SHARE BUYBACKS DUE TO REPATRIATED FOREIGN CASH REACHED HIGHEST LEVEL ON RECORD DURING Q1

-- SOURCE 06-05-18 BoA via ZeroHedge - "The Q1 Results Are In And... Spending On Share Buybacks Hits All Time High --

In addition to being one the best quarter for corporate earnings growth since 2011 due to Trump's corporate tax cuts and fiscal stimulus, Q1 earnings season was closely watched for another key reason - to see what companies are doing with the excess cash "unlocked" thanks to Trump's repatriation holiday: would companies spend it on capex and growth, or would they continue to splurge on buybacks, dividends and other shareholder friendly actions instead?

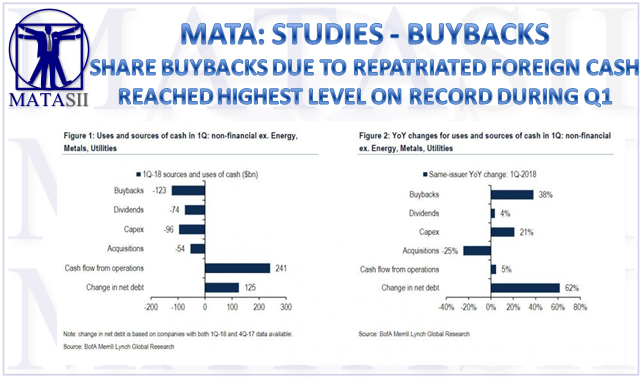

Now, thanks to Bank of America's credit team which has combed through Q1 public filings, we have an answer, and there is no contest: if Trump had indeed hoped that his tax reform would boost capex more than buybacks, then it has indeed been a failure. As BofA reports, amid high grade non-financial issuers of debt, share buybacks reached the highest level on record during 1Q (ex. Energy, Metals, Utilities) as companies spent repatriated foreign cash.

To be fair, investment in capex did increase, although at half the rate as buybacks, while spending on dividends was stable and spending on acquisitions declined relative to 1Q of last year.

Digging deeper, in Q1 share buybacks among IG issuers rose to an all time high $123BN, up from $82bn in 4Q-17 and $66bn in 3Q-17. The jump in buybacks was driven by companies spending repatriated foreign cash not on capex and higher wages as Trump may have intended (if only in public comments) but on shareholder friendly activity. Furthermore, as BofA adds, 24 high grade issuers with large foreign cash holdings accounted for two-thirds of the total increase in buybacks relative to 4Q.

So what about CapEx? The good news is that spending on long-term growth was $96bn in 1Q, not that much lower than what was spent on Capex. The not so good news is that while capex spending was up from $79bn in 1Q-2017 - a far more modest increase than CapEx - it was down from $103bn in 4Q. Overall the YoY increase in capex spending was 21% (on an issuer-matched basis). The 24 issuers with large holding of foreign cash accounted for over half of the increase in terms of dollars, and capex spending for that group jumped 57% YoY. This suggests that some foreign cash was also invested organically, even if the bulk was returned it to shareholders via buybacks.

The two other corporate uses of cash, spending on acquisitions and dividends, saw recent trends extend, and were thus not impact by Trump's fiscal reform; Spending on M&A specifically continued to decline in 1Q, falling to $54bn from $64bn in 4Q-17 and the recent peak of $85bn in 4Q-2017. This reflects a relatively low pipeline of M&A deals with funding needs late last year. Finally, spending on dividends actually declined $74bn in 1Q from $78bn in 4Q (Figure 8). However, dividend payouts were up 4% on a YoY basis.

Then again, none of this should be a surprise: recall that last November, Gary Cohn explicitly asked corporate managers what they planned on doing with the newly released cash. "If the tax reform bill goes through, do you plan to increase investment — your company's investment, capital investment?" He asked for a show of hands. Alas, as the camera revealed, virtually nobody raised their hand.

Responding to this "unexpected" lack of enthusiasm to invest in growth, Cohn had one question: "Why aren't the other hands up?"

We now know why.

Finally, buybacks and capex aside, BofA also looked at overall credit trends in the first quarter and finds that gross leverage for US public non-financial high grade issuers increased to 3.04x in 1Q from 2.98x in 4Q, while net leverage rose to 2.67x from 2.54x. Both gross and net leverage are now the highest on record, which is great as long as rates are near record lows, but will promptly become a recipe for disaster as rates keep rising.