MARGIN DEBT: LEVERAGED LEVELS AT ALL TIME HIGHS

-- ABSTRACTED FROM: 04-04-17 Lance Roberts via RealInvestmentAdvice.com, "Margin Debt Hits Record, Nothing To Worry About?"

On a quarterly basis, the market is currently more overbought than at just about any other point in history. The vertical red lines denote the bear markets that occur from these levels.

Importantly: Note the current conditions HAVE NEVER lasted indefinitely.

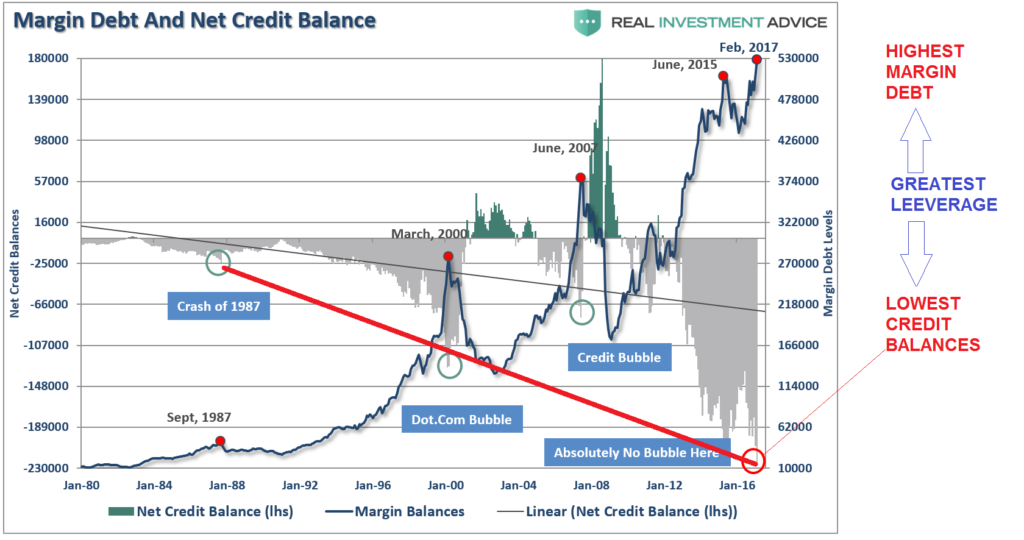

Besides the markets being more extended, bullish and overvalued than at virtually any other point in history, they are currently more levered as well. The NYSE released its latest margin debt figures for February which shows investors piled on leverage pushing levels to all-time highs.

It is worth noting that when net credit balances have plunged very negative levels it has been the “fuel” for a major mean reverting event at some point in the future.

....

By itself, margin debt is inert.

Investors can leverage their existing portfolios and increase buying power to participate in rising markets. While “this time could certainly be different,” the reality is that leverage of this magnitude is “gasoline waiting on a match.”

When an event eventually occurs, it creates a rush to liquidate holdings. The subsequent decline in prices eventually reaches a point which triggers an initial round of margin calls. Since margin debt is a function of the value of the underlying “collateral,” the forced sale of assets will reduce the value of the collateral further triggering further margin calls. Those margin calls will trigger more selling forcing more margin calls, so forth and so on.

Notice in the chart below that margin debt reduction begins innocently enough before accelerating sharply to the downside. This time will likely be no different.