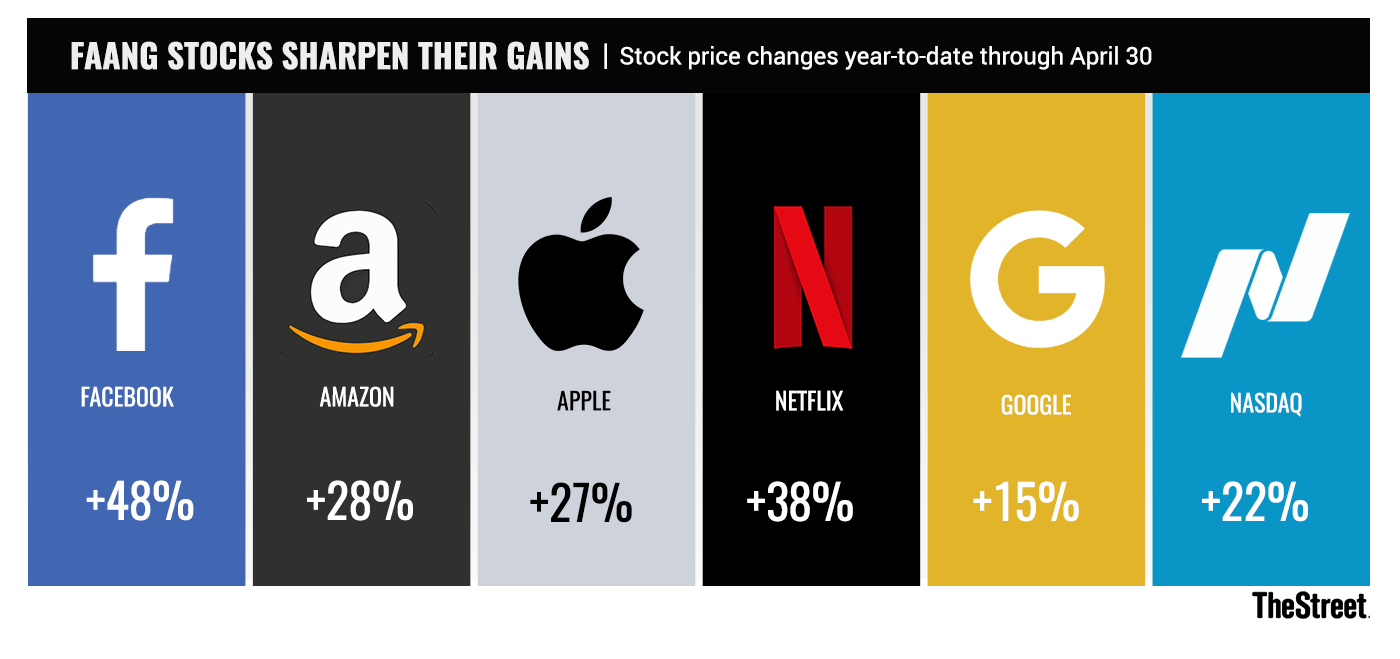

Q1 “FAANG” REPORT CARD

So far its been another big year for MATASII's SII FAANG & NOSH stocks.

After a difficult end to 2018, when the group was hammered alongside the broader market worries, the large-cap tech stocks have come roaring back in a rally that's largely continued through the release of their first-quarter earnings. So far this year, every member of the group apart from Alphabet has notched gains that outperform the Nasdaq composite of 22%. The best-performing stock of the group, Facebook, is up 48% so far this year.

So how did the first quarter look for the FAANGs? Here's a breakdown of how they did as reported by TheStreet.com

1. Facebook (FB - Get Report)

Grade: B+

Facebook's stock is in quite a different place than it was a few months ago, when the Cambridge Analytica data scandal and a relentless parade of bad headlines led to widespread concerns about the company's management. For the first quarter, Facebook beat expectations across the board, posting record highs in revenue, profits and user counts. A large fine from the FTC, which could total $5 billion according to Facebook's earnings report, may have brought some closure to the Cambridge Analytica issue and helped lift the overhang from Facebook's troubled 2018 -- even as it dragged down profit forecasts. Still, questions remain over how Facebook will balance its new "privacy-focused" mantra with its advertising business, which currently makes up 99% of the company's revenue, in the quarters and years ahead.

2. Apple (AAPL - Get Report)

Grade: B

Apple posted a solid earnings and revenue beat in its March quarter that helped to clear away some of the concerns about slowing iPhone growth, particularly in China. And CEO Tim Cook sounded far more upbeat on his company's earnings call a than he has recently. But they were also helped by relatively low expectations, noted D.A. Davidson's Tom Forte in a note on Wednesday: "We attribute the impressive operating results to Apple outperforming against low expectations following its surprise earnings pre-announcement for the December 2018 quarter," he wrote. Investors were also no doubt heartened by a $75 billion buyback program and 5% dividend increase. Nonetheless, as Apple shifts the narrative away from iPhone revenue, it still has some work to do in persuading investors that new services and other initiatives can make up for a slowdown in smartphone sales.

3. Amazon (AMZN - Get Report)

Grade: A-

Amazon continued to rack up huge profits in its first quarter earnings, reporting earnings per share of $7.09 versus $4.72 even amid slower growth in revenue across the board and lukewarm results from its high-margin advertising segment. But looking ahead, it also posted much lighter profit guidance than expected, owing in part to spending on new initiatives such as transitioning to free one-day shipping for Prime members. "With a continued sizable margin expansion at AWS, combined with improving profitability in North America and reduced international losses, consolidated operating income of $4.4B significantly exceeded AMZN's target range of $2.3B-$3.3B, despite elevated spending in fulfillment, content and international expansion," wrote CFRA's Tuna N. Amobi in a note.

4. Netflix (NFLX - Get Report)

Grade: B-

The streaming giant posted robust quarterly growth in subscribers, a feverishly-watched metric as Netflix faces formidable rivals in the market in Disney (DIS - Get Report) , Apple and others. That was helped by a big win in international growth, with Netflix adding 7.9 million subs there versus guidance of 7.3 million. Guidance fell short of hopes, however, leading to concerns that increasing competition and price increases will indeed affect Netflix's position in the market. "Lighter-than-expected Q2 guidance of 5.0M (0.3M U.S. and 4.7M internationally) could portend a more conservative stance on the potential impact of recent price hikes and intensifying streaming competition, but a positive surprise is possible," wrote CFRA's Tuna N. Amobi in an Apr. 17 note.

5. Alphabet (GOOGL - Get Report)

Grade: C+

It isn't often that Alphabet looks like the runt of the litter, but that was the case this earnings season. Alphabet missed on revenue expectations by about $1 billion, posting 15% sequential growth in ad revenue compared to 24% the year prior, a potentially worrisome sign for the search giant and advertising giant. Moreover, Alphabet's vague approach to explaining its financial results exacerbated investors' discontent, with Alphabet stock down more than 9% since posting its earnings on Monday. Some analysts reasoned that the drop presents a buying opportunity, but signs of slowing growth in its core business didn't make for a pretty picture last quarter.

[SITE INDEX -- MATA - FUNDAMENTALS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: FUNDAMENTALS

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 05-01-19 - - "Slow GDP Growth Is Very Bullish For Stocks At This Stage Of The Business Cycle"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.