MAJOR CURRENCY REALIGNMENTS APPEAR UNDERWAY

Shift Away from US/Canadian Dollar to Euro/Pound

BACKDROP

As the MACRO SURPRISE INDEX fell dramatically and aggregate Treasury complex positioning (in 10Y equivalents) shifted back into bearish territory in the last two weeks -- The Eurodollar shorts (bets on rate hikes) increased back near record shorts...

However, while Eurodollar shorts (rate hike bets) have increased, it appears traders are shifting the timing further out as open interest shifts notably further out and call options (implicitly betting on lower rates, not higher) are dominating trading in recent days (as economic data crashes)...

CURRENCY RE-POSITIONING

USD - Weakening Long Positioning

And as rate hike expectations drop, so net USD longs tumble to the lowest since September 2016...

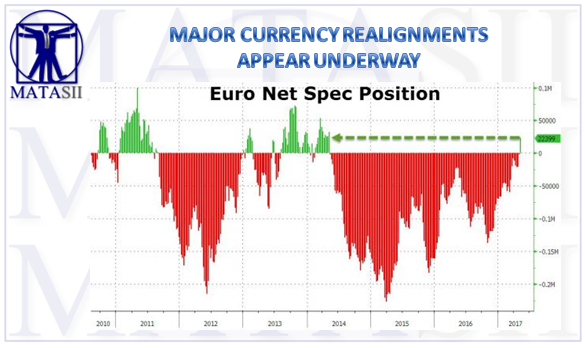

EURO - Strengthening Euro Longs

With EUR positionig has soared back into a long position (the longest since May 2014)

CANADIAN DOLLAR - Record Shorts

As Loonie net shorts hit an all-time record high...

UK POUND - Falling Net Shorts

And Sterling net shorts are the lowest since Brexit...