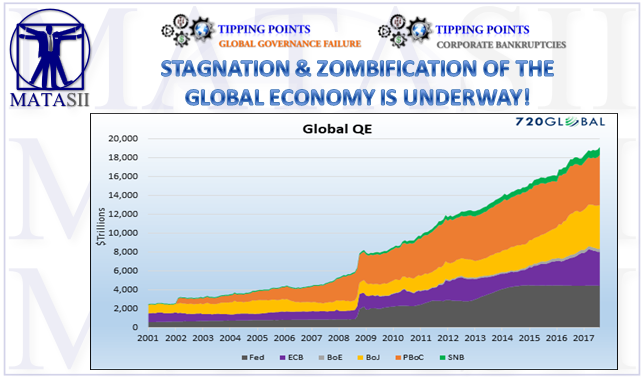

STAGNATION & ZOMBIFICATION OF THE GLOBAL ECONOMY IS UNDERWAY

Liquidity injections and zero interest rate policies disguise risk and may give a false sense of security.

- The difference between now and the Asian or the 2008 crisis is that this time the excess risk is hidden under central banks’ balance sheets and will continue to do so.

- Because of this the endgame is not likely to be a 2008-style bang, but a slow, painful and unstoppable 'Zombification' of the global economy.

- An endless debt growth machine makes an economy less dynamic, and stagnation is guaranteed.

- We can therefore fully expect more Financial Repression policies in the form of:

- More white elephants,

- Massive unproductive spending with fancy names at the expense of taxpayers and savers. Resulting in what is likely to be yet another massive transfer of wealth from salaries and savers to the governments.

- Investors will continue to be forced into riskier assets for lower returns and the accelerated crowding out of productive sectors in favor of government and crony subsidized sectors.

- Money velocity will continue to head lower,

- Productivity growth will continue to collapse,

- Meanwhile mainstream economists will hail the financial repression madness with the excuse that “there is no inflation”, while citizens all over the world complain and demonstrate against the rise in cost of living.

- The idea that Quantitative Easing has failed to spur growth and healthy recovery of the world economy is correct.

- The thought that the mistakes of quantitative easing are solved by outright currency printing and more government crowding out of the productive economy is simply ludicrous.

You do not correct mistakes with a bigger mistake.

JAPAN'S ZOMBIFICATION LEADERSHIP

- The fact that Japan has survived two decades of stagnation with the wrong Keynesian policies should not be an excuse to do the same, but an opportunity to do the opposite.

- Japàn keeps its imbalances because it is one of the few that has undertaken this concerted policy of zombification.

- This cannot be transferred to the rest of the world, because the result would not be Japanese-style stagnation but Argentina-style crisis chain.

- Many economists defend the zombification of economies under a false social premise. The argument is the following: What is bad about following the example of Japan? It has low unemployment, its debt is cheap and the economy survives rather well. It is a social contract and debt does not matter.

- Everything is wrong with this argument.

- Japan’s low unemployment has nothing to do with monetary and fiscal policy and everything to do with demographics and lack of immigration.

- Japan’s low cost of debt is not a blessing. It is the result of using the savings of citizens to perpetuate an almost-Ponzi scheme that does not prevent the country from spending more than 20% of its budget on interest expenses.

- The idea that it is irrelevant because the Treasury buys more bonds tells us how insane we are defending such policies.

- It is a massive kick-the-can policy transferring the risk to the next generations.

- It is no wonder that Japanese citizens don´t spend or invest as much as their central planners would want them too. They are not stupid. They know that the government is going to confiscate wealth via monetary and fiscal means at some point.

- This endless debt machine makes the economy less dynamic, and stagnation is guaranteed. But the strength of the Yen and the low cost of Japanese debt are only supported by the high level of international reserves and strong financial flows of the country.

[SITE INDEX -- TIPPING POINTS - GLOBAL GOVERNANCE FAILURE]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS & PUBLIC ACCESS)

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 04-10-19 - Daniel Lacalle via DLacalle.com - "Central Banks Are Driving Us Toward A Stagnant Global Zombie Economy"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.