|

FISCAL DEFICIT

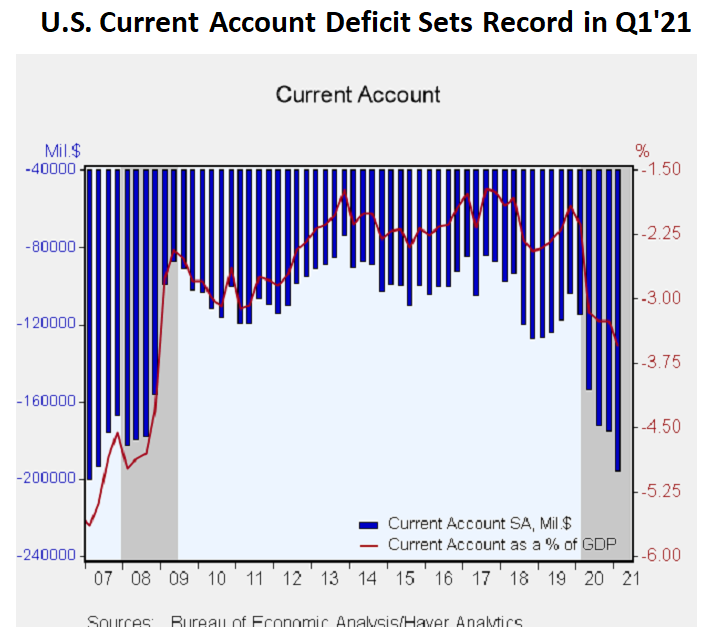

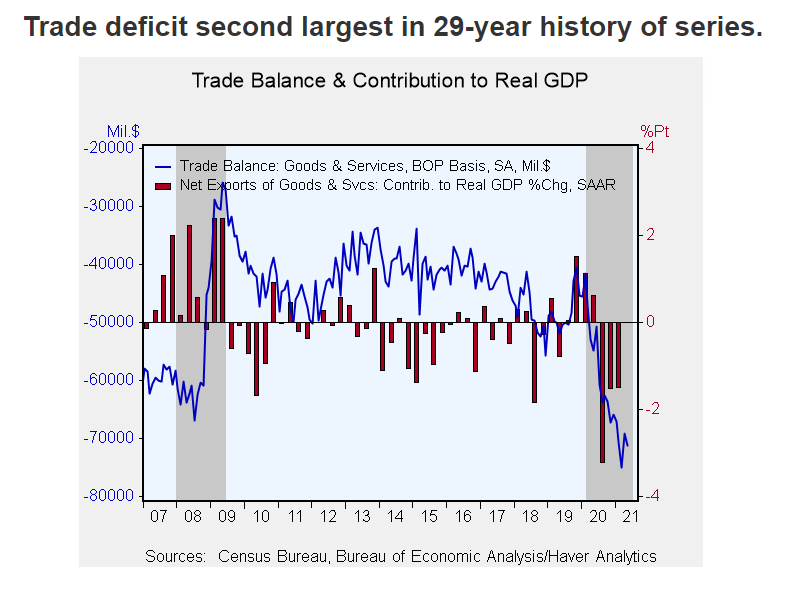

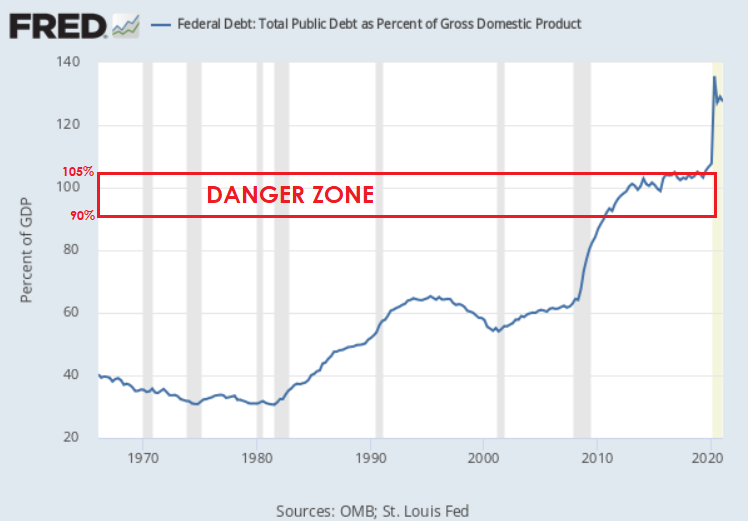

The Washington Political Class presently geared up to borrow and spend on a scale that America has not seen since we had to fight and win World War II. Our debt burden would break all records, eclipsing even the 1940s (Interactive Chart: right, and Biden’s Budget below).

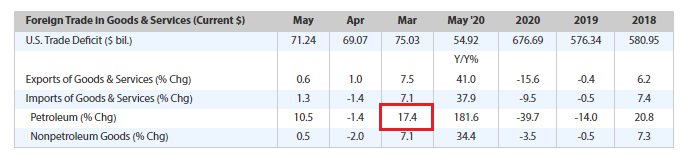

The nonpartisan Congressional Budget Office (CBO) estimated in January 2020 that annual budget deficits will exceed $1 trillion, and that the debt—then hovering at $17.2 trillion—would more than double as a share of the economy over the next 30 years. These numbers don’t take into account $65 trillion of unfunded liabilities for Social Security and Medicare. The CBO now projects that, under current law, the deficit will reach $1.9 trillion in 10 years and the debt will skyrocket from 102% to 202% of GDP within 30 years.

The words “current law” are critical as the CBO forecasts only what will happen should government make no changes in spending and tax policies. But President Biden has already proposed $5 trillion in additional spending over the next 10 years, much of it for new or expanded entitlements, labeled “infrastructure” and “investment.”

THE US DEBT

$26.51 trillion

As of July 20, 2020, debt held by the public was $20.57 trillion, and intra-governmental holdings were $5.94 trillion, for a total of $26.51 trillion.

So we properly understand what the above number means, let me explain:

- 1 Million Seconds = 12 Days

- 1 Billion Seconds = 32 Years

- 1 Trillion Seconds = 32,000 Years

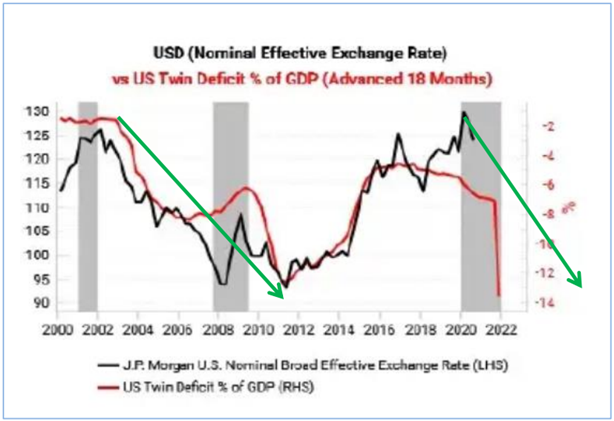

Think this will ever be paid back? Don’t you think buyers of long term US Debt don’t understand it better than you, since it is their job to know! How much of a haircut on the US dollar do they need to even buy US Debt and still be confident there will be another lender available when they want to exit??

|

The triggering measures of major concern to lenders vary but are most often considered when:

The triggering measures of major concern to lenders vary but are most often considered when: