MACRO ANALYTIC COVERAGE UPDATED

10Y UST - "TNX" YIELD

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII - BONDS & CREDIT

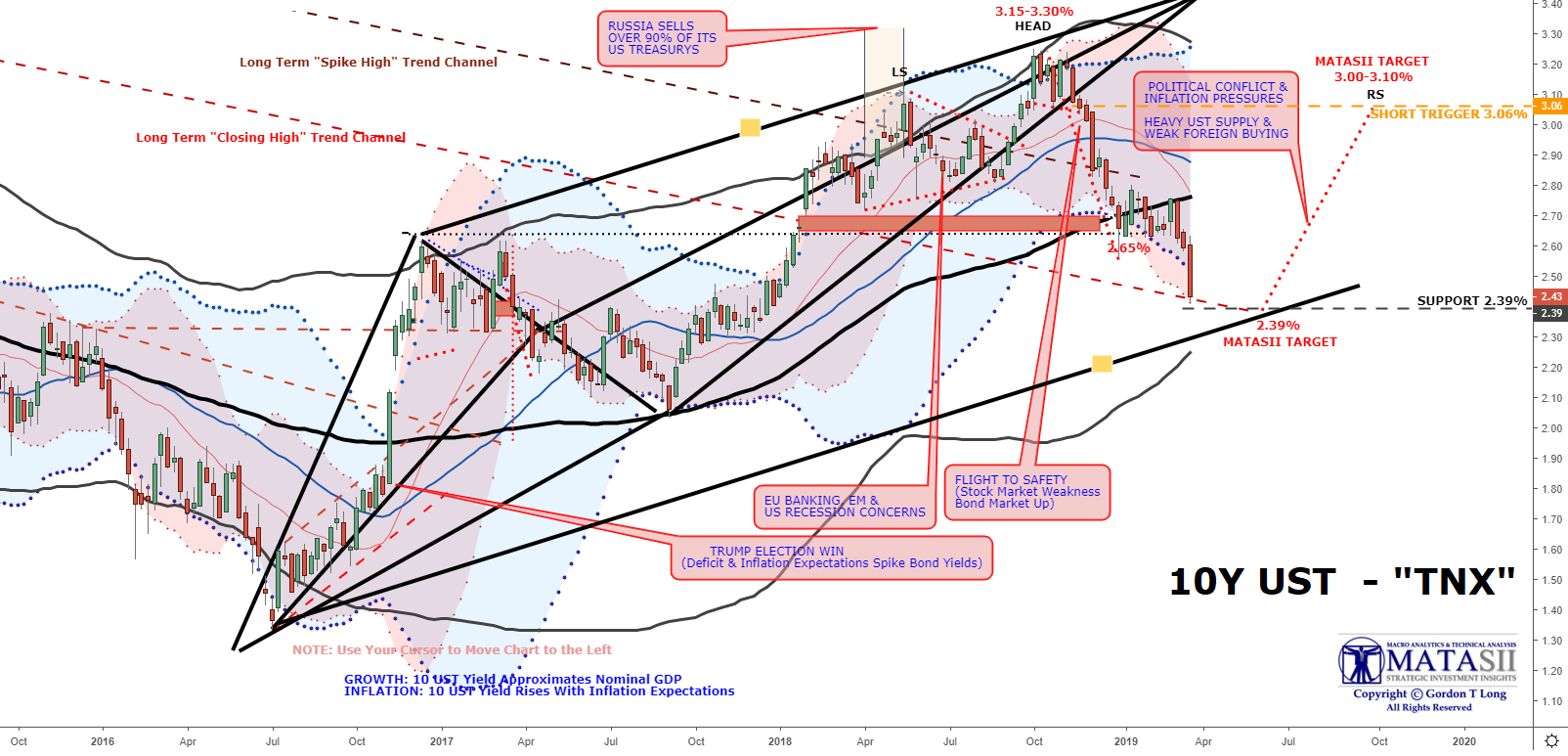

MATASII SYNTHESIS:

- We see significant support for the 10Y UST Yield at 2.39%,

- We would cover our shorts if yield bounces off this support level.

