SAXO BANK: DATA SHOWS THERE IS "ZERO CONFIDENCE IN THE REAL ECONOMY"!

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS & PUBLIC ACCESS) READERS REFERENCE

SOURCE: 02-08-19 - Steen Jakobsen, Chief Economist & CIO, Saxo Bank - "Jakobsen: Data Shows There Is "Zero Confidence In The Real Economy""

MATASII SYNTHESIS:

- In 2018 based on their core macro view the Saxo Bank argued the world was coming to a standstill, which they described with the term 'the Four Horsemen'

- Quantity of money collapsing,

- Price of money rising,

- The price of energy = a tax on consumption,

- Anti-globalization = reduced global trade volumes,

- In December, Saxo moved to their new theme of 'Global Policy panic'

- In a world with no business cycle and just a credit cycle in its place, a slowdown or an equity market selloff would be met with more credit and a pause from the Federal Reserve.

- In January we saw a market return in excess of the weighted yearly return normally expected for an entire year!

GOING FORWARD

- Expect weakening growth and earnings with lower inflation via the multiplier and the velocity of money,

- The Trade Deal

- Narrative could wind up being a very "buy the rumor, sell the fact" affair as the Four Horsemen come riding back in.

- The China-US trade deal will go ahead, but only on the level of a framework... or rhetoric, really.

- It is time to re-estimate your risk.

The Non-Rebound

As we predicted, policymakers rushed to the aid of late-2018's faltering markets with more of the same: credit and a QT pause.

Clearly, a new narrative is needed, and we think it's time to re-evaluate risk.

You will all recall how forcefully we argued that the world was coming to a standstill in 2018 based on our core macro view, which we termed 'the Four Horsemen':

- Quantity of money collapsing

- Price of money rising

- The price of energy = a tax on consumption

- Anti-globalisation = reduced global trade volumes

Then in December, we moved to our new theme of 'Global Policy panic'.

The Global Policy Panic argument held that, in a world with no business cycle and just a credit cycle in its place, a slowdown or an equity market selloff would be met with more credit and a pause from the Federal Reserve.

This has now come to pass, and January of this year saw a market return in excess of the weighted yearly return normally expected for an entire year!

A new impulse and a new narrative are clearly needed...

(The China-US trade deal will go ahead, but only on the level of a framework... or rhetoric, really.)

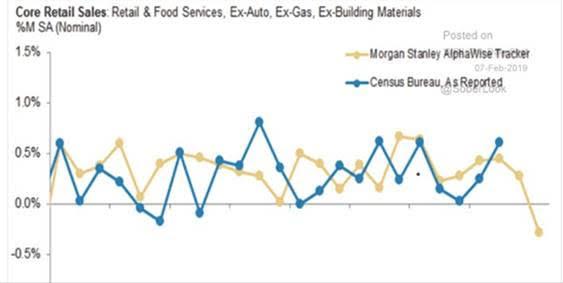

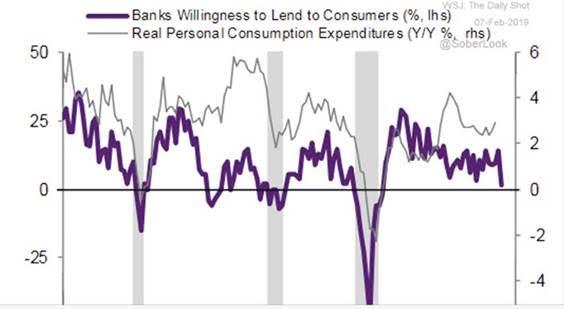

What you should be concerned about as you move to manage/protect your portfolio is summed up in these two charts from today's edition of the Wall Street Journal's Daily Shot:

The data presented here illustrate two major points:

- There is zero confidence in the real economy – not among consumers and not among banks.

- The first chart dictates

Taking action

Start by offloading 'risk-on' for a more balanced view (there is no need to panic, the illusion of an incoming trade deal and incoming reflation will largely remain just that).

Sell calls on upside equity risk, particularly in the US, which is extremely expensive again.

Increase cash or buy protection in both equities and high-risk currencies (GBP, AUD or KRW versus CHF, DKK or JPY).

It is time to re-estimate your risk. Whatever the level you have chosen, I am cautioning that the trade deal narrative could wind up being a very "buy the rumour, sell the fact" affair as the Four Horsemen come riding back in.