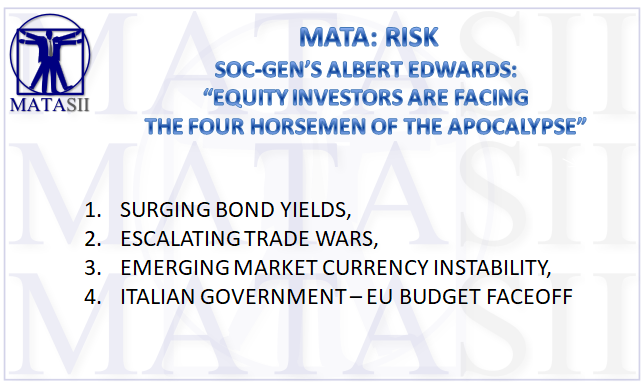

SOC-GEN'S ALBERT EDWARDS: "EQUITY INVESTORS ARE FACING THE FOUR HORSEMAN OF THE APOCALYPSE"

-- PUBLIC SOURCE FOR YOUR REFERENCE: 10-11-18 - "Albert Edwards: "Equity Investors Are Facing The Four Horsemen Of The Apocalypse"" --

Even SocGen's Albert Edwards was surprised at how quickly his latest predication was validated.

Recall that 3 weeks ago with the 10Y yield at 3.10%, with Edwards looking at the surge higher in 10Y Yields the SocGen strategist pointed out that the break in the 10y above 2.8% was not the key level that could mark the end of the secular bull market, but rather it was the 3.05% zone as shown in the chart below.

Commenting on this breakout, he said that rates might surge further and addressed whether this would mean the end his "Ice Age" thesis. As he noted, if investors “get the wrong side of a new multi-year bear market in government bonds, all investment portfolios will be shredded to ribbons as bonds are the cornerstone of most equity valuation models”.

Fast forward to today when in his latest note he writes "let me be totally honest: I was most surprised that the US 10y yield managed to smash through its multi-decade downtrend last week, mainly due to the fact that the CFTC data showed that speculators had already built unprecedented large short positions. It seemed that every man, woman and child was already bearish and so who was left to sell? Well clearly someone was! One thing that helped tip bond prices over the edge and take yields up to 3¼% was the fundamental support from stronger than expected economic data (see chart below). "

Another factor for the latest breakout in yields which pushed the 10Y interest rate to fresh 7 years highs was the previously discussed economic exuberance by Fed Chair Powell who managed to convince markets that they were still too sanguine on their expectations on interest rates, "and the futures strip ratcheted up another notch towards the Fed dots."

The speech last week by Fed Chair Powell was interpreted as unusually upbeat - referring to a remarkably positive outlook for the economy. This contributed to the surge in expectations for further tightening throughout next year. For, although expectations for tightening in the first half of next year had been rising for some time, until very recently this had merely pulled rate hikes forward from H2 to H1. In recent weeks, expectations of more rate hikes have risen sharply in both halves of next year and even spilled into 2020.

Yet while he may have called the short-term move in rates correctly, Edwards is anything but a bond bear. In fact, quite the opposite, and as he notes, "despite the highly significant technical breech of the critical 3.05% long-term secular downtrend, I still stand by my forecast that US 10y yields will go deeply negative in the next recession (to around minus ½-1%)."

I recently reviewed the Global Strategy Weekly of 13 June 2007 when I was at Dresdner Kleinwort (I was not able paste the pdf into this weekly for copyright reasons). Then the remarkably similar and decisive break in the 20-year downtrend of bond yields did not mark the end of the bull market, despite 10y yields breaking above 5.05% and rising to 5¼%.

Edwards than reminisces that as Q3 2007 progressed, "yields slumped towards 4% as the bond market began to sniff the recessionary vapors." And, just like now, equities ignored the signs of course and made new highs in October a few weeks after the Fed's first rate cut. "But by December, less than six months after the June peak in yields, the US economy had entered the very worst of recessions" Edwards notes, a point he made last month when he laid out the reasons why the next recession "might be only six months away."

As a result, and contrary to conventional wisdom, Edwards continues to think that "recession and a collapse in bond yields is a greater threat to equities than a further push up in yields from this point, especially given the over-extension of speculative shorts."

Having broken above 3.05%, do not be surprised if this sell-off loses energy.

Maybe, but not today, because even with the disappointing core CPI print, which missed on the biggest plunge in used-car prices in 15 months, the 10Y is already higher than before the number was released.

Having thus concluded his traditionally deflationary view on bonds, Edwards then focuses on Italy, where he highlights one specific chart, which he carries "in my handout while I discuss Italy's dire long-term economic situation within the eurozone, which has resulted (unsurprisingly) in a populist backlash. Frankly, I am surprised that it has taken so long to reach this crunch point."

The chart comes from an excellent recent article in Politico magazine. The full article is well worth reading to understand the hostility in Italy towards the EU, particularly among the young. Politico notes, “In countries like France, the U.K., Germany and the Netherlands, polls show a notable generational difference in attitudes toward the EU. Young people tend to feel more positively toward the bloc, while older people tend to hold less favourable opinions. In Italy, the trend is reversed.” Voters under 45 are significantly more likely to vote to leave the EU (51%, compared to 26% over 45), according to a study conducted by Benenson Strategy Group in October 2

To Edwards, this suggests that "the passing of time will only make anti-EU sentiment worse as the older cohort who approve of the EU die" and is the opposite in the UK where Remainers hope a second referendum may change the result purely due to demographic change since the last vote.

In other words, "in Italy time is not a healer. Time is the one thing the pro-EU establishment does not have on its side in Italy."

* * *

So putting it all together, here is Edwards' traditional punchline which, it will come as no surprise to anyone, is of the doom and gloomy variety:

Equity investors are facing the four horsemen of the apocalypse thundering towards them. Out in front leading the charge is the surge in US bond yields, but close on its heels is the escalating trade war and the instability in emerging market currencies. The final but probably most unpredictable horseman is the current faceoff between the Italian government and the European Commission on Italy’s budget deficit.

And in case this was not graphic enough, Edwards also compares what lies in store for equity investors to the fiery death of citizens of Pompei that took place shortly after Vesuvius erupted:

I just can't seem to escape the financial markets though, because as I saw the cowering skeletal remains in Herculaneum, I was minded of how equity investors might soon feel. They have a big decision to make. Is the eruption in the bond market subsiding? Is it safe to stay in equities and return to normal domesticity, or should they flee?

It's all very well to say that the victims of Pompeii and Herculaneum should have heeded the warning signs in the weeks leading up to the devastating eruption of 79AD. But equity investors might be ignoring similar early warning signs that the bond market is giving.

“After 12 hours huddled in the beachside boat houses, the refugees from Herculaneum had probably assumed that the worst was over. Vesuvius had been erupting all day and, apart from the hail of pumice, there seemed to be no obvious danger. Yet as the 300 men, women and children sat in the semi-darkness debating whether to return to their homes or flee down the coast, a scorching cloud of superheated volcanic ash burst into the crowded shelters. They were instantly fried alive.”

Edwards' recommendation: when you see a volcano erupt next to you, run.