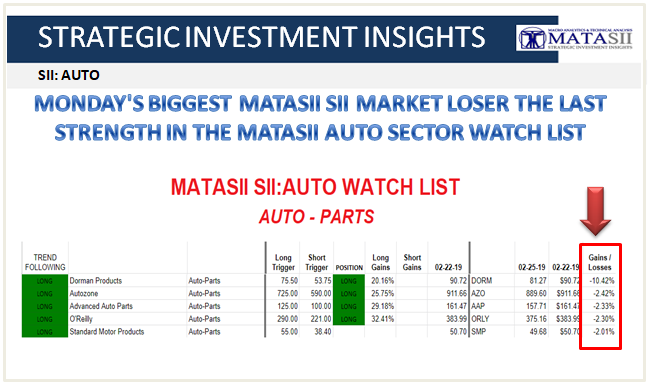

MONDAY'S BIGGEST MATASII SII MARKET LOSER THE LAST STRENGTH IN THE MATASII AUTO SECTOR WATCH LIST

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII: RETAIL - AUTO

MATASII SYNTHESIS:

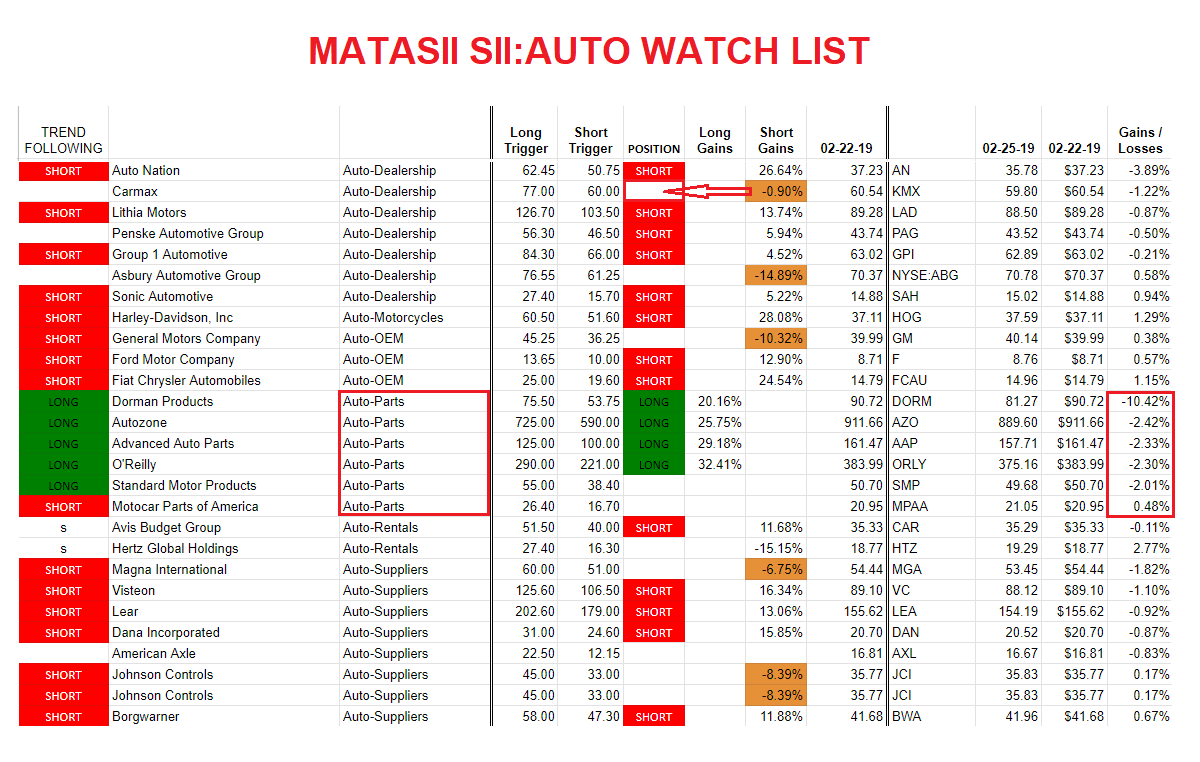

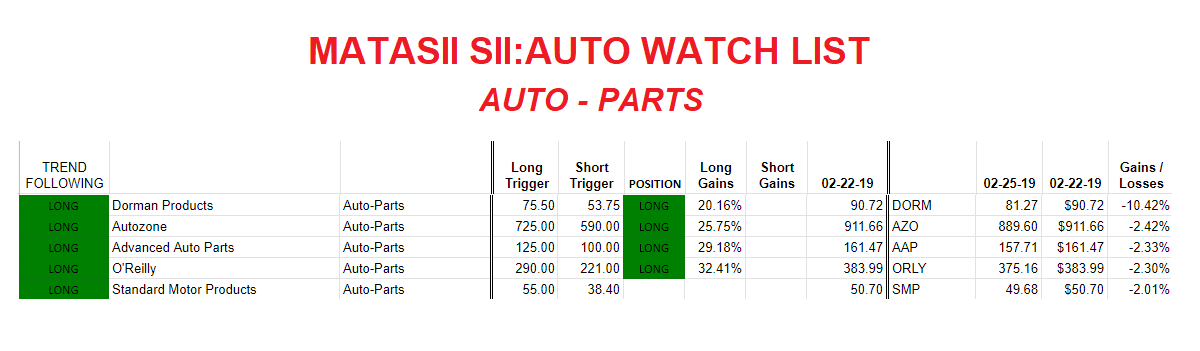

Below is a rather busy table listing all the members of the MATASII AUTO SII. We have broken down this table (following charts) so you can focus on its key messages.

