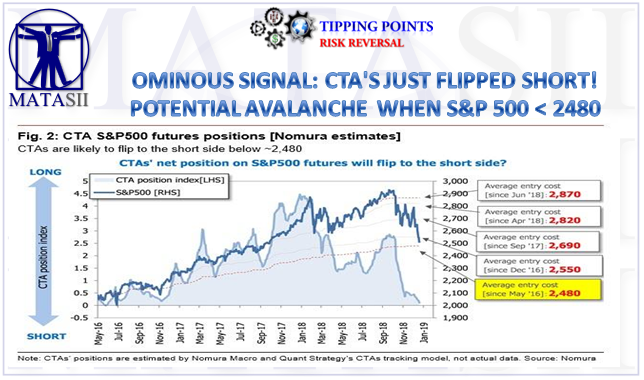

OMINOUS SIGNAL: CTA'S JUST FLIPPED SHORT! POTENTIAL AVALANCHE WHEN S&P 500 < 2480

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

12-20-18 - "Watch Out Below: For The First Time In Three Years, CTAs Just Flipped Short"

- Sentiment has clearly turned increasingly negative with bears increasing their domination of the market,

- Speculative investors like hedge funds will finish the year not only in pain, but having largely liquidated many of their winners (and losers), as their beta to the market shrinks with every passing day,

- Hedge funds have been on the verge of suicide for weeks, and retail investors have rarely been more bearish,

SPX futures below 2,480 is the critical support level for typical CTA trend-following strategies.

- The more the market falls, the more shorts will be layered on and the greater the downside momentum and acceleration,

- Now is the time when CTAs are likely to chase further downside of SPX futures by starting to add fresh shorts,

- The crashing market confirms that pattern chasers have indeed turned short and are now accelerating every move to the downside.

RESEARCH: Watch Out Below: For The First Time In Three Years, CTAs Just Flipped Short

While bullish traders have been cursing the Fed and chairman Powell for daring to suggest the punch-bowl is being pulled away, and they actually have to take - gasp - risk if they want to generate return, sentiment has clearly turned increasingly negative with bears increasing their domination of the market, which has seen all major indexes tumble and hit fresh 2018 lows while the Nasdaq officially entered a bear market.

And even though Nomura's quants note that through the end of the year there are a number of important economic events that could a shift in market sentiment, speculative investors like hedge funds will finish the year not only in pain, but having largely liquidated many of their winners (and losers), as their beta to the market shrinks with every passing day.

But while we already know that hedge funds have been on the verge of suicide for weeks, and retail investors have rarely been more bearish, the far more important question is:

What are unemotional robo-traders - who trade each and every day, come rain or shine, i.e. algos, quants and robots - doing?

For the answer we go to Nomura's Masanari Takada who writes that systematic trend-followers like CTAs are liquidating what's left of their remaining long positions at full speed. The silver lining is that since CTA have already largely deleveraged, the size of these remaining positions is very small, and the sell-off pressure created by cutting loss-making positions should be limited.

There is a far bigger risk however as SPX futures slide below 2,480 – the critical support level for typical CTA trend-following strategies.

The risk is that CTAs flip to the short side for the first time in about three years, at which point it will no longer be about covering long exposure but rather adding to the short side, and by implication, the more the market falls, the more shorts will be layered on and the greater the downside momentum and acceleration.

As Nomura concludes, "now is the time when CTAs are likely to chase further downside of SPX futures by starting to add fresh shorts, and thus we will have to keep a close eye on trend-following investor reactions."

One look at the crashing market confirms that pattern chasers have indeed turned short and are now accelerating every move to the downside.