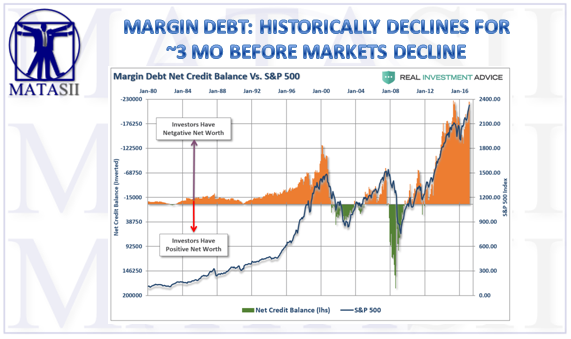

MARGIN DEBT: HISTORICALLY DECLINES FOR ~3 MO BEFORE MARKETS DECLINE

-- ABSTRACTED FROM: 04-04-17 Lance Roberts via RealInvestmentAdvice.com, "Margin Debt Hits Record, Nothing To Worry About?"

Currently, margin debt is still rising as the “fear of missing out” on potential upside in the market is trumping longer-term logic of risk management and portfolio controls. However, this has always been the case with investors historically as the chase for returns leads to “buying tops” and “selling bottoms.” This time will very likely turn out similarly.

As I stated, the important thing to remember about margin debt is that alone it is inert and poses no real danger to the market. However, when combined with the correct catalyst, it will act as an accelerant to a market correction when forced liquidations fuel additional selling.

Few investors have survived the corrections that in hindsight were deemed “obvious.” However, in the short-term, these dangers remain dismissed as the markets continue to climb a “wall of worry.”

But that is a climb that does not last forever.

.....

By itself, margin debt is inert.

Investors can leverage their existing portfolios and increase buying power to participate in rising markets. While “this time could certainly be different,” the reality is that leverage of this magnitude is “gasoline waiting on a match.”

When an event eventually occurs, it creates a rush to liquidate holdings. The subsequent decline in prices eventually reaches a point which triggers an initial round of margin calls. Since margin debt is a function of the value of the underlying “collateral,” the forced sale of assets will reduce the value of the collateral further triggering further margin calls. Those margin calls will trigger more selling forcing more margin calls, so forth and so on.

Notice in the chart below that margin debt reduction begins innocently enough before accelerating sharply to the downside. This time will likely be no different.