SII RETAIL: ARE GROCERY CHAINS AN EMERGING PROBLEM AS THEY ARE POTENTIALLY "AMAZONED"?

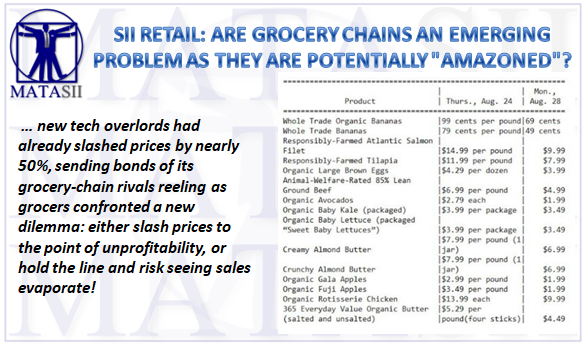

Amazon officially assumed control of Whole Foods Market on Monday and by noon, channel checks at WFM stores revealed that its new tech overlords had already slashed prices by nearly 50%, sending bonds of its grocery-chain rivals reeling as grocers confronted a new dilemma: either slash prices to the point of unprofitability, or hold the line and risk seeing sales evaporate.

And as bonds of even highly rated grocery chains have underperformed this week, Bloomberg is questioning whether the WFM acquisition has fundamentally changed market dynamics in what was previously an island of stability in a retail sector beset by bankruptcies.

But Amazon, with its seemingly infinite capacity to slash prices and brook losses, has created new risks for Whole Foods' rivals.

“The bonds that financed Apollo Global Management’s purchase last year of upscale grocer Fresh Market plunged to new lows this week. The cost of buying contracts to protect against a default in Albertsons Cos.’s debt has jumped. Bonds of Bi-Lo Holdings have lost almost half their value this year.”When Apollo Global bought Greensboro, North Carolina-based Fresh Market for $1.4 billion last year, the grocery world seemed quite different. The chain, known for its fresh produce, had seen sales slow. To lure customers back to Fresh Market’s roughly 170 stores, the private-equity titan was betting it could rely on its experience with previous - and profitable - investments in companies such as organic grocer Sprouts Farmers Markets.

But Fresh Market is struggling for some of the same reasons that sent Whole Foods into the arms of Amazon. Mainstream competitors including Kroger Co. and Wal-Mart Stores Inc. have pushed deeper into sales of fresh produce and organic products. Supermarkets have opened so many stores that many analysts expect a shakeout. Before the Amazon deal, Fresh Market bonds traded as high as 91 cents on the dollar. Now they fetch less than 76 cents.”

The reason is simple: Amazon, which is insulated not only by its e-commerce hegemony but also by investors who don’t expect the company to turn a profit. One analyst aptly referred to this as the Amazon-Whole Foods "fear factor.”

“It’s the fear factor of Amazon,” said Mickey Chadha, an analyst at Moody’s Investors Service. “No retailer can under-price as long as Amazon can, make no money and get away with it. That’s why people are scared.”

* * *

News of the Amazon deal obliterated billions of dollars of grocers’ valuations, slicing $2 billion off Kroger’s market cap in one day. The grocer’s stock is down 35% this year. Yet its bonds have held steady.

Meanwhile, nearly $3 billion in Albertsons bonds due in 2021 have tumbled..

“Kroger’s bonds, which are investment grade, haven’t been hit. But about $3 billion of Albertsons debt coming due in 2021 has felt a chill. The loans have been trading at 97.6 cents on the dollar. Large, liquid, secured loans of that size typically command par, or 100 cents. A public stock offering for the Cerberus Capital Management-backed grocer was again put on hold after Amazon announced its purchase of Whole Foods.”

...causing the cost of insuring them to skyrocket.

As one might expect, analysts now believe that large chains with relatively low debt burdens will somehow manage to survive.

But smaller chains like Bi-Lo Holdings may soon find that their debt burdens are untenable:

“For example, Bi-Lo Holdings has borrowed hundreds of millions to make cash payouts to private-equity owner Lone Star Global Acquisitions. One of the bonds the company sold to pay the dividends now trades at levels indicating investors expect to recoup only a third of what they loaned the company.”

Tops Friendly Markets, another troubled grocer, is being choked by its $720 million debt pile.

“Tops Friendly Markets, which is reporting millions in losses, is straining under $720 million in debt. Using a maneuver typical of distressed companies, it put off repayments due in 2018 while it grapples with price deflation and traditional rivals in its western New York home turf. If earnings and the balance sheet don’t improve, investors holding the rest of Tops’ bonds could find they’re stuck with spoiled goods.”

However, there's at least one factor that may insulate the market's weaker hands, at least for a little while. There are 40,000 grocery stores in the US, only 400 of which are WFMs...

So, should investors be bracing for a wave of grocery bankruptcies resembling this year’s record run of failures among department stores, apparel sellers and electronics retailers? Maybe not right away. But once Amazon's had a few years to expand its footprint, a massive shakeout seems inevitable.