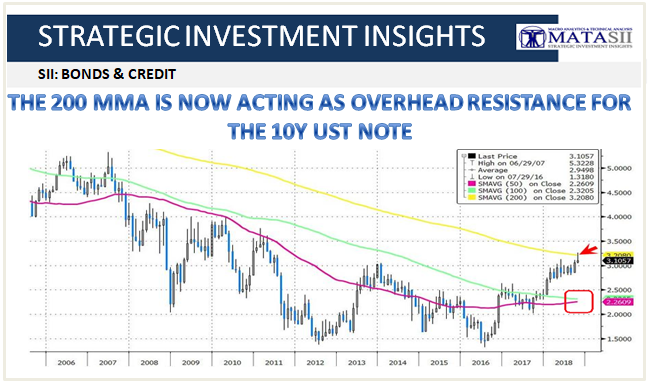

THE 200 MMA IS NOW ACTING AS OVERHEAD RESISTANCE FOR THE 10Y UST NOTE

A PUBLIC SOURCED GRAPHIC FOR MATASII (SUBSCRIBERS-SII & PUBLIC ACCESS) READERS REFERENCE

SII - BONDS & CREDIT

On the monthly charts, 10-year Treasury yields look like they want to go up, but they failed rather miserably at the 200-month moving average. However, we have an approaching potential cross of the 50 & 100 MMA's (red box) which may soon act as a catalyst for higher yields? We suspect that a surprise Republican "House" win in the Mid-Terms may make this happen.

It’s now major league resistance and, importantly, confirms a lot of what can be gleaned from much shorter studies. You can be sure traders would love to see what’s above there.

Perhaps the caution comes from the fact that monthly support is a decent bit lower than what is suggested by the dailies.