|

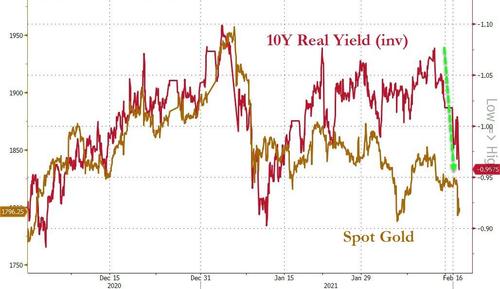

As Wolf Richter reports: “For the Fed, these increases in the long-term Treasury yields and the continued declines in junk bond yields and the near-record-low mortgage rates are a soothing combination, speaking of inflation and not financial stress.

If the spread of junk bonds and mortgage rates to Treasury securities were to blow out suddenly, that would be a sign of financial stress, and might be more worrisome for the Fed.

So the rat that the Treasury market is smelling is consumer price inflation. It’s gnawing its way through various layers of the economy. And the Fed has said that it will ignore inflation for a “while,” and that it will welcome an overshoot of inflation. Only when it becomes “unwanted” inflation, as Powell put it without specifying what that means, would the Fed crack down.

So maybe the Fed would crack down when inflation stays above 4% or 5% for a “while?”

However, once inflation has solidly set in, it’s hard to stop. That’s the rat the Treasury market is smelling, and if you’re sitting on a bond that yields 1.2% for the next 10 years, that’s not a mouthwatering item on the menu.”

|