STAGE 1- RECOVERY

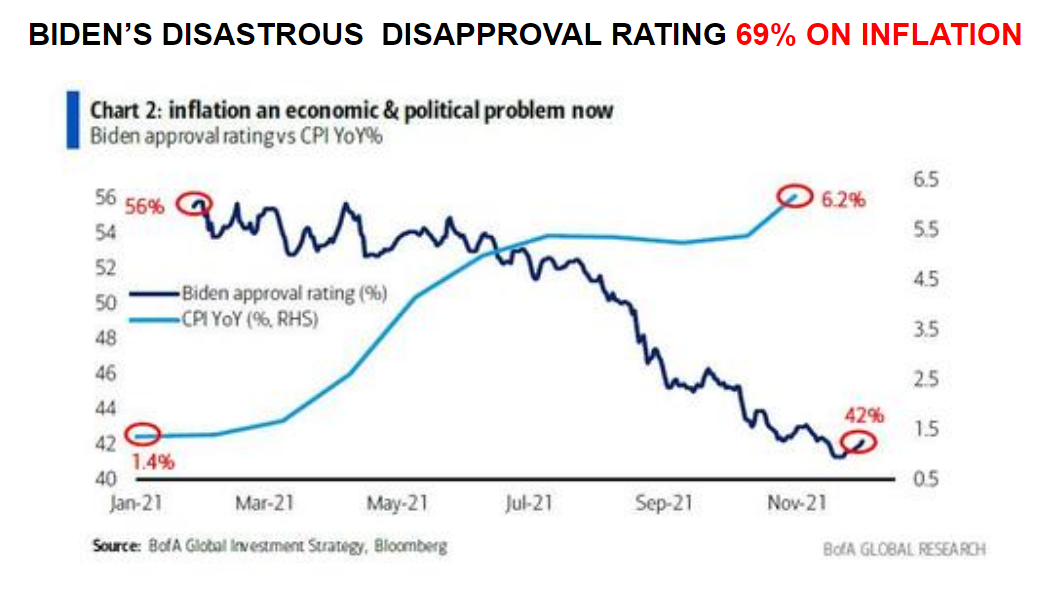

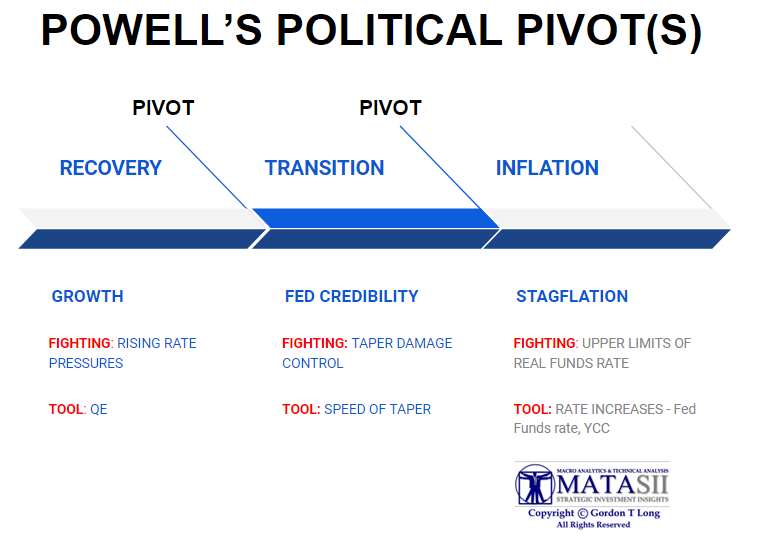

The four charts to the right are what the Biden Regime sees and politically wants to believe (and promote) to both improve Biden’s Poll results and the Democratic platform for those up for re-election next November.