KEY TAKEAWAYS:

- On a Monthly, Weekly and Daily basis we are seeing weakness across various Auto SII securities - even those that had previously moved against the sector's weakening trend,

- The fact we are now seeing major weakness in the only "LONG" performer (PARTS) in the sector is confirming the serious of the weakness in the sector,

- MATASII'S Proprietary "Trend Following" Methodology is confirming the Intermediate Cyclical Trend for the Auto Sector (left column of table).

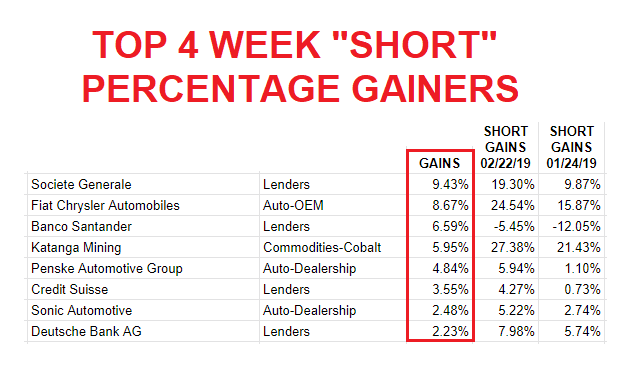

MONTHLY "SHORT" GAINERS

- The Auto Sector Watch List components continue to see weakness, representing 3 of the Top 8 SHORT Gainers.

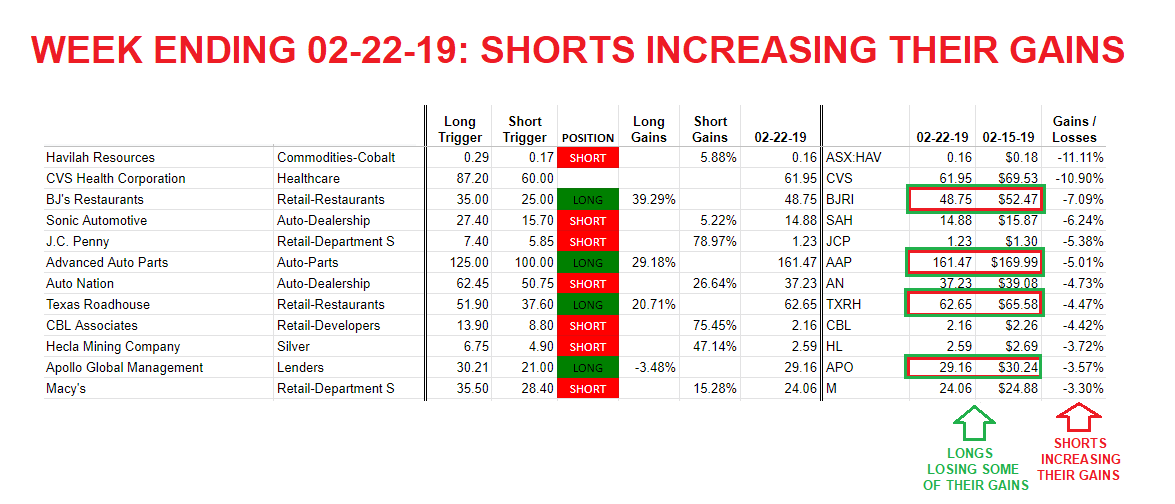

WEEKLY SHORT GAINERS

- When you include Auto Retailers, Retailing based securities showed the dominant weakness for the week ending 02-22-19. 8 out of top 12 losing positions were Retail based,

MONDAY'S "LONG" LOSERS

- The entire AUTO-Parts group lost ground on Monday, led by Dorman Products.

The automotive aftermarket supplier said that revenue climbed 14% in the fourth quarter of 2018 compared to the year-earlier quarter, with adjusted net income rising 25% over the same period. Yet even though Dorman's guidance for 2019 included sales growth projections of 6% to 10% for 2019, in line with what most of those following the stock had been expecting, earnings guidance was notably weaker than the consensus forecast among investors. 2018 was a solid year for Dorman, but shareholders seem less certain that the auto parts maker can keep up the pace this year.

FOR DETAILS SEE MATASII POST:

AUTO SECTOR WATCH LIST

- MATASII'S Proprietary "Trend Following" Methodology is confirming the Intermediate Cyclical Trend for the Auto Sector (left column of table).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.