THE DOG’S NOSE: CREDIT LEADS AGAIN!

As we laid out in this month’s UnderTheLens video, it is the “Dog’s Nose” that first senses changes. Those changes are initially detected in the Credit Markets. This is precisely what occurred early this week when the HY market suddenly exploded in a corrective counter rally. With Credit Markets always leading, by the end of the week we witnessed the Equity Markets (the Dog’s Tail) abruptly stopping a 7 week plummet and then violently initiating a counter rally.

We will show how this unfolded and how you could have capitalized on it if you were looking at the right tell tales of Credit, Inflation Breakeven /Real Rates and Valuations (PE’s, Flows and Sentiment).

=========

WHAT YOU NEED TO KNOW

- Recent market drop has effectively priced in the next recession. A recession that is highly likely but still only a strong possibility. This makes the market “ripe” for a significant “relief rally”!

- HY Spreads are leading the way in saying the market may now be getting “a little ahead of itself”.

- Inflation Break-evens and Real Rates have abruptly went negative. Starting on Monday 05/23/22, Real Rates began to rapidly fall.

- Being defensive is no longer cheap! Defense trades are now close to record premium. Drawdowns are now 75% of the way to prior recession bottoms.

- This week’s Credit and Equity Market reaction gives us important insights into what to expect between now and the US Mid-Term elections.

- Valuation – PE Ratios: The May LONGWave video entitled “Recessions & PE Compressions” called for significant adjustments in market and FAANG PE compressions. It appears this occurred even faster than we expected.

- Market Flows: After weeks of market outflows, this was reversed last week not only in the US but also in many of the markets around the world. Money began coming off the sidelines!

- Market Sentiment: Sentiment hit historic lows and was too attractive for contrarian investors to resist.

=========

|

|

|

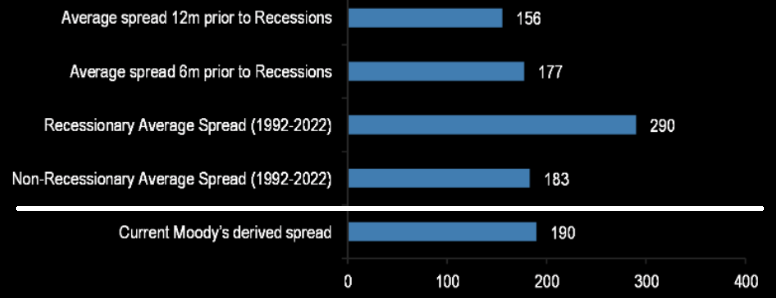

CHART: Right — Spreads are already where they typically are 6m/12m prior to a Recession! Is it overdone?

Is it too much too fast?

The Credit Market was the first to give us the answer Monday 05-23-22.

|

|

|

|

CREDIT LEADS

The credit market smelled out the issue and as usual warned early.