- We would expect to see a Fibonacci Retracement reversal from the 2.39% level

TECHNICAL ANALYSIS OUTLINE INDEX:

- ORIGINAL IDEA

- PRIMARY INDICATOR - Longer Term: 6 Months - 2 Years

- 12 & 24 Monthly MA Bands

- 5/13/21 Monthly EMA

- SECONDARY INDICATOR - Intermediate Term - 3 Months - 12 Months

- 20/40/80 Weekly - MATA Indicator

- 20/40/80 Weekly MA Bollinger Bands

- TERTIARY INDICATOR - Near Term - Next 1- 3 Months

- 50/100/200 DMA

- 89 DMA w/BB

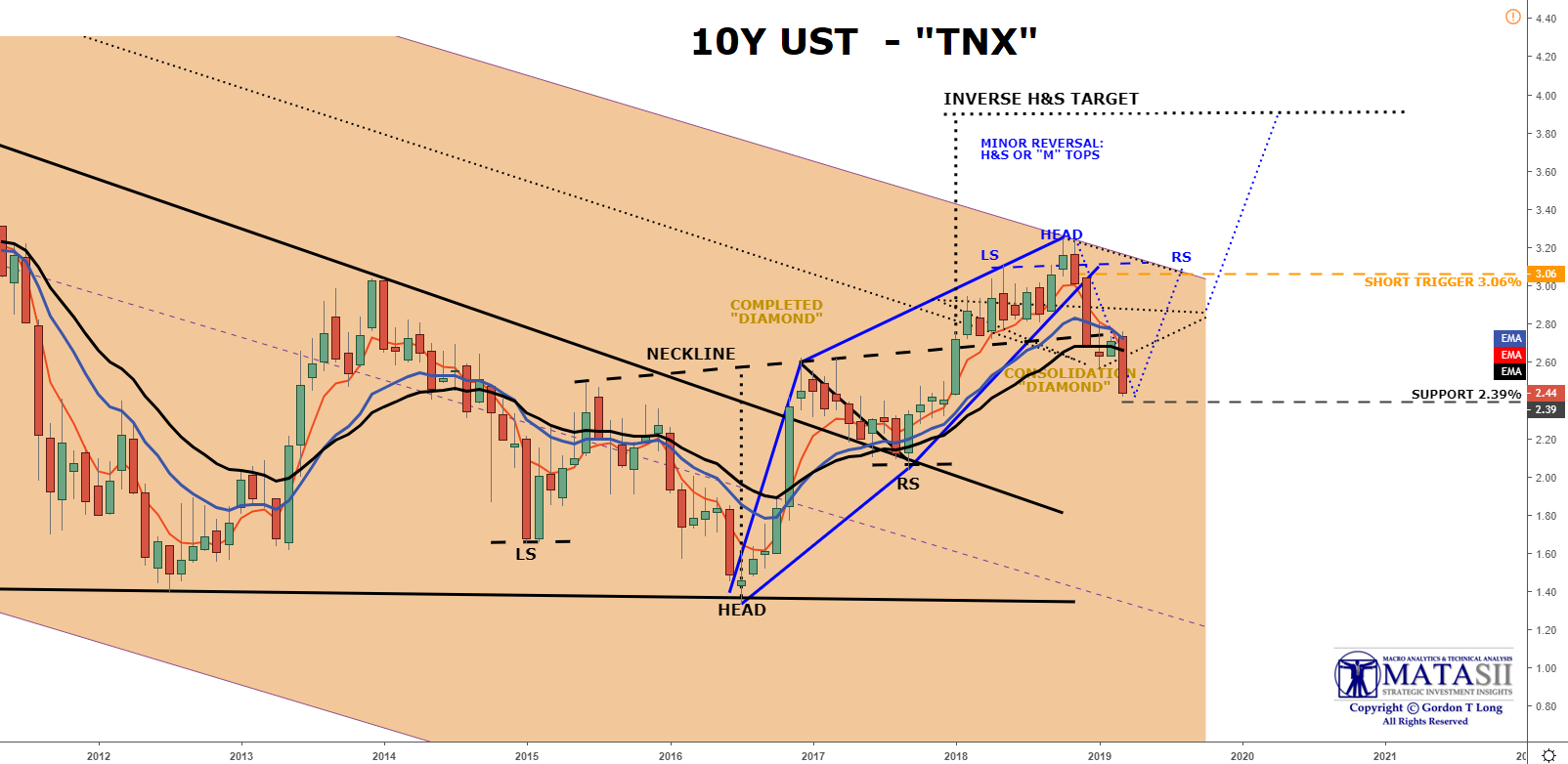

ORIGINAL IDEA - LAST IDEA UPDATE: APRIL 30th 2018

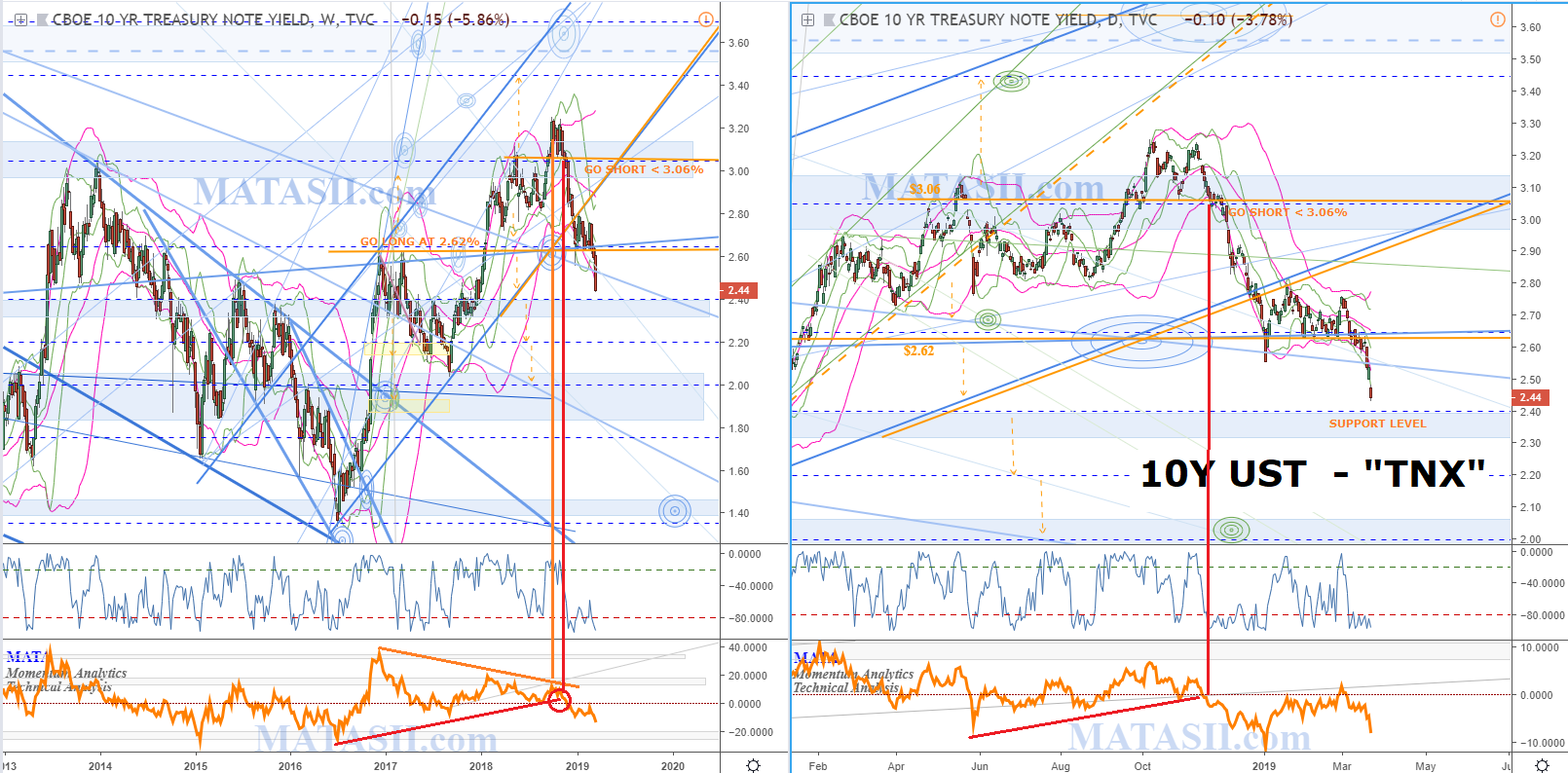

PRIMARY INDICATOR - Long Term: 6 Months - 2 Years

- SHORT POSITION TRIGGERED AT 3.06% - In Transition, Not Yet Trending

- Need Confirmation for downward trend. We have not got it yet and as such this could quite easily be a counter rally in a still upward BIAS.

- We are watching the 5 MMA which is still above 21,

- Though the 13 MMA is trending down it is still above the 21 MMA.

- We see firm support at ~ 2.39%

SECONDARY INDICATOR - Intermediate Term - 3 Months - 12 Months

- MATA INDICATOR (Bottom Panel) shows support still at lower Yield,

- We have a Long Term "closing high' trend channel (in dotted red) which will provide some support,

- We have parallel channel lower support (shown in black) which suggests the consolidation extends out in time.

TERTIARY INDICATOR - Near Term - Next 1- 3 Months

- Price is against the lower 200 DMA, 2 standard deviation Bollinger Band,

- The 89 DMA Lower Bollinger Band will provide near term support,

- The MATA Indicator is approaching a bottom.

FAIR USE NOTICEThis site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.