MORGAN STANLEY: CHINA'S CURRENT ACCOUNT DEFICIT A KEY TURNING POINT IN 2019

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 02-24-19 - "Morgan Stanley: China's Current Account Deficit Will Be The Most Important Turning Point In 2019"

MATASII SYNTHESIS:

- China's trade surplus has shrunk by a third in just three years:

- In 2015, the country exported around $150 billion worth of goods more than it imported each quarter.

- In the third quarter of 2018, the goods trade surplus was just $100 billion.

- Now due to the upcoming:

- Loss of China's current account cushion,

- Softening domestic activity,

- Tariffs

- .....it means that "for the first time in 25 years, China would have to make a choice between external stability and growth."

China is Transforming into a Consumption-Driven economy

- China is now a big spender, and in early 2018, China got more of its growth from consumption than the U.S. As China's increasingly wealthy population spends more at home and abroad, its total trade surplus with the rest of the world has shriveled to a fraction of its former size.

- China captured a whopping 75% of nonresident portfolio investment in emerging markets in 2018 and will absorb around 70% in 2019, up from just 28% in 2017.

- China's Americanization has had a staggering impact on recent capital flows: in the second quarter alone, China attracted $61 billion of net portfolio investment inflows—triple the quarterly levels it was drawing in as recently as 2014.

- All other emerging markets, meanwhile, saw a 2018 full-year net outflow of $45 billion according to IIF data.

- One implication: Even if the dollar weakens in 2019, many emerging economies could still struggle, because they are now competing with China for foreign investment capital.

- As China consumes more, there is less money available for investment

- Beijing has been trying to attract more foreign capital to fill in the gap.

- As a result, emerging markets suffered last year not only because of the rising dollar, but because China is attracting a disproportionately large inflow to its stock and bond markets.

This has enormous implications for global capital markets

- China’s policymakers are urgently trying to attract bond investors, and Goldman Sachs anticipates a fresh campaign by China to promote investment in its assets.

- A key milestone will come in April when China debt will start to be included in the Bloomberg Barclays Global Aggregate Index, assuming certain criteria for accessibility and transparency are met.

The unhedged yield differential between US and China bonds has collapsed to almost nothing.

"Capital inflows, especially those into the bond market, will be very crucial for China’s balance of payments, as the current account will deteriorate further amid the trade war and the restructuring of the economy."

- For government bonds, inflows could reach US$80-100 billion this year and as much as US$120 billion annually over 2020-30, on average. This compares with US$35 billion per annum over 2015-18.

- The weight of CNY in global FX reserves will rise too, from 2.5% (excluding China’s reserves) to 5-10% over the next 5-10 years, bringing around US$40 billion a year of inflows.

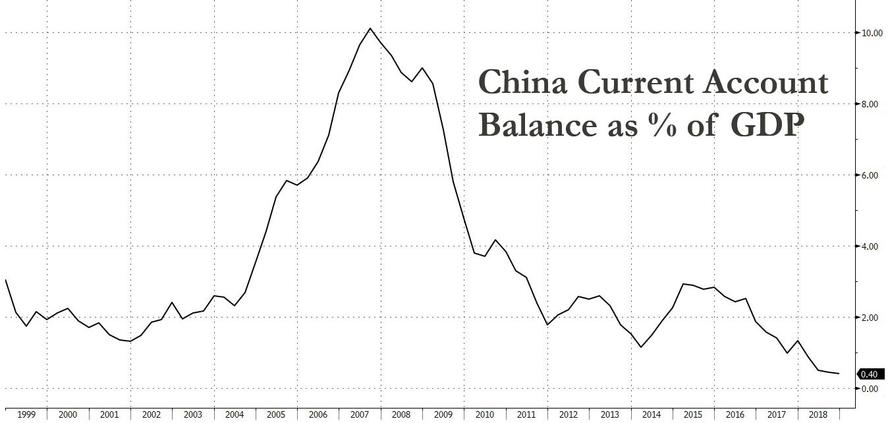

One month ago, when discussing the "tectonic shift" in China's economy, namely China's transformation from a surplus current account economy to deficit, we highlighted several observations, most notably that of UBS which wrote that the upcoming loss of China's current account cushion, softening domestic activity, and upcoming tariffs mean that "for the first time in 25 years, China would have to make a choice between external stability and growth."