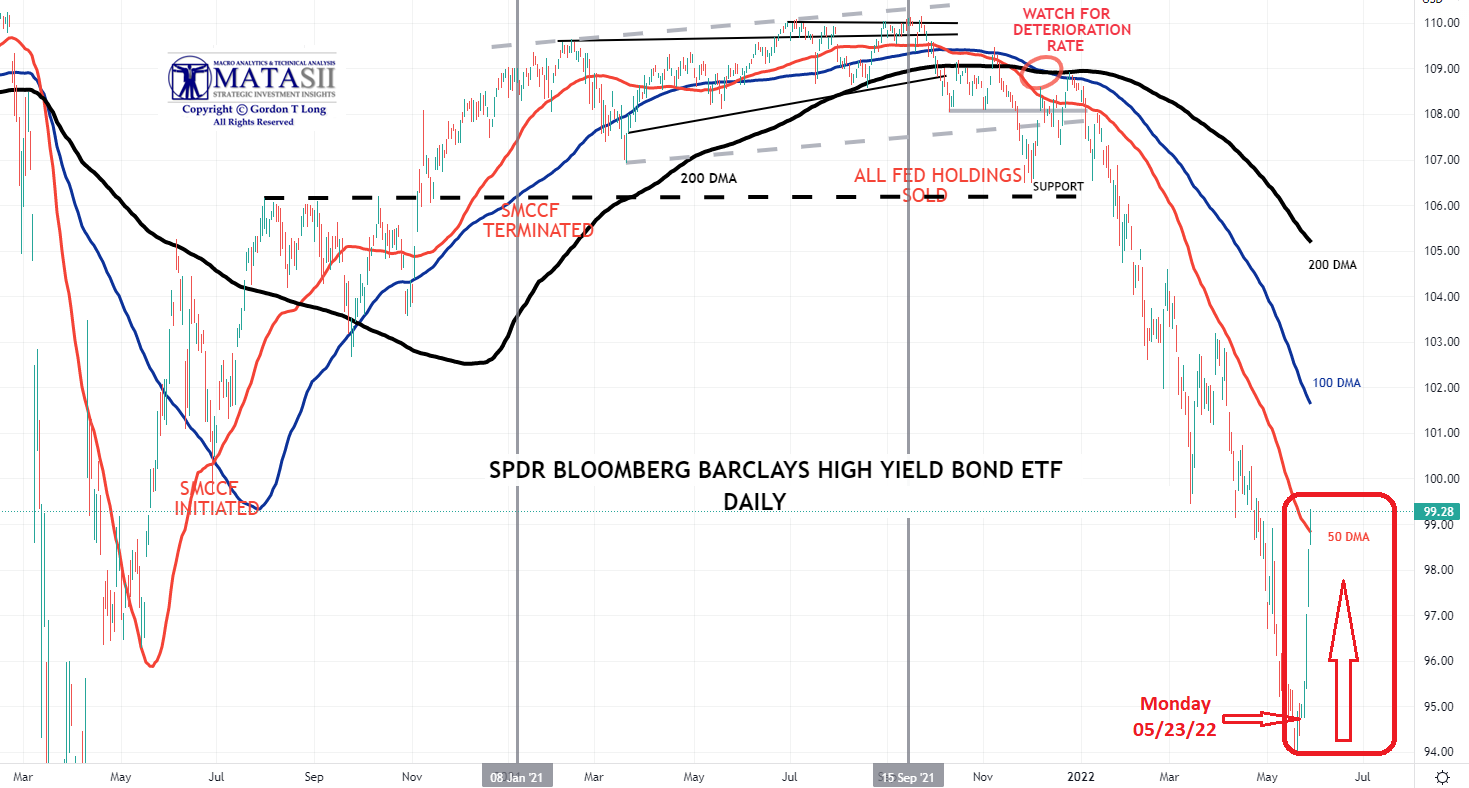

The HY (JNK) market (chart below) sent a loud message starting on Monday 05-23-22 as a significant counter rally began. Note the violence of the rise highlighted in the red box below.

|

|

|

|

BREAK EVENS & REAL RATES

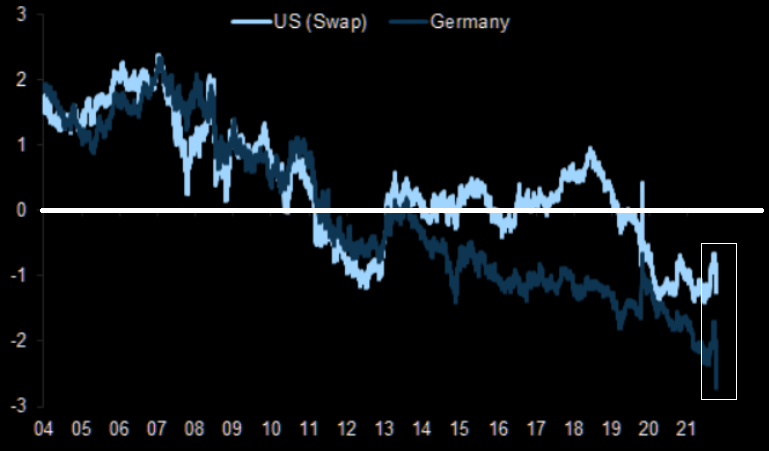

In the Bond Market Break-evens and Real Rates also started falling rapidly on Monday, 05/23/22.

|

|

|

CHART: Below — US 10Y TIPS yield and German 10Y BY-Break-evens also deteriorating rapidly last week.

|

|

THE DOG’S TAIL

Equity markets are like the Dog’s Tail and only began the “Awareness Reaction”. We spelled out the “Awareness Reaction” in this month’s UnderTheLens video. Per that discussion we witnessed this “Awareness Reaction” on late Wednesday and then the acceleration on Thursday and Friday.

The current market reaction gives us further guidance in what to expect for the remainder of 2022 leading up to the US Mid-Term Elections.

CHART: Right — Also see “Current Market Perspective” for more detail of Double Combo Corrective Wave “Y” that will unfold after “X” is completed. The recent action shown to the right.

|

|

|

WHAT THE EQUITY MARKETS THEN FOCUSED ON WAS:

Being defensive is no longer cheap! Defense trades are now close to record premium.