THEIR STORY BOARD NARRATIVE (charts to the RIGHT)

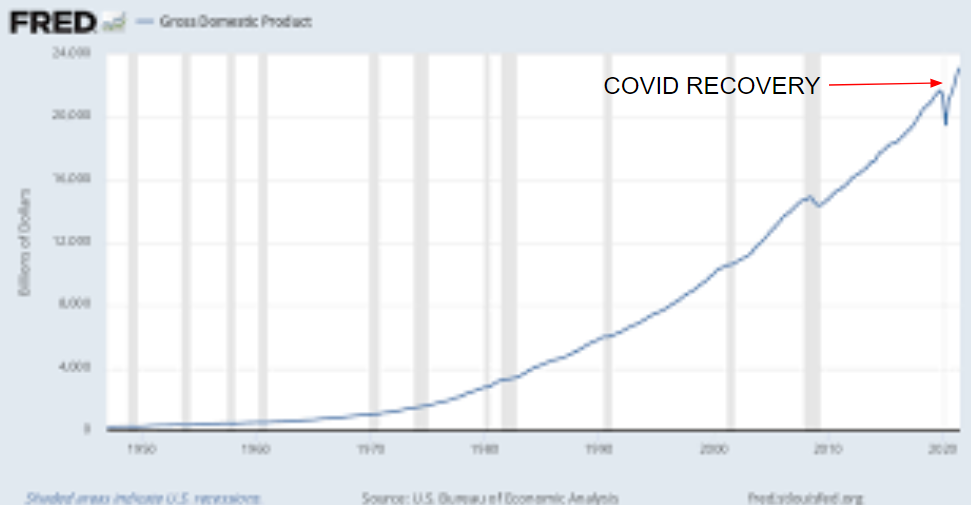

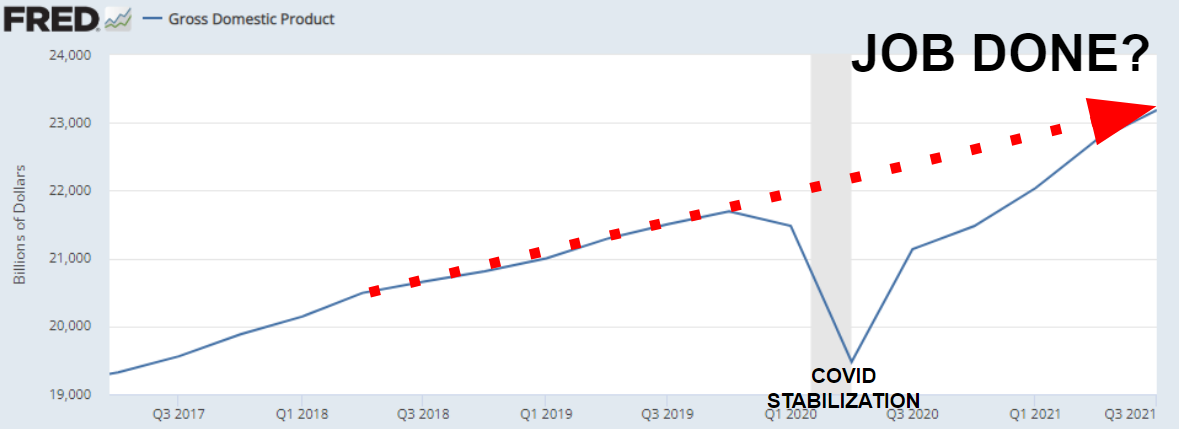

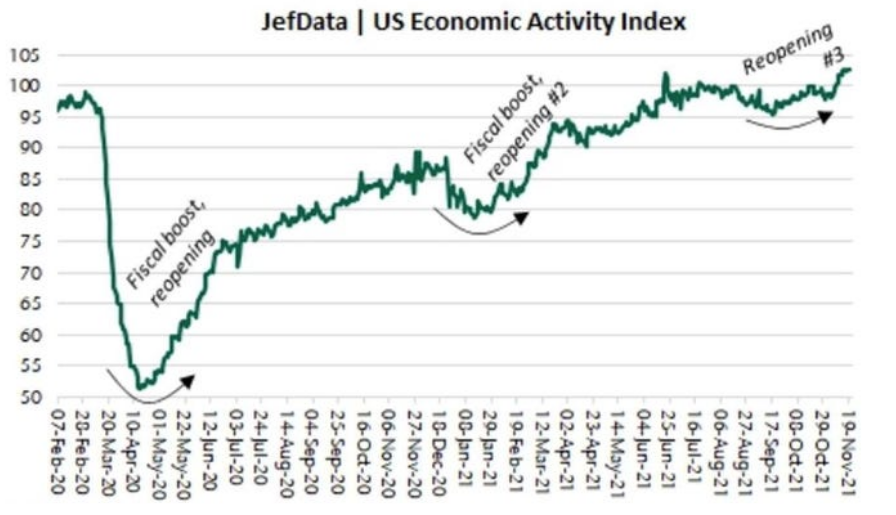

CHART 1: GDP has recovered from the Covid shock.

CHART 2: In Biden’s first year, the US Economy has surpassed the Pre-Covid highs.

CHART 3: Payrolls are back near Pre-Covid highs with Job Openings far surpassing the unemployment rolls.

CHART 4: Coming Fiscal spending will further propel economic growth to new highs.

Biden Regime’s Conclusion; Job Well Done!

However, it’s all false reality which Powell must not distract from!

