|

2- INCREASING TREASURY SUPPLY 2- INCREASING TREASURY SUPPLY

When the US Treasury issues more supply than spending, it is a stealth form of “Quantitative Tightening”

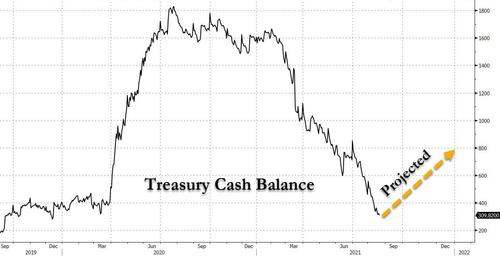

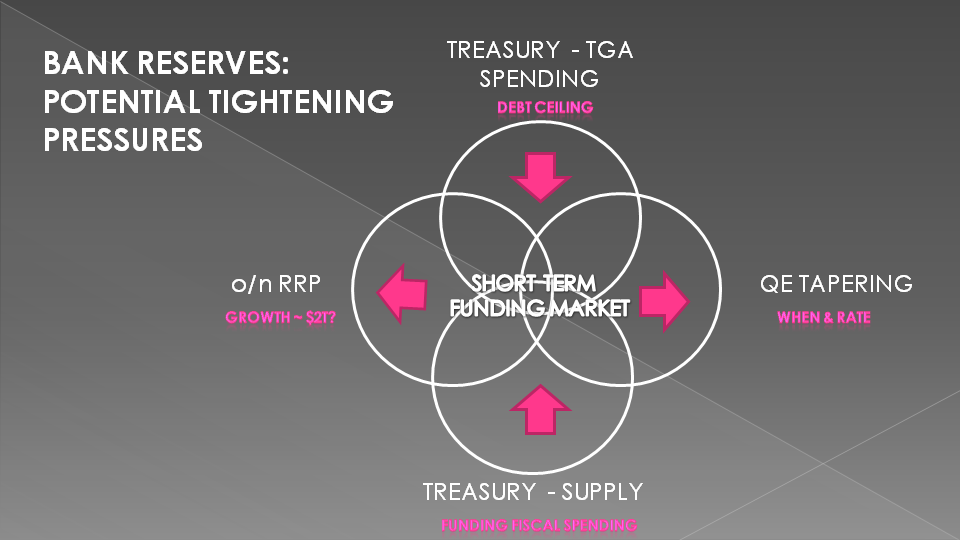

The US Treasury has trapped itself into being forced to unleash a massive Quantitative Tightening in the coming months which will drain a further $500 billion in liquidity by year-end.

The combination with the build in Reverse Repos (assuming it increases to a project ~$2.0T level with no ending of QE) amounts to ($800 + $500) $1.3T.

This will be higher if:

- US Treasury is forced to draw down the TGF to $0 from $300B due to delays in approval to defer the Debt Ceiling which could take the QT to $1.5T,

- Any amount of ‘Taper’ is implemented before year end,

- If the O/N RRP is forced above the currently projected #2.0T daily level.

The Man Group reports:

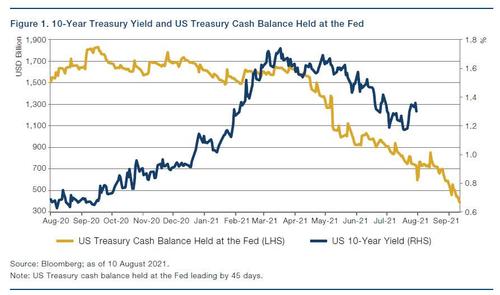

In a ‘normal’ world (where the debt ceiling isn’t an issue), the US Treasury would not have tapped into its cash balance. Instead, it would have issued enough debt to match its spending needs. Net net, this would have no impact on markets – the amount the Treasury spends (which is like a cash injection into the US economy) would be offset by the amount of debt issuance (this would take liquidity out of the system as investors would be using their cash to buy US Treasury instruments).

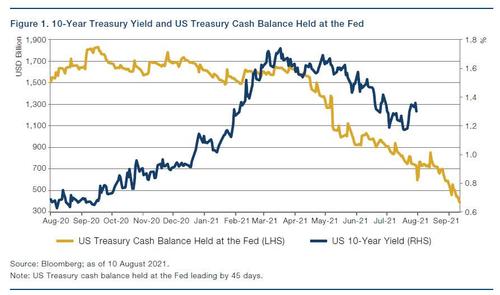

However, in the last few months, the US Treasury has slowed down issuance because of the debt ceiling. This, in turn, has forced the Treasury to tap into their ‘rainy day’ fund and deplete its cash balance. Because it hasn’t done much issuance to take out liquidity, net net, these actions by the US Treasury have acted like substantial quantitative easing (i.e., cash injection without the offsetting liquidity withdrawal from issuance).

Separately, the Treasury has indicated that once the debt ceiling is increased, it plans to run the cash balance at USD750 billion. This would imply that the Treasury is taking more out of the system via issuance than it is putting back into the system via spending, because it is replenishing its rainy-day fund. This acts like quantitative tightening..

|

2- INCREASING TREASURY SUPPLY

2- INCREASING TREASURY SUPPLY