which fails, we will reduce risk more and add negative hedges to portfolios,

- On a weekly basis, the market is now extremely oversold on both a relative-strength basis and prices are pushing 2-standard deviations below the 50-week moving average,

Last week, we further reduced equity risk further bringing exposures down to just 40% of our portfolios. On a rally to the 200-dma which fails, we will reduce risk more and add negative hedges to portfolios.

Daily View

There is little good news to be had this week. The market broke recent lows and will now be looking to retest the lows of earlier this year. With the 50-dma sloping sharply lower and the 200-dma following suit, the backdrop of the market has turned decidedly “bearish.”

More importantly, and also a negative, is the market is now consistently trading below the 200-dma. This should serve as a warning to investors to reduce equity exposure on rallies and remain hedged until these trends begin to reverse themselves.

Action: After reducing exposure in portfolios previously, we reduced risk further this past week. Sell weak positions into any market strength on Monday.

Weekly View

As stated previously, since we prefer longer-term holding periods for our positions, we prefer to use weekly and monthly data to reduce the number of signals but reveals the more important overall trends of the market.

On a weekly basis, the market is now extremely oversold on both a relative-strength basis and prices are pushing 2-standard deviations below the 50-week moving average. As shown below, on a weekly basis, a “sell signal” has been registered for the second time this year suggesting that investors reduce equity risk in portfolios.

However, given the extreme oversold conditions of the market, look for a rally through the end of the year to make adjustments to overall risk exposures.

Note that such reversions from prior over-extensions are usually associated with more meaningful market events. However, as I noted on Tuesday at RIA PRO

“Currently, the market is oversold and is set up for a short-term bounce. In the next few days, we will look to add a trading position to portfolios for a potential year-end rally. As we have stated previously, we are moving into the ‘seasonally strong’ period of the year combined with a post-midterm election period which has historically equated to a positive push in the market.

However, nothing is guaranteed so the recent changes to portfolios to raise cash, shore up risk, shorten-durations, and increase credit quality all remain prudent actions.

Most importantly, while the market will indeed garner a rally over the next couple of months, such will not change the fact that we are in the midst of a substantially more important topping process. The chart below lays out the potential range for a bounce before a continuation of the current decline ensues.”

I want to caution you that by the time longer-term sell signals are issued, the market tends to be more extremely oversold and due for a reflexive bounce. It is still highly advised that bounces be used to reduce equity exposure until there is a definitive improvement in the overall technical backdrop of the market.

Action: Sell weak positions into any strength next week.

Monthly View

Moving back to a monthly view, signals become much slower and much more important. However, signals are ONLY VALID on the 1st trading day of each month. Therefore, while the markets have registered a monthly signal as of this week, it will ONLY be valid if the markets fail to rally enough to reverse it by the end of the month.

Nonetheless, the deterioration in the markets is extremely concerning and by slowing the signals down further to crosses of very long-term moving average, the risk to investors becomes much clearer.

Action: Reduce risk on rallies, as detailed above, and look to add hedges.

As always, the messages being sent by the market are more than just concerning and suggests that actions be taken to reduce portfolio risk on rallies in the weeks ahead.

I warned previously the Fed was likely to hike rates until something broke.

“But one thing is for sure…if something hasn’t already broken, it will break soon if rates keep rising.

That day may be much sooner than most expect.”

It continues to appear that day has come.