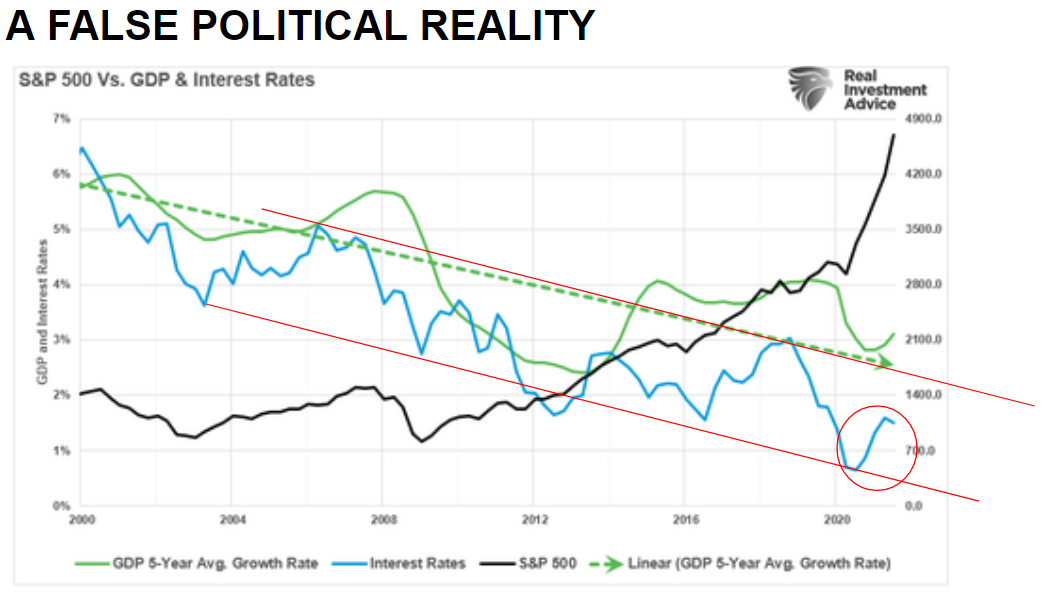

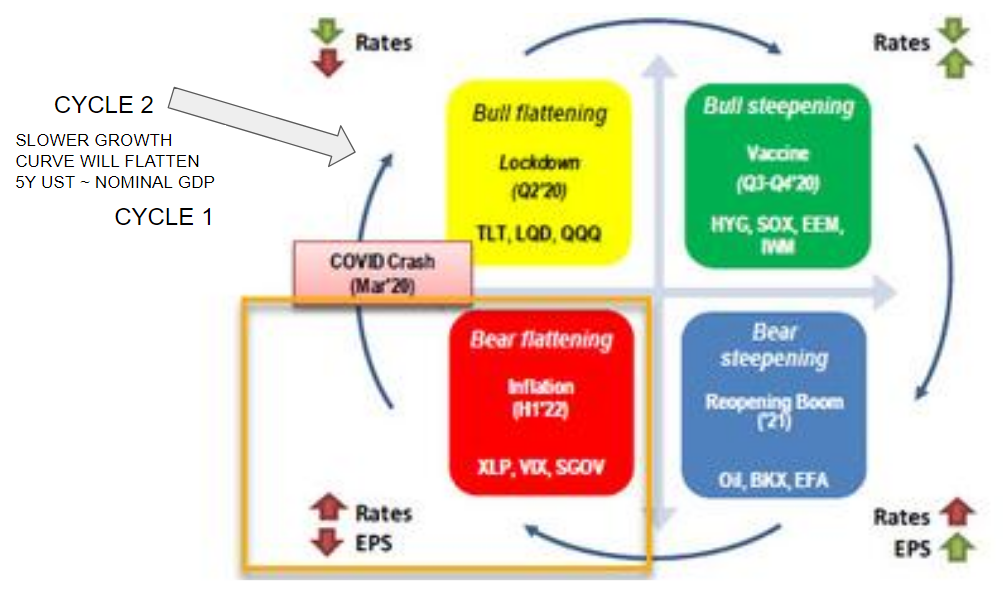

A FALSE POLITICAL REALITY (charts BELOW)

