RETAIL: AUTO - HURRICANE REPLACEMENTS NEARLY COMPLETE - "VICIOUS CYCLE" SOON TO RESUME!

Before I get started, I’d like to share a few important things that will help bring perspective to my analysis.

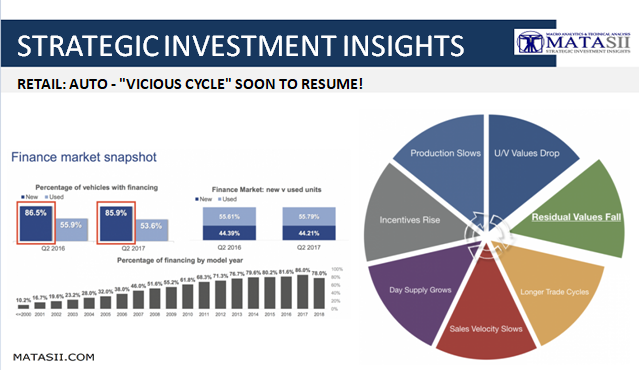

- Eighty-six percent of consumers purchasing a new vehicle use financing. The frequency of replacement (trade cycles) by this group significantly impacts the velocity of new-vehicle sales.

- Under normal conditions, vehicles financed for 60 or 72 months are traded at 36 or 42 months, respectively.

- Most leases have a 36-month duration and are held till maturity.

- Think of new-vehicle sales as potential used-vehicle supply. The moment the ownership paperwork is completed on a new vehicle, it becomes a used vehicle.

Why used vehicle values?

Only jobs and credit are more important than used-vehicle values are to the health of the auto industry. Fully 86% of new-vehicle sales are financed, and under normal conditions the majority of those vehicles are traded within three years. Knowing that most car loans have a 60–72-month duration, we can assume that the majority of vehicles traded at the three-year mark are not paid off. The level of equity in these loans directly affects consumer behavior and in large part determines when the vehicle will be traded for another new vehicle. The frequency with which this very large group of consumers trades vehicles on which they still carry loans is one of the most important factors in new-vehicle sales velocity. I can make a strong argument that when used-vehicle values decline sufficiently, they can outweigh the positive effects of strong jobs and easy credit – we’ve seen this already this year.

2017 recap

Here’s what we’ve witnessed to date after record-breaking new-vehicle sales in 2016. Used-vehicle values fell, slowing the velocity of new-vehicle sales as people chose used over new. Inventory piled up at retail dealers; and after dealers failed to stimulate sales of new vehicles through bigger discounts and incentives, manufacturers were forced to slow or halt production to manage day- supply levels.

In June of this year, used-vehicle values began to stabilize because

- Wholesale supply (inventory from rental vehicle companies) tightened and

- Demand for used cars rose as new-vehicle sales fell (new-vehicle sales provide trade-ins to be resold on the used-vehicle market).

Another drop in used-vehicle values will trigger the same cycle again, although this time it will be much worse because used-vehicle value performance impacts residual value decisions for new leases. When residual values fall, monthly payments will rise, adding another layer of resistance to retail sales growth. Please read ‘The Perfect Storm 2 – Autonomics’ for a more detailed explanation on the importance of leasing.

After this year’s sales lagged last year’s for eight months in a row, September marked the first sales gain of 2017. This happened in large part because approximately 600,000 vehicles incurred flood damage during hurricanes Harvey and Irma and had to be replaced. However, I believe that the perceived benefits to vehicle sales of these hurricanes are wildly overstated. To date, approximately 400,000 insurance claims have been filed, but only those claimants with full coverage insurance will receive the replacement value of their vehicle. There were also 125,000 jobs lost due to Harvey alone. Employment is one of the most important requirements when would-be buyers attempt to secure an auto loan.

