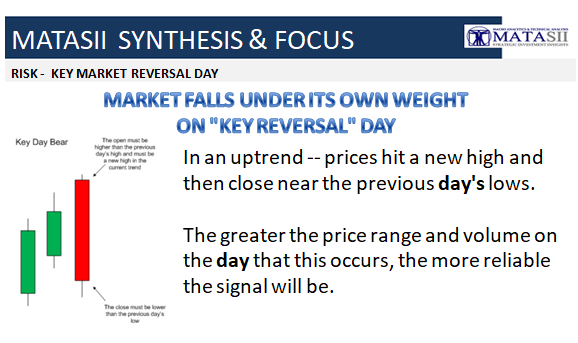

MARKET FALLS UNDER ITS OWN WEIGHT ON "KEY REVERSAL" DAY

The Dow opened Tuesday above 26,000 with the global stock melt-up giving signs of going parabolic after having witnessed the fastest 7 day Dow 1000 point rise in history! This following the move from 24,000 to 25,000 in the Dow in just 23 days. Then something occurred that we haven't seen in a long time - a 320 point Key Reversal Day where stocks opened higher than Fridays close but then closed lower. What happened?

First, Though Goldman Sachs had already been expressing concern about its Risk Appetite Indicator readings, Bloomberg put some reality into this level of risk taking when it reported that the price tag on bearish options had dropped to a trough relative to bullish contracts.

Data compiled by Bloomberg showed that the spread between the price of one-month, 25-delta puts and calls for the S&P 500 was roughly two standard deviations below its five-year mean, . This was an indication of the greed (or lack of fear) in the market which was suppressing the CBOE's volatility gauge. This was a record low skew - bullish/greed - lower than at the peak of the market in 2007.

Courtesy of ZeroHedge.com

Bloomberg's data showed that a pattern of paying less for downside protection was creating a persistent decline in put prices which was driving a downtrend in the Skew Indicator during most of last year’s second half. Conversely, as the market euphoria has taken hold, contributing to the historically significant level of bullish positions, investors chasing upside have led to an increase in the cost of calls.

Secondly, this all came after BoAML 's latest monthly survey of Fund Managers (which polls 183 participants with $526bn in AUM) showed the net % of investors saying they are taking out protection against a near-term correction in the markets fell to net -50%, the lowest level since 2013.

It seems that the majority of investors now expect the equity market to peak in “2019 or beyond” pushing back the timing by two quarters from December, when the majority expected a top in Q2 2018.

Additionally the survey showed that the net share of investors saying global corporate earnings will rise 10% or more over the next year comes in at net 15%, the highest level since 2011.

All of this euphoria simply fails to match the earnings reality which is being optimistically distorted by high tax cut expectations and questionable economic growth projections. There appears to be little room for disappointment between now and when these earnings are to hopefully materialize?

Then thirdly as a result of all this, Morgan Stanley after reporting that the market was in the Late Cycle Euphoria Stage, jumped all over this blatant anomaly and slammed the market when it issued an S&P warning recommending buying protective Puts just as S&P Calls were hitting an all time high.

This was to much for an already over extended market to handle and it just dropped on its own wait. A pretty good call as it turned out as the historically low VIX moved to higher levels not seen in over a month!

Key Reversal days have a history of being important events that need to be wisely heeded!