ARE RECORD STOCK BUYBACKS APPROACHING AN "EMPTY TANK"!

Warren Buffett is well known for comparing stock prices to GDP to assess whether stocks are becoming over-valued with inherent levels of excess risk.

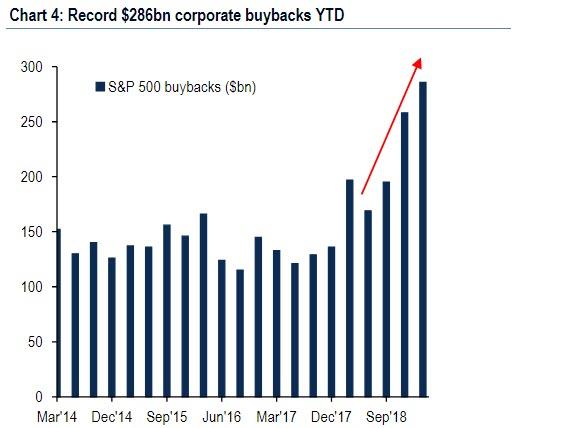

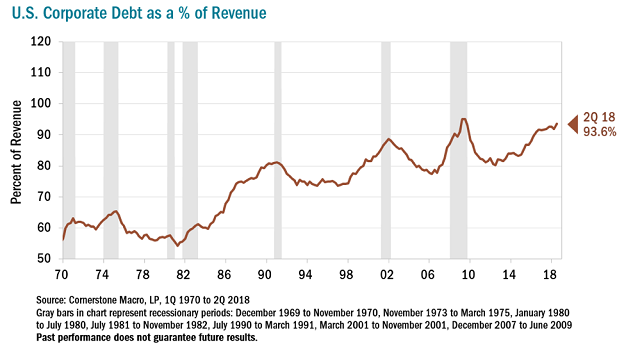

Stock buybacks this year continue to be financed with corporate leverage. However, the question is how much more leverage can corporations take on as a percentage of the total economy?

Do we now need to think of Buffett's benchmark guidance in terms of the corporations debt since almost all of its record increased leverage has been used to boost record stock prices and additionally shrink total market shares outstanding?

With a Recession on the horizon when revenues historically drop precipitously,consider this:

[SITE INDEX -- TIPPING POINTS - US STOCK MARKET VALUATIONS]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS & PUBLIC ACCESS)

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.