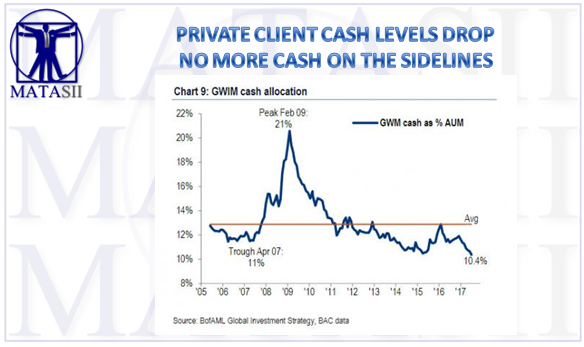

PRIVATE CLIENT CASH LEVELS DROP - NO MORE CASH ON THE SIDELINES

One can finally put all references to "cash on the sidelines" in the trash can, not only for purely logistical reasons (when someone buys a stock, the seller ends up with the cash), but also from a purely cash allocation basis. According to the latest BofA flow show report, Michael Hartnett writes that as of the latest week, private client cash - i.e., high net worth individuals, or those who still allocate capital to single-stocks and ETFs on a discretionary basis (unlike the broader US public which has long ago given up on the stock market), is now at a record low, taking out the cash levels observed in the period just prior to the last market peak in 2007: "GWIM cash allocation % AUM falls to all-time low of 10.4%."

Furthermore, for all the talk about climbing a wall of worry, the same investor group has now allocated 60.3% of its AUM to equities, just why of the recent peak in March 2015 (63%) and far above the pre-crisis peak of 56% in April 2007. At the same time, private clients have reduced their allocation to debt to the lowest on record, or just above 23%.