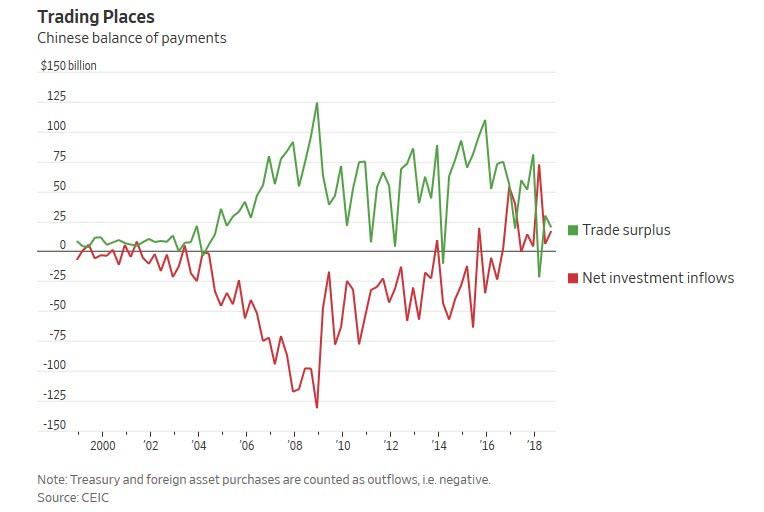

To be sure, China is still an export powerhouse - after all, it is China's massive trade surplus with the US that is arguably the reason for the ongoing trade war between the US and China. However, it is China's declining trade balance with the rest of the world that is of bigger concern in this context. As a reference, China's trade surplus has shrunk by a third in just three years: in 2015, the country exported around $150 billion worth of goods more than it imported each quarter. In the third quarter of 2018, the goods trade surplus was just $100 billion.

Going back to China's core transformation, we also noted that a key driver behind China's declining current account is that after having long been the world’s heavyweight saver and a huge buyer of foreign assets like Treasurys, the world's most populous nation is now a big spender, and in early 2018, China got more of its growth from consumption than the U.S., the global king of consumer spending where some 70% of economic growth is due to consumer spending. And as China's increasingly wealthy population spends more at home and abroad, its total trade surplus with the rest of the world has shriveled to a fraction of its former size.

In other words, China is rapidly becoming the next US.

This transformation of China into a consumption-driven economy has enormous implications for global capital markets, and impacts everyone from retirees investing in U.S. Treasurys to fund managers investing in emerging markets like Indonesia or India. It could also eventually help ease some of the frictions between the U.S. and China.

Meanwhile, as China consumes more, there is less money available for investment, and - taking another page of the US playbook - Beijing has been trying to attract more foreign capital to fill in the gap. As a result, emerging markets suffered last year not only because of the rising dollar, but because China is attracting a disproportionately large inflow to its stock and bond markets.

As the chart below shows, according to the IIF, China captured a whopping 75% of nonresident portfolio investment in emerging markets in 2018 and will absorb around 70% in 2019, up from just 28% in 2017. China's Americanization has had a staggering impact on recent capital flows: in the second quarter alone, China attracted $61 billion of net portfolio investment inflows—triple the quarterly levels it was drawing in as recently as 2014. All other emerging markets, meanwhile, saw a 2018 full-year net outflow of $45 billion according to IIF data. One implication: Even if the dollar weakens in 2019, many emerging economies could still struggle, because they are now competing with China for foreign investment capital.

As a result, China’s policymakers are urgently trying to attract bond investors, and Goldman Sachs anticipates a fresh campaign by China to promote investment in its assets. A key milestone will come in April when China debt will start to be included in the Bloomberg Barclays Global Aggregate Index, assuming certain criteria for accessibility and transparency are met.

It is unclear, however, if buyers will emerge: after all they may have just as attractively yielding US bonds competing for the same capital. Indeed, the unhedged yield differential between US and China bonds has collapsed to almost nothing.

Standard Chartered's Becky Liu summarized Beijing's dilemma as follows: "Capital inflows, especially those into the bond market, will be very crucial for China’s balance of payments, as the current account will deteriorate further amid the trade war and the restructuring of the economy."

Now, in its latest Sunday Start note, Morgan Stanley writes that "this year investors are likely to witness a number of major turning points" with head EM strategist James Lord writing that among among such notable calls by Morgan Stanley strategists such as expecting the USD bull market to reverse, EM assets to outperform and the US economy to slow versus the rest of the world, the bank has added another "big transition" to the list, namely the "tectonic shift" we first discussed in January: "China’s economy should slip into its first annual current account deficit since 1993."

And since as we described previously, "China’s internal resources will no longer be sufficient to fund its desired growth", Morgan Stanley is inclined to believe that whether Beijing wants to or not, this dramatic transformation will force afurther gradual opening up of the economy, because in order to maintain its growth, in the future, "foreign investors will be chipping in more than ever before."

