MORE COMPANIES HAVE STARTED CUTTING THAN RAISING REVENUE GUIDANCE

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MATA: FUNDAMENTALS

11-05-18 - "For The First Time In 19 Months, More Companies Are Cutting Than Raising Revenue Guidance"

MATASII TAKEAWAYS:

- The first cracks in US corporate earnings are starting to appear - profit outlooks have been more negative than from recent quarters which has taken the shine of the good headline numbers,

- Bank of America calculates, in October, the three-month earnings revision ratio (ERR) fell to 1.11 from 1.32, the lowest level in nearly a year, confirming that the ratio of earnings raises to cuts is crashing down to earth from its recent record post tax reform highs,

- More concerning is that the more volatile 1-month ERR crossed below 1.0 for the first time in two years, to 0.77 from 1.18, prompting BofA to ask if "this the beginning of a longer trend of estimates cuts?",

- Consensus 2019 EPS has drifted down just 0.4% during earnings season in October-less than half the post-crisis average estimate cut over the same period. Which probably means that sellside analysts are only now going to start slashing their longer-term forecasts,

- While Financials remained flat. Real Estate, Industrials, and Health Care saw the biggest deterioration,

- Nearly all sectors are seeing more downward than upward revisions to sales forecasts over the last three months, with Staples and Financials seeing the biggest deterioration in sales forecasts, while Industrials, Energy, and Health Care have seen the most improvement,

- It is only a matter of time before shrinking revenues and contracting margins catch up to the bottom line, resulting in an annual EPS decline in the very near future.

Confirming investor concerns about "peak profits", the first cracks in US corporate earnings are starting to appear.

On one hand, Q3 earnings season has been impressive: with 75% of the S&P 500 having reported their results so far, 82% percent of companies have beaten consensus expectations on profits, while 61% have beaten on revenue. Earnings growth is running at a solid +26.5% yoy pace in aggregate, a robust pace, while sales are growing at a +8.79% yoy pace.

And yet, some profit outlooks have been more negative than from recent quarters which has taken the shine of the good headline numbers.

Specifically, as Bank of America calculates, in October, the three-month earnings revision ratio (ERR) fell to 1.11 from 1.32, the lowest level in nearly a year, confirming that the ratio of earnings raises to cuts is crashing down to earth from its recent record post tax reform highs. While revision trends continue to decelerate from early 2018 highs, the ratio remains above its long-term average of 0.87, signalling strong returns at least in the short-term.

More concerning is that the more volatile 1-month ERR crossed below 1.0 for the first time in two years, to 0.77 from 1.18, prompting BofA to ask if "this the beginning of a longer trend of estimates cuts?"

Meanwhile, while this breadth ratio has weakened, consensus 2019 EPS has drifted down just 0.4% during earnings season in October-less than half the post-crisis average estimate cut over the same period. Which probably means that sellside analysts are only now going to start slashing their longer-term forecasts.

Broken down by industry, all sectors except Energy saw their 3m ERR decline, while Financials remained flat. Real Estate, Industrials, and Health Care saw the biggest deterioration. Despite the broad-based moderation, most sectors' (except Staples, Materials, and Comm Svcs) 3m ERR is still above 1.0, suggesting more raises than cuts to earnings estimates. The ERR is also still above average for Health Care, Industrials, Discretionary, Tech and Utilities.

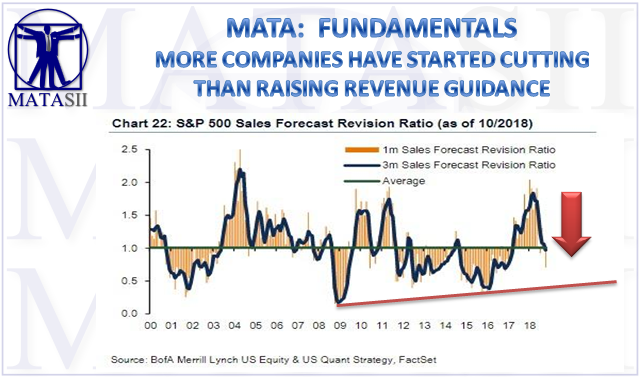

But the big surprise in Q3 earnings was that despite the generally better-than-expected 3Q sales results - with a few notable tech exceptions - the 3-month sales forecast revision ratio (SRR) fell to a 19 month low of 0.97 from 1.07. With the ratio now below 1.0 (also its long-term average), it indicates more cuts than raises to sales forecasts for the first time since March 2017. And even more troubling, the 1-month SRR tumbled to a two-year low of 0.70 from 1.0.

A detailed breakdown shows that nearly all sectors are seeing more downward than upward revisions to sales forecasts over the last three months, with Staples and Financials seeing the biggest deterioration in sales forecasts, while Industrials, Energy, and Health Care have seen the most improvement. Only Health Care and Industrials have a 3m SRR above average.

Aside from sellside estimates, and focusing on management teams - or those most familiar with their companies' future prospects - in October, the three-month ratio of above- vs. below- consensus management earnings guidance (GR) ticked down to 0.84 from 0.93.

The above data confirms that for those who believe Q3 has been the downward inflection point in corporate sales and profits, the data confirms the former. As for the latter, it is only a matter of time before shrinking revenues and contracting margins catch up to the bottom line, resulting in an annual EPS decline in the very near future.