THE COMING 'BLACK SWAN' IS ACCELERATING DE-DOLLARIZATION

We have built markets bubbles based on false assumptions that have consequences. Accelerating De-Dollarization will soon be the "grim reaper" of reality! The coming Black Swan is De-Dollarization!

FALSE ASSUMPTIONS

- The 1999 repeal of the Glass-Steagall Act of 1933 was in the best interests of the American economy and its citizens through the increased investment of borrowed money.

- What was put aside is the fact that the original act was intended to assure that banks would never again recklessly create loans to the public that could never be repaid.

- The repeal ushered in a period of reckless loans & a mammoth debt bubble.

- As is always true, the creation of massive debt is like a shot of economic heroin in an economy. The euphoria is very real. Unfortunately, so is the withdrawal. This withdrawal kicked in with the real estate crash of 2007.

- The Fed (which, if you remember, had created the bubble) recommended that, although the bankers had benefited enormously through the creation of the debt, they were now in trouble. Rather than have them pay for their misdeeds, the Fed Chairman put forward the concept of quantitative easing (QE). Through QE, the government would pump money into the banks to bail them out. Therefore the banks benefited hugely from the reckless loans, then benefited hugely again, through the debt-funded QE.

- Quantitative pumped money back into a failing economy. In fact it did not. It was never intended to!

- Most of the money that was created through quantitative easing never actually hit the streets. It was simply gobbled up by the banks!

- The pretense was that QE would be used to pay off bad loans, re-energising the economy. Interestingly, enough money was pumped into the banks through QE1, 2 and 3 to literally write off every mortgage in the country. Had that been done, those cleared of debt would indeed have had the ability to re-invest in the economy.

CONSEQUENCES

1- A GREATER DEPRESSION

- A by-product of the crash is that it brought on the Greater Depression.

- Real income has not increased since 2007, but inflation has.

- Although the US government claims inflation to be at 1.52%, it’s actually far higher – over 5%.

- Likewise, unemployment is claimed to be at 3.8%, yet the real unemployment rate (as calculated by John Williams’ Shadowstats) is over 21%.

- By any of these measures, the US is unquestionably in a depression.

2- DEBT BUBBLE

- Global debt has reached $100 trillion, up from $13 trillion in 1990.

- Debt now represents 57% of global financial assets.

- At $18.4 trillion, the US has the largest treasury debt in the world, close to 40% of the total.

- STOCK MARKET: It has become the norm for companies to buy back their own stocks. Although, this is economically dangerous, it does temporarily inflate the apparent value of the stocks and politicians do point to the stock market boom as proof of their sound fiscal management.

- BOND MARKET: The bond market is at an all-time high.

We see a boom in markets that’s a false-reading.

- It was created entirely through debt and that debt is now in a bubble of historic proportions.

3- VELOCITY OF MONEY

The velocity of money can be defined as, “the rate at which money circulates or is exchanged in an economy in a given period.” It’s generally measured as a ratio of gross national product (GNP) to a country's total money supply.

- The velocity of money has dropped below that which was necessary to maintain a productive economy in 2009 and has never recovered.

- Without money turnover you do not have a functioning economy!

- In the real world of Main Street, the velocity of money has declined dramatically since 2009 and has tanked in 2017, unable to recover.

DE-DOLLARIZATION

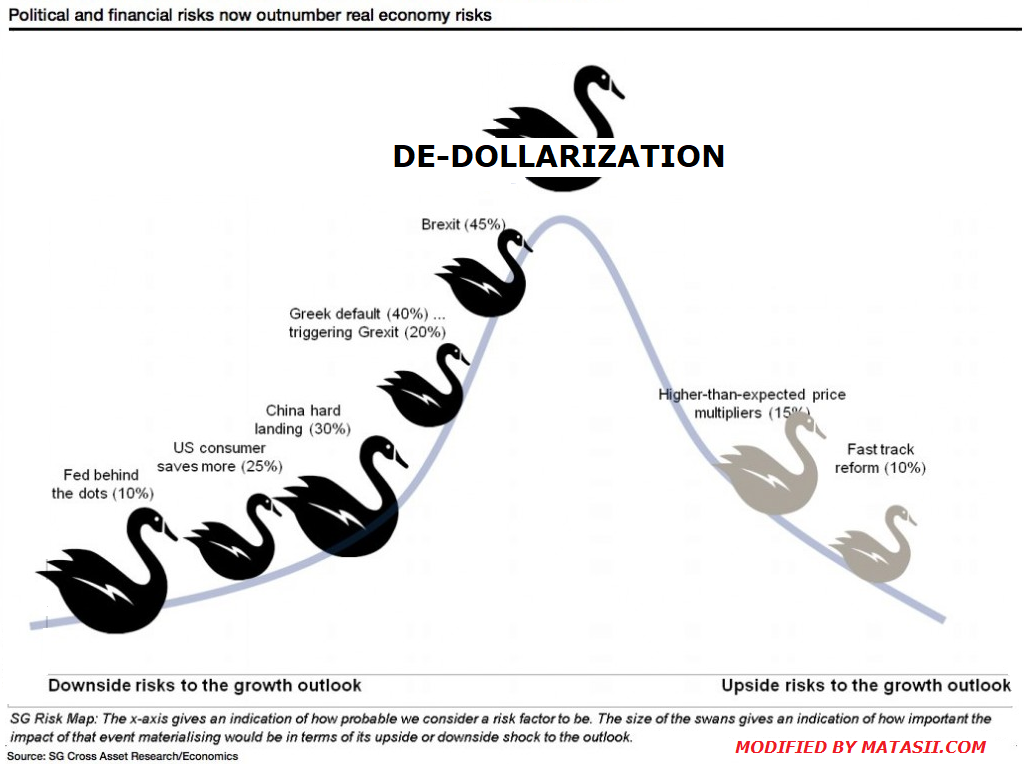

All that’s required to eliminate the notion and to send the economy into a tailspin is a black swan event.

- Will it be the dumping of treasuries back into the US system, as is now on the increase?

- Will it be the full implementation of CIPS, the Chinese interbank payment system?

- Will it be the elimination of the dollar as the petrodollar, as is now underway?

Any one of these DE-DOLLARIZATION black swans are waiting in the wings. All that’s needed is for one of the swans to walk onto the world stage.

READ OUR FULL 153 PAGE 2019 THESIS ON DE-DOLLARIZATION

[SITE INDEX -- THESIS 2019: DE-DOLLARIZATION]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS-THESIS & PUBLIC THESIS ACCESS )

THESIS 2019: DE-DOLLARIZATION

MATASII RESEARCH ANALYSIS & SYNTHESIS:

Abstracted from: 04-29-19 - Jeff Thomas via InternationalMan.com - "All That's Missing Is A Black Swan..."

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.