While Morgan Stanley sees this transformation as one that will ultimately benefit global investors as a massive, new market will increasingly open up for foreign investments - and one can debate profusely if foreign investors are best served by allocating capital to the black boxes that are China's economy and capital markets - it does warn - as we did - that "as China’s demand for foreign capital picks up, it will simultaneously fall in the rest of the world" and that "the process may not be smooth for all, and it will come down to which countries benefit from China’s higher future imports."

It appears that one of those nations will be the US - the question is whether the US will also be just as willing to allocate capital to China's capital markets which at least on the equity side, have already suffered two burst bubbles in just the past decade.

In any case, here is Morgan Stanley's James Lord explaining why China's transformation to a current account deficit nation could be the biggest "turning point" for the world in 2019.

* * *

This year investors are likely to witness a number of major turning points. Our 2019 Global Strategy Outlook called for the

USD bull market to reverse, EM assets to outperform and the US economy to slow versus the rest of the world. We’ve

added another big transition to the list: China’s economy should slip into its first annual current account deficit since

1993.Unlike that year, when China saw a normal cyclical C/A deficit in an emerging economy, this shift to a ‘saving short’ economy is structural. My colleague Robin Xing reckons that the aging population will consume more and save less, driving the deficit to US$50 billion in 2019 and as high as US$430 billion by 2030. The flip side is that China’s capital inflows will have to ramp up significantly as a result, which is where the opportunity lies. All this is consistent with our long-term thesis of China transitioning to high-income status.

In truth, China’s current account has been deteriorating for a while. In 2007, it was in surplus to the tune of 10% of GDP but moved close to balance by 2018. A shift to a deficit in 2019 is just another step along the road. Yet a move into the red still matters. From now on, China’s internal resources will no longer be sufficient to fund its desired growth, and we think that the shortfall will encourage further gradual opening up of the economy. In future, foreign investors will be chipping in more than ever before.

Where could they step up? Foreigners own 8% of the Chinese government bond market, 2.6% of equities and less than 2% of corporate bonds. These numbers are tiny compared to elsewhere (e.g., 35-40% foreign equity ownership in Taiwan and Korea), but if we’re right, they’re about to rise significantly.

For government bonds, inflows could reach US$80-100 billion this year and as much as US$120 billion annually over 2020-30, on average. This compares with US$35 billion per annum over 2015-18. My colleague Min Dai has been discussing the implications of China’s inclusion in global bond indices for some time, and Bloomberg recently confirmed that China will join the Global Aggregate index in April. Entry into the GBI-EM and WGBI indices might not be far behind. Asset managers would face a high bar to justify excluding Chinese bonds once they are part of the Aggregate index.

We think that the weight of CNY in global FX reserves will rise too, from 2.5% (excluding China’s reserves) to 5-10% over the next 5-10 years, bringing around US$40 billion a year of inflows. This view tends to generate plenty of debate. Many investors see little prospect of the renminbi taking a greater share of reserve assets without full currency convertibility and capital mobility. We agree that without deep reforms, CNY will struggle to raise its share significantly. However, this share is tiny relative to China’s economic importance, and a modest increase is not unrealistic.

What about equities? My colleagues Laura Wang and Jonathan Garner expect 2019 to be a record year, with US$70-125 billion of inflows. Again, index inclusion is a major theme, with China entering the FTSE Russell from June and MSCI likely to raise the A-share inclusion factor for the EM index in May. The team expects flows to normalise between US$100-220 billion over the next ten years, with foreign ownership hitting 10%.

FDI should remain resilient too, funding around half the expected deficit. Robin and team are not great believers in the offshoring argument and think that the authorities will open up more sectors to foreign involvement. But considering that China has been a large recipient of FDI for a while, the future may not look significantly different from the past. It is the fixed income and equity flows that are on the cusp of a major turning point.

What’s the takeaway? First, take a look at Hong Kong Exchange & Clearing (0388.HK), the gateway to the Stock and Bond Connect programmes that access mainland China’s markets. The exchange clips a coupon on the back of every transaction. Second, with ample financing for the current account we think that CNY will rally. We see USDCNY at 6.55 by end-2019 and 6.30 by end-2020 with gradual trade-weighted gains over the long term. Cyclically, a trade deal and the stabilisation in China growth should help too.

As China’s demand for foreign capital picks up, it will simultaneously fall in the rest of the world, so this doesn’t have to end badly for other deficit economies. But the process may not be smooth for all, and it will come down to which countries benefit from China’s higher future imports. This is something to explore in future research, so stay tuned.