JP Morgan: “Anything short of a recession will likely catch most investors completely wrong footed, in our view, especially after broad and severe drawdowns that are 75% of the way to prior recession bottoms.”

|

|

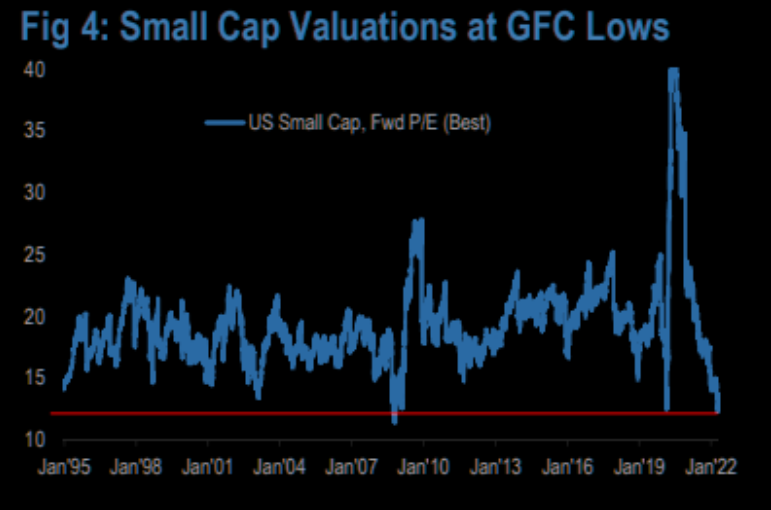

VALUATIONS: PE RATIO

The May LONGWave video entitled “Recessions & PE Compressions” called for significant adjustments in market and FAANG PE compressions.

It appears this occurred even faster than we expected.

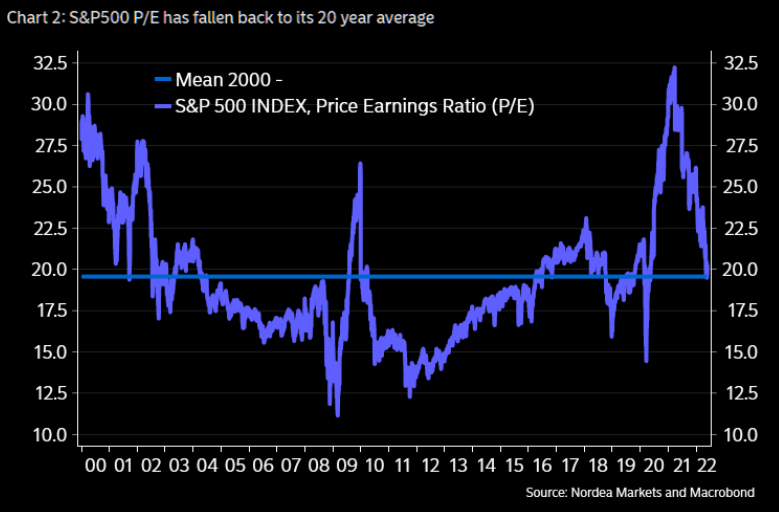

CHART: Right — Valuations have come down fast!

CHART: Below — Since early winter the S&P 500 PE’s have quickly fallen back to their 20 year average.