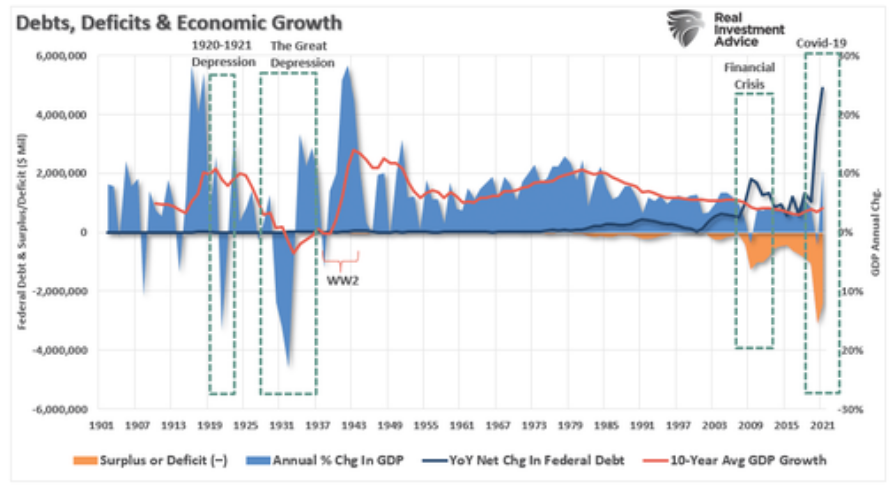

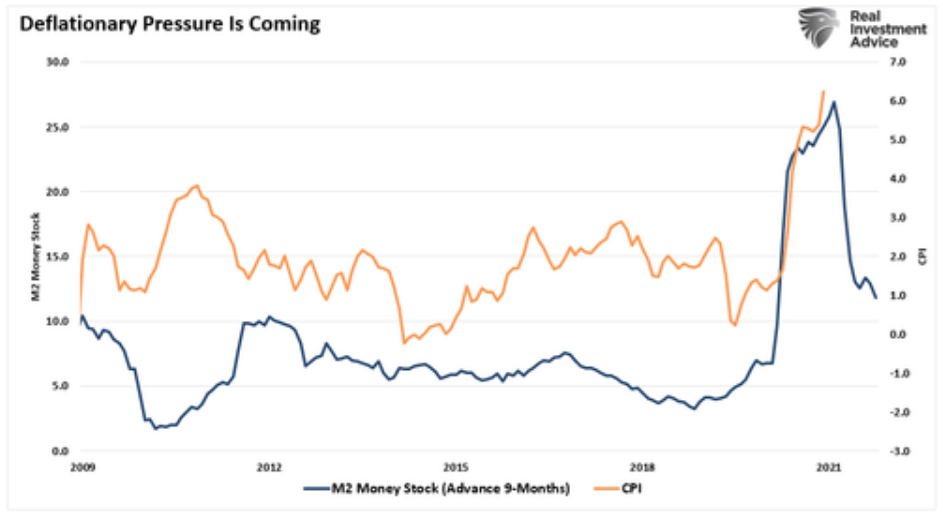

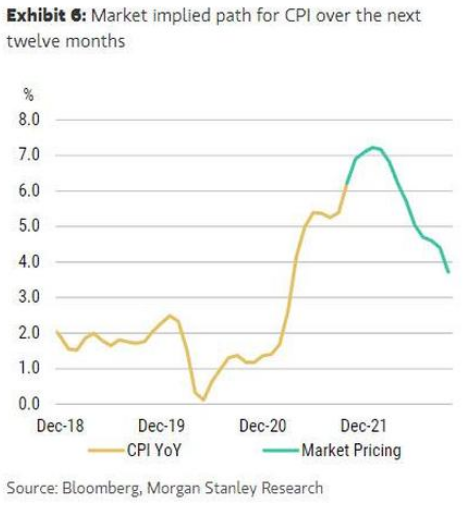

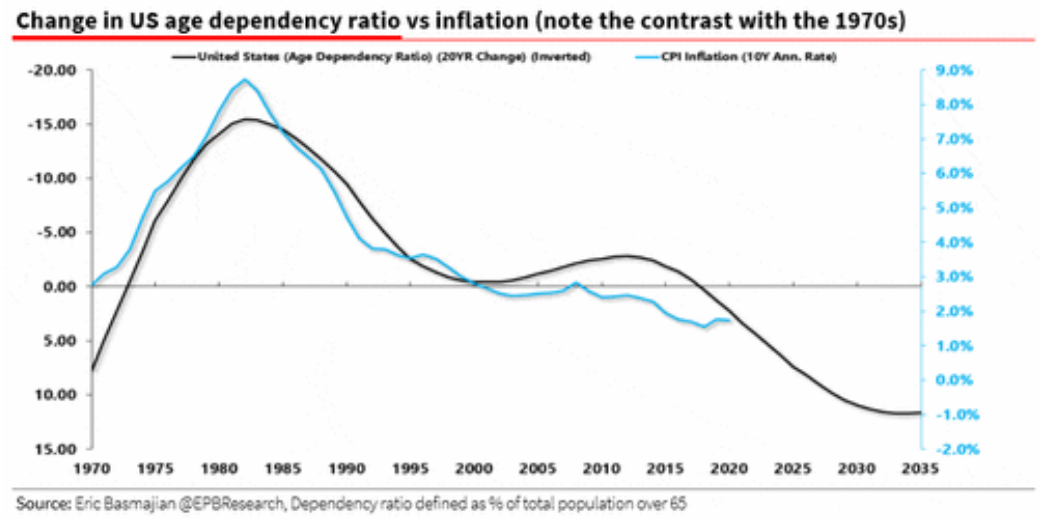

The economic recovery from the Covid shock is built on historic injections of liquidity and the growth in the Federal Reserve’s Balance Sheet. Little of this massive fiscal deficit spending actually went into productive investment to support growth. At best it was short term “triage” for a failing economy; at worst – political desperation in front of a looming debt crisis.

The reality is that the huge deficit growth was most fundamentally used for unprecedented transfer payments to desperately maintain consumption spending. Consumption is not investment!

CHART 1: The chart (BELOW LEFT) illustrates that US GDP growth has been, and still is, a major problem. The US economy is close to the end of an unprecedented decade long business expansion cycle fabricated on endless versions of Quantitative Easing (QE).

CHART 2: The second chart (BELOW RIGHT) shows that short term GDP growth is only the result of massive deficit spending to provide government transfer payments. This has resulted in greatly distorted GDP reporting and an illusion of economic growth.