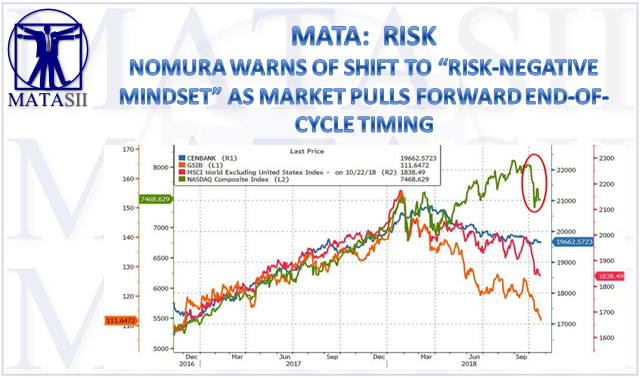

NOMURA WARNS OF SHIFT TO "RISK-NEGATIVE MINDSET" AS MARKET PULLS FORWARD END-OF-CYCLE TIMING

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MATA: RISK OFF-ON

10-23-18 - "The Market Is "Pulling Forward End-Of-Cycle Timing" - Nomura Warns of Shift To "Risk-Negative Mindset""

MATASII TAKEAWAYS:

- The realization of the fact that global central bank balance sheets are contracting and the world is tightening finally started to dawn on even the most ardent dip-buyer,

- The S&P as the “YTD global Equities safe-haven” theme now too is “cracking”,

- Warns of a slow and ongoing “pain trade” for legacy consensual Equities fund positioning as our global Equities factor monitors showing “Growth” again hit hard to the benefit of “Value”,

- The statement is being made from investors that they are increasingly committing to “the best is behind us” mentality,

- Sentiment has flipped to “fade bounces” / “sell the rips,” taking-down Net Exposure to new lows for the year via selling of “longs” and now again hammering “shorts”,

- We are experiencing this shift to said RISK-NEGATIVE mindset again, as the market pulls-forward the “end-of-cycle” timing.

With global investors desperately searching for a narrative to explain "what changed" as the calendar flipped a page to exuberant September to awful October, we suspect the realization of the fact that global central bank balance sheets are contracting and the world is tightening finally started to dawn on even the most ardent dip-buyer...

Even China's promise of never-ending support for stocks was unable to support stocks overnight, and as Nomura's MD of cross-asset strategy notes:

This then looks like general Macro consensual positioning “gross-down” flow, as “Longs” in SPX, Nikkei, Crude and USD are under pressure, while “Shorts” in USTs, ED$, EUR and Gold all squeeze.

Additionally, Charlie McElligott points out that the S&P as the “YTD global Equities safe-haven” theme now too is “cracking”:

After shattering through the 200d MA once again yesterday, S&P futures are now again within reach of the MTD lows (2712) as discretionary tactical longs “tap out” and asset managers continue to sell-down legacy longs (still ~$80B in SPX)

Pointing out that the S&P has big gamma at 2700 strikes (~$3.9B for 10/26 expiry, ~$3.6B for 10/29 expiry) with the largest “pull” remaining at the 2750 strike (~$4.7B / ~$4.0B)

The strategist warns of a slow and ongoing “pain trade” for legacy consensual Equities fund positioning as our global Equities factor monitors showing “Growth” again hit hard to the benefit of “Value” overnight across Asia-Pac, Japan and Europe (on top of the same ongoing MTD theme in U.S.)

This of course was the top concern going into EPS season:

would investors pivot to “late-cycle” mentality with regard to the likelihood of generally “lowered guidance,” or would they take the “glass half full” route of “lower bars to beat” in Q4

...thus far, the statement is being made from investors that they are increasingly committing to “the best is behind us” mentality.

Not surprisingly then as Equities funds have now lost the majority of their YTD performance, McElligott notes that sentiment has flipped to “fade bounces” / “sell the rips,” taking-down Net Exposure to new lows for the year via selling of “longs” and now again hammering “shorts” (Most Shorted -10.7% MTD, Crowded Shorts -9.9% MTD, 1Y Momentum Shorts -7.8% MTD)

McElligott sums up the shift in market sentiment perfectly:

The “Tighter Financial Conditions” mindset has now begun to permeate the collective investor psyche, transitioning mentality from “growing faster than we are tightening” to “tightening ourselves into a slowdown”...

...with now daily client mentions of “Fed Policy Error,” as Mr Powell commits to hiking into restrictive territory, despite currently “tame” core inflation.

US financial conditions are seeing accelerated "tightening" thanks to the reintroduction of a Treasury term premium and the impact it is having on the dollar and equity vol...

And tighter financial conditions imply ISM Manufacturing moving lower...

Critically, as McElligott concludes, the market is starting to price in the 'end': Thus we are experiencing this shift to said RISK-NEGATIVE mindset again, as the market pulls-forward the “end-of-cycle” timing

Eurodollar futures implied hikes for 2019 are now again slightly BELOW a full two-hikes (and again massively below the Fed’s currently-projected 3 hikes)

2020 again edges closer to inversion (which would imply more likelihood of a CUT than additional hikes)—as the Rates market is fading the Fed’s ability to stick to their dot-plot, instead believing that the market will force the Fed to “pause” their normalization / slow “quantitative tightening”...or even outright EASE.

Finally, the Nomura MD notes that Gold is particularly interesting because as previously noted two weeks ago, this legacy “Max Short” position in our Systematic model will be generating massive notional of $46B to “buy” on a cover to get back near flat at just “-16% Short”