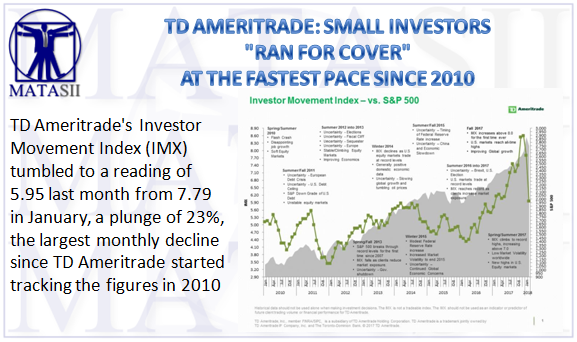

TD AMERITRADE: SMALL INVESTORS "RAN FOR COVER" AT THE FASTEST PACE SINCE 2010

JPM wrote

"the potential withdrawal of retail investors as the marginal buyer of equities could create clear downside risk for equity markets for the near term - especially after buying an unprecedented $100bn of equity ETFs in only one month during January."

Incidentally, the January inflow coincided with what many dubbed the market's blow-off top, or mania, phase.

We now have confirmation that JPM was right because according to TD Ameritrade, in February euphoria turned to panic as mom and pop investors ran for cover from tumbling stocks at the fastest pace since at least 2010.

As shown in the chart below, TD Ameritrade's Investor Movement Index (IMX) tumbled to a reading of 5.95 last month from 7.79 in January, a plunge of 23%, the largest monthly decline since TD Ameritrade started tracking the figures in 2010, according to a press release. This was also the second straight loss for the gauge, which fell 9 percent in January.

“After the amazingly quiet 2017, we saw 2018 start with some volatility,” said JJ Kinahan, chief market strategist at TD Ameritrade. “It appears that TD Ameritrade clients decided to significantly limit their volatility risk in the market, changing their game plan from less speculative to more of a low beta weighted one.”

Speaking to Bloomberg, Kinahan added that the drop demonstrated "our clients really showing a lot of caution for the period. After last year where our clients built up their exposure all year long, we saw a little bit of a click down in January, and a significant click down in February.”

That said, the decline didn’t persist throughout the month, according to Kinahan. Instead, the broker-dealer’s clients picked up some holdings around Feb. 9 when the selloff subsided. But shortly after, they resumed selling with force."

Hence JPM's concern that retail investors may now be selling rallies instead of buying dips.

According to TD Ameritrade, the equities that were sold the most in February were Gilead Sciences and Facebook. Bristol-Myers Squibb was also net sold after it reached an 18-month high, as was Snap which reported a revenue increase which led to a jump in share prices. Finally, Target was net sold following an analyst upgrade and increased price estimate. Additional names sold included ConocoPhillips, Juno Therapeutics, and Bioverativ.

And yet, despite the sharp pullback in risk, clients remained net buyers in the period. Among the biggest net buys were General Electric and Ford as both companies neared multi-year lows. Apple and Amazon were also net buys, despite reporting better than expected earnings then trading lower following market volatility. Boeing traded higher following better-than-expected earnings and was also a net buy. Microsoft was a net buy after beating earnings, as was Alibaba Group, which was down almost 20 percent from recent highs during the period.