OECD SLASHES GLOBAL GDP FORECAST, WARNS "OUTCOME COULD BE WEAKER STILL"

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 03-06-19 - "OECD Slashes Global GDP Forecast, Warns "Outcome Could Be Weaker Still""

MATASII SYNTHESIS:

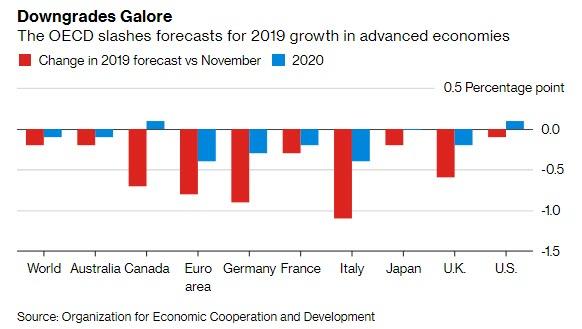

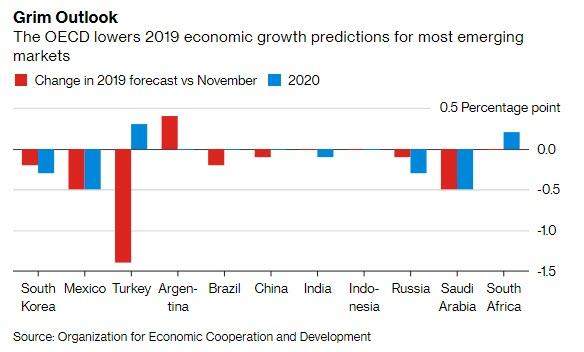

- OECD downgraded the 2019 GDP forecast of almost every Group of 20 nation including the US, China, UK and Euro Area,

- It now expects Italy to be headed to worst year since 2013.

- "Growth outcomes could be weaker still if downside risks materialize or interact."

- "The global expansion continues to lose momentum,"

- Weakness in the euro area and China are proving more persistent, trade growth has slowed sharply and uncertainty over Brexit has continued.

- The OECD's gloomy forecast may be already stale since central banks led by the Fed have already responded to the changed circumstances, and the ECB may follow soon,

- The OECD seemed especially worried about Europe's near-recession, noting that while central banks should stay in expansionary mode, the group called for structural reforms and fiscal stimulus in the European countries that could afford it (cough Germany), saying that “monetary policy alone cannot resolve the downturn in Europe or improve the modest medium-term growth prospects.”

- The OECD singled out Brexit as one of the persistent threats, warning that If the U.K. doesn’t secure a deal, it sees a risk of a near-term recession, with “sizeable negative spillovers” on other countries.

The world is rapidly headed for a recession unless something changes, according to the latest gloomy warning from the OECD overnight, which has joined the IMF in warning that the global economy is suffering more than expected from trade tensions and political uncertainty which are clouding prospects particularly in Europe, where the OECD slashed its 2019 growth outlook to just 1%, almost half its prior 1.8% forecast.

"The global expansion continues to lose momentum," the Paris-based Organization for Economic Cooperation and Development said as it downgraded the 2019 GDP forecast of almost every Group of 20 nation including the US, China, UK and euro area, while it now expects Italy to be headed to worst year since 2013. "Growth outcomes could be weaker still if downside risks materialize or interact."

The OECD's growth guillotine was not exactly a surprise as these are the organization’s first forecasts in almost four months, and it is forced to play catch-up with developments in a world in which central banks U-turned from hawkish to dovish to reflect a sharp slowdown from Japan to the US. Indeed, as Bloomberg notes, in that period little has gone right for the world’s biggest economies: Weakness in the euro area and China are proving more persistent, trade growth has slowed sharply and uncertainty over Brexit has continued.

Perhaps because it came about a month after the IMF's own latest forecast cut, the OECD’s numbers were even more downbeat than the monetary fund's, particularly the euro region and the U.K., where the organization warns that things could get even worse.

It isn't just doom and gloom, however, with a modest silver lining peaking between the clouds in recent weeks, with some modest signs that the global economy may be turning the corner as the U.S. and China are making progress on ending their lengthy trade dispute (if only for market-moving reasons), while JPM's global composite Purchasing Managers Index rose in February for the first time in three months.

“Getting a clear steer on global growth is very difficult right now, but at least, the latest PMIs have some positives,” HSBC economist James Pomeroy said in a note on Wednesday.

More importantly, and the reason why the OECD's gloomy forecast may be stale already is that central banks led by the Fed have already responded to the changed circumstances, and the ECB may follow as soon as tomorrow. On Tuesday China was forced to lower its goal for economic growth this week, rolling out another bevy of fiscal stimulus to boost its economy.

Whether or not central bank intervention will successfully reverse the economic slowdown remains to be seen. For now, however, the dismal OECD outlook goes against hopes that sources of weakness at the end of 2018 would prove temporary, creating more headaches for policy makers who may now need to find more combative solutions with limited room for maneuver on the fiscal and monetary side.

The OECD seemed especially worried about Europe's near-recession, noting that while central banks should stay in expansionary mode, the group called for structural reforms and fiscal stimulus in the European countries that could afford it (cough Germany), saying that “monetary policy alone cannot resolve the downturn in Europe or improve the modest medium-term growth prospects.”

As noted above, Europe suffered the brunt of the downgrades, and while the US outlook was lowered slightly, the U.K.’s 2019 forecast was cut to 0.8 percent from 1.4 percent, and Germany’s to 0.7 percent from 1.6 percent.

Predictably, the OECD also singled out Brexit as one of the persistent threats, warning that If the U.K. doesn’t secure a deal, it sees a risk of a near-term recession, with “sizeable negative spillovers” on other countries.

Finally, China - which two days ago announced its new growth target range of 6- 6.5% from "around 6.5%" - remains another major concern as a sharper slowdown there would have “significant adverse consequences for global growth and trade", just as we warned in out 2019 year ahead preview. The OECD now expects China's expansion to slow to 6 percent next year from 6.2 percent in 2019.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.