That said, August and September sales volumes were affected by the storms. While September results were strong, it’s important to note that only 63,881 more vehicles were sold than in the same months of 2016. With so many vehicles destroyed and such a small number of additional vehicles sold, I can’t help but wonder how much September weakness these hurricanes masked. Some analysts are forecasting continued strength through Q1 of 2018 – I strongly disagree. It simply does not take that long to replace a lost vehicle once an insurance claim is filed. I believe the sales spike in September may have included the majority of the demand for replacement vehicles and that the coming months will see little residual benefit from these unexpected events.

The hurricanes were also responsible for the largest spike in used-vehicle values this year. Retail dealers aggressively bought used vehicles at auction, based on speculative forward demand assumptions. I say speculative because normal, healthy demand starts with a sale. A dealer sells a vehicle then buys another to maintain proper inventory levels. This sales spike waved a huge red flag for two reasons. First, all of the vehicles lost will not be replaced, at least not in the short term. Second, with a high day supply of new vehicles and all-time high incentives, much of the replacement demand may be absorbed by new-vehicle sales instead of used-vehicle sales. If retail dealers get stuck with this inventory after paying a strong premium, they will not return to auctions until those vehicles are sold. In early September I was concerned that a drop in demand from dealers occurring the same time that lease return volume picks up in the fourth quarter could cause a sharp drop in used-vehicle values.

Where are we now?

My concerns were well founded. I noticed a buildup of wholesale supply in mid-September that has now grown to the largest I’ve tracked all year. Without adequate demand to absorb the build in wholesale supply, used-vehicle prices have fallen significantly in October. How significantly? Enough to erase all of the gains in September as well as all of the gains going back as far as June, when used-vehicle values began to stabilize.

For months, I’ve been preaching patience to investors with an interest in shorting auto-related equities. I expected a rebound in new-vehicle sales as retail dealers and manufacturers continued to offer larger and larger discounts in response to a day-supply problem that for some reached 2008 crisis levels. A combination of all-time-high incentive spending and replacement demand from the hurricanes satisfied this necessary piece of the puzzle in September. I also expected a bounce in used-vehicle values, which came to fruition as well.

In my professional opinion, the time to act is now. The events I’ve described should start the same vicious cycle that we witnessed earlier this year, although this time with more acute ramifications.

Will used-vehicle values continue to fall?

The simple answer is yes – mostly because of the performance of used-vehicle values versus residual values on active leases. When used-vehicle values underperform their respective residual values at maturity, the return rates for the captive banks rise. Higher return rates lead to more inventory at wholesale auctions, leading to lower used-vehicle values. Lease return volume will continue to grow steadily along with higher return rates, peaking sometime in late 2019. Here are a couple of examples of maturity curves going forward, using information found in recent auto lease ABS filings for Ford and Mercedes:

Another factor to consider is margin compression. As more used vehicles enter the retail market, consumers will have more options, and retail dealers will have to compete harder to earn their business. It’s important to understand the difference between new vehicles and used vehicles with regard to margin compression. Unlike new vehicles, which have a set cost for all retailers, used vehicles are subject to natural price discovery. A used vehicle is always awarded to the highest bidder at a wholesale auction. Consider for a moment how used-vehicle managers and buyers think: First, what will the vehicle sell for in my market? Second, what is my estimated reconditioning cost, auction fee, transportation expense, etc.? Third, how much profit do I want to make? What’s left over is the bid limit. As margins compress due to growing competition, the calculations are adjusted and bid limits keep falling.

What stops the vicious cycle of falling used-vehicle values?

As I stated at the beginning of the article, think of new-vehicle sales as used-vehicle supply. The same thing that stopped the decline in used-vehicle values during the last recession will be needed this time around: years of declining new-vehicle sales.

Falling new-vehicle sales volume will negatively impact a wide range of companies in the automotive industry, including manufacturers, suppliers, lenders, and retail dealers. Falling used-vehicle values will affect the same companies, but none more directly than rental car companies, whose largest expense is per-unit depreciation.