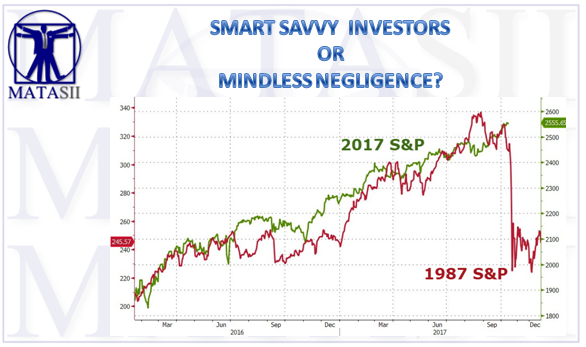

SMART SAVVY INVESTORS OR MINDLESS NEGLIGENCE?

-

- “Stock Market has increased by 5.2 Trillion dollars since the election on November 8th, a 25% increase.”

- Dow’s up over 15.5 percent year-to-date.

- The value of global equities is now 3 1/2 times that at the financial crisis bottom in March 2009.

- The dollar-denominated capitalization of worldwide shares (Aided by an 8% drop in the U.S. currency) appreciated in 2017 by $20 trillion. That is comparable to the total value of all equities nine years ago. It’s also, oh irony, awfully close to the total increase in central bank balance sheets, through QE etc.

- More than 85% of the 95 benchmark indexes tracked by Bloomberg worldwide are up this year, on course for the broadest gain since the bull market Pasted from

- The Euro Stoxx 50 Index is up 10%, Italy’s FTSE MIB Index is up 17% and Germany’s DAX Index is up 13%. The rally is even stronger when priced in U.S. dollars, with the Euro Stoxx 50 up 23% since the start. Pasted from

- Emerging markets have surged 31%, developed nations are up 16%. (be reminded Emerging markets and developed economies have borrowed up the wazoo)

- Technology megacaps occupy all top six spots in the ranks of the world’s largest companies by market capitalization for the first time ever, up 39% this year. The $1 trillion those firms added in value equals the combined worth of the world’s six-biggest companies at the bear market bottom in 2009. Apple, priced at $810 billion, is good for the total value of the 400 smallest companies in the S&P 500.

- The European Central Bank has been buying bonds and securities at a rate of €60 billion a month for years now. How can it be any wonder that officially stock markets are up 14%? Maybe we should be surprised it’s not 114%.

We have a harmonized recovery in the global economy that’s virtually without precedent

RISKS & HAZARDS NO LONGER MATTER!

Consider just some of the historically significant current risks:

-

- Not the prospect of nuclear war with North Korea will stop this bull market.

- Not the gold backed yuan oil exchange agreements being developed between Beijing, Moscow, and Tehran, and the implications for the petrodollar’s reserve currency status.

- Not weak jobs numbers.

- Not runaway government debt,

- Not consumer debt nor corporate debt haven’t fazed the stock market’s trajectory. Because everyone loves debt. Especially bankers. They want more debt so they can buy more stocks

- Not Nosebleed level valuations - they don’t matter either. Because, if you haven’t heard, high valuations are no longer high; they’re permanent. Likewise, the beginning of the Fed’s great unwind of its $4.5 trillion balance sheet has hardly elicited a flinch.

- Not President Trump’s shoddy tax reform proposal, the proposal that would tax income that’s already confiscated via state and local taxes, hasn’t done a thing to deter today’s smart and savvy investors. Why should they care about taxes when, thanks to The Donald, their portfolio wealth has increased by 25 percent since election day?

- Not dangerous Passive Investing since smart and savvy investors, particularly buy and hold index investors, have reaped plentiful fruits for mindlessly plowing their capital into low cost S&P 500 index ETFs. Indeed, this strategy has worked well for nearly a decade. Surely it will continue, right? A passively managed S&P 500 Index ETF, such as the SPDR S&P 500 ETF (NYSE: SPY), is up over 279 percent since March 9, 2009. Investors that merely bought and held have been rewarded for their lack of discrimination. Conversely, those who scratched their head, did some homework, and concluded that the market’s fundamentals are deficient, have been sorely punished.