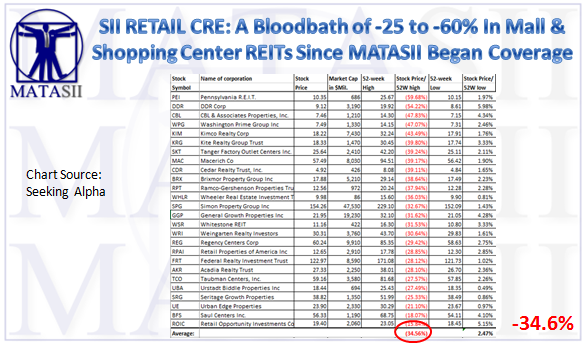

SII RETAIL CRE: A bloodbath of -25 to -60% In Mall & Shopping Center REITs Since MATASII Began Coverage

If you were investing in eREITs (as a whole) you have likely done just fine versus investing in the Retail-exposed eREITs.

This is where the erosion of value has really taken front stage.

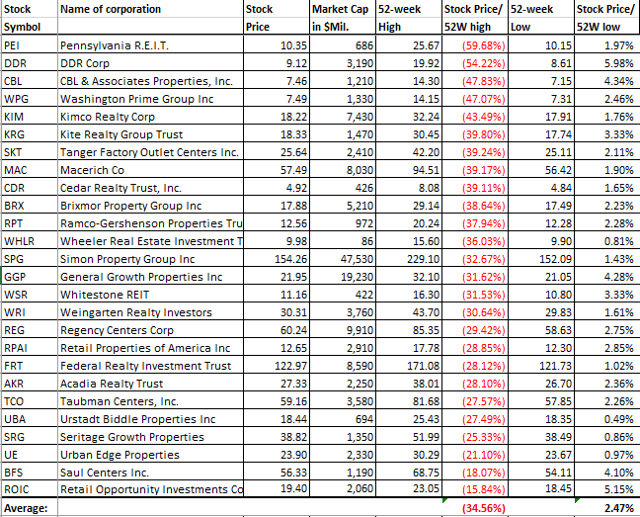

Stock prices of 23 out of 26 malls and shopping-center eREITs have lost between 25% to 60% of their market-caps from their 52-week highs:

- The seven names with market-caps greater than $5B (SPG, GGP, REG, FRT, MAC, KIM, BRX) shed 34.73%, on average, of their peak valuations.

- The six names with market-cap smaller than $1B (WHLR, WSR, CDR, PEI, UBA, RPT) lost 38.63%, on average, from their peak valuations.

If you look at the performance of eREITs over the past 10 months, you can easily see that the peak took place during July 2016, just about when MATASII started coverage of SII: RETAIL CRE.

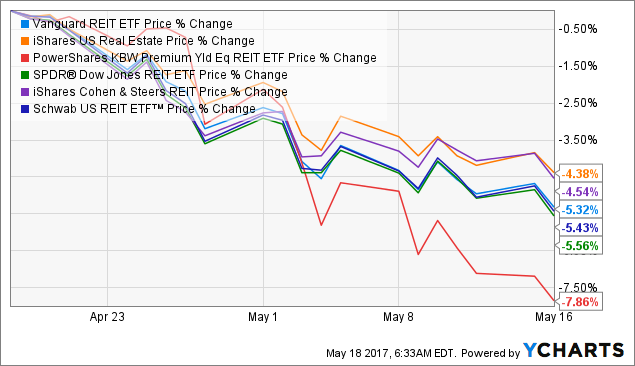

While eREITs total return is minus ~7-8%, equities (NYSEARCA:SPY), BDCs (BIZD, BDCS) and mREIT (REM, MORT) have delivered double-digit returns.

Putting it differently, if you were investing in eREITs over the past 10 months your total return is not only negative but it's trailing the market and especially other RICs by 20-25%.

This trend has clearly intensified over the past month: