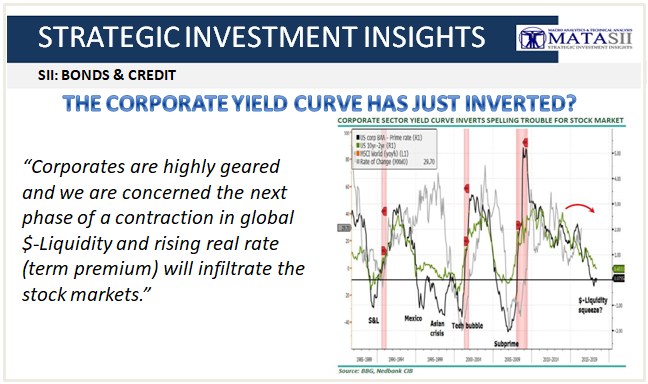

THE CORPORATE YIELD CURVE HAS JUST INVERTED

-- SOURCE: 06-19-18 - "The Corporate Yield Curve Has Just Inverted" --

A very interesting observation by the Nedbank analysts is that:

The corporate sector curve (Baa-rated Corporates less the Prime rate) has now inverted. The implication of this is just as profound as a sovereign yield curve inversion as it means that "the cost of capital for corporates is now higher than the return on capital."

Incidentally, as the chart below shows, every trough in this curve has always corresponded to some market crisis, whether the Asian Crisis, the Tech bubble, the Great Financial Crisis, or the $-liquidity squeeze we are experiencing now.

Their conclusion: "Corporates are highly geared and we are concerned the next phase of a contraction in global $-Liquidity and rising real rate (term premium) will infiltrate the stock markets."

Well, the dollar just hit a fresh 2018 high, and stocks are tumbling, so once again the shape of the yield curve may very well be all we needed to know what happens next.