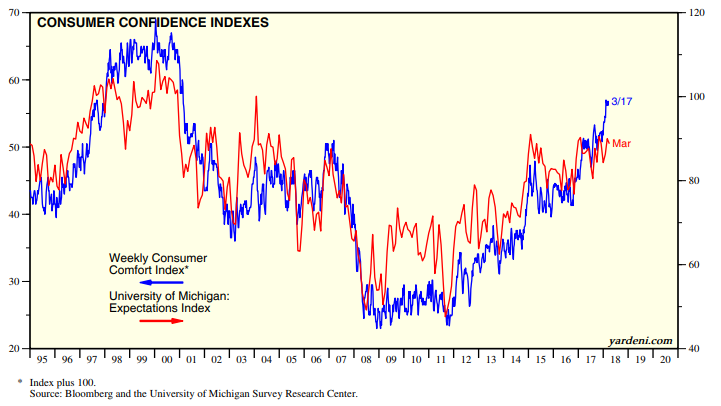

SENTIMENT: CONSUMER COMFORT CLIMBS TO 17 YEAR HIGH

In an editorial 08-22-17 entitled "WHAT WE KEEP FORGETTING ABOUT MARKET EUPHORIA & GREED" I outlined that in the Short Term the market reacts to Sentiment. I showed that research by Dr Ed Yardeni indicated how closely) the Consumer Comfort Index in fact tracks the Forward S&P 500 PE. The Consumer Comfort Index slightly leads which allows you to get a "Heads-Up" on a potential shift! I followed up with an article entitled "SENTIMENT: CONSUMER COMFORT CORRELATES WITH FORWARD S&P 500 PE" on 09-07-17.

U.S. consumer sentiment advanced last week to a fresh 17-year high as greater optimism about household finances and the buying climate more than offset a deterioration in views about the economy, the Bloomberg Consumer Comfort Index showed Thursday.

HIGHLIGHTS OF CONSUMER COMFORT (WEEK ENDED MARCH 31)

|

- Weekly index rose to 57.2, the highest since Feb. 2001, from 56.8

- Personal finances measure rose to 64.7, highest since May 2007, from 63.8

- Gauge tracking views of the economy fell to an eight-week low of 57.8 from 58.7

- Comfort index of buying climate rose to 49.1, highest since 2000, from 47.8

|