|

|

|

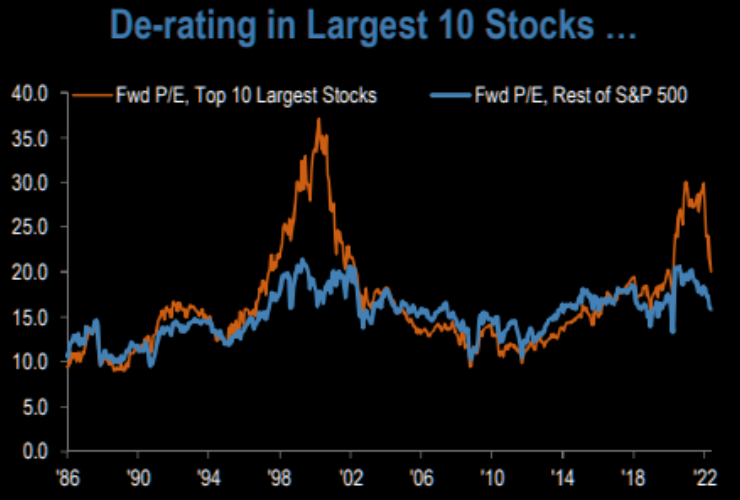

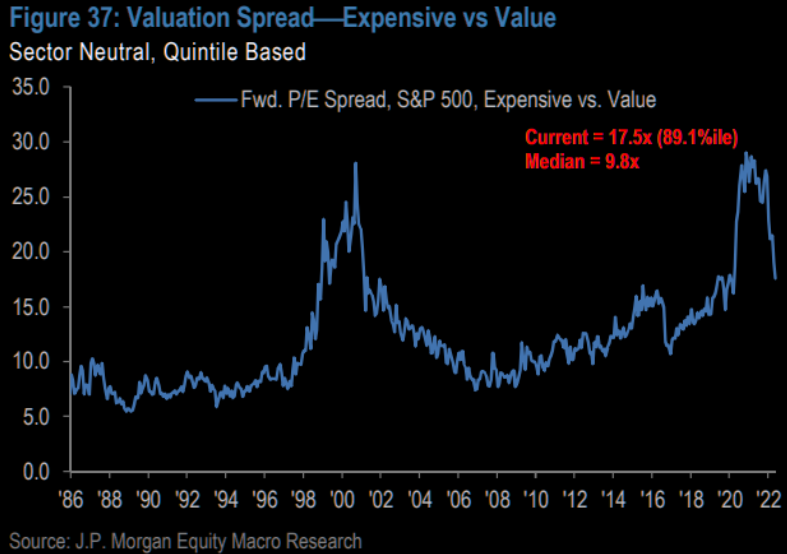

CHART: Below — The relative “richness” is pretty much gone. If FOMO starts kicking in for real, things will get even more dynamic when people start looking at what has become relatively cheaper.

|

|

|

|

The most recent collapse of expensive vs the market and vs value. Investors are beginning to think it is time to chase much cheaper (but expensive) securities on a relative basis.

|

|

|

|

|

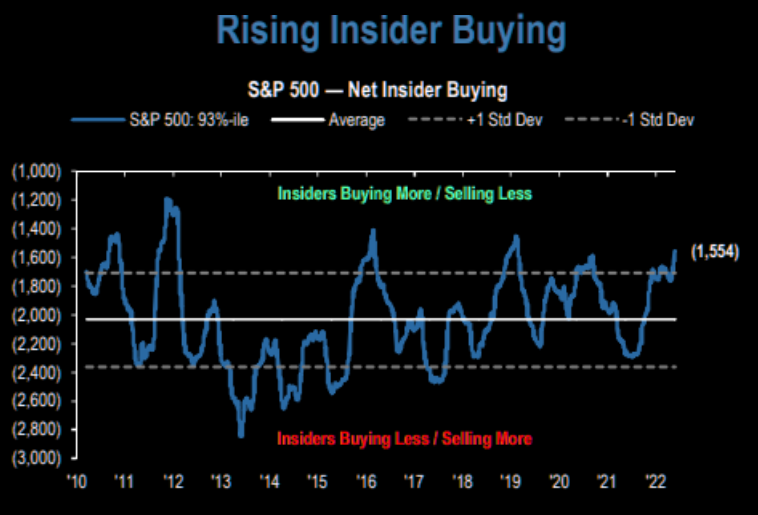

Contrary to the still very bearish sentiment, insiders have been loading up. JPM writes: “…insider buying activity at 1STDev above trend for S&P 500 based on the breadth of net insider buying…seen across Industrials, Discretionary, Healthcare, Technology, Communications and Real Estate”. The question is, do they see something the bearish crowd doesn’t?

|

|

|

|

MARKET FLOWS

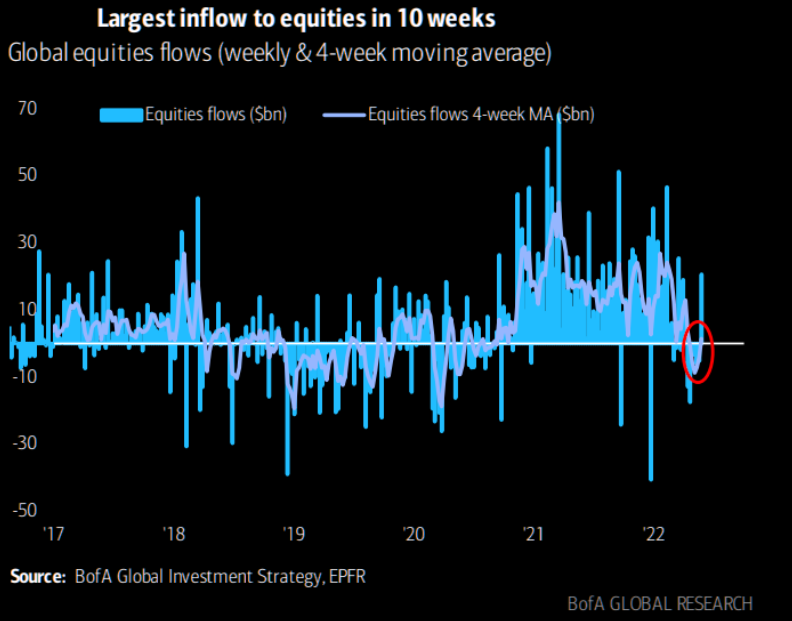

After weeks of market outflows, this was reversed last week not only in the US but also in many of the markets around the world.

Money began coming off the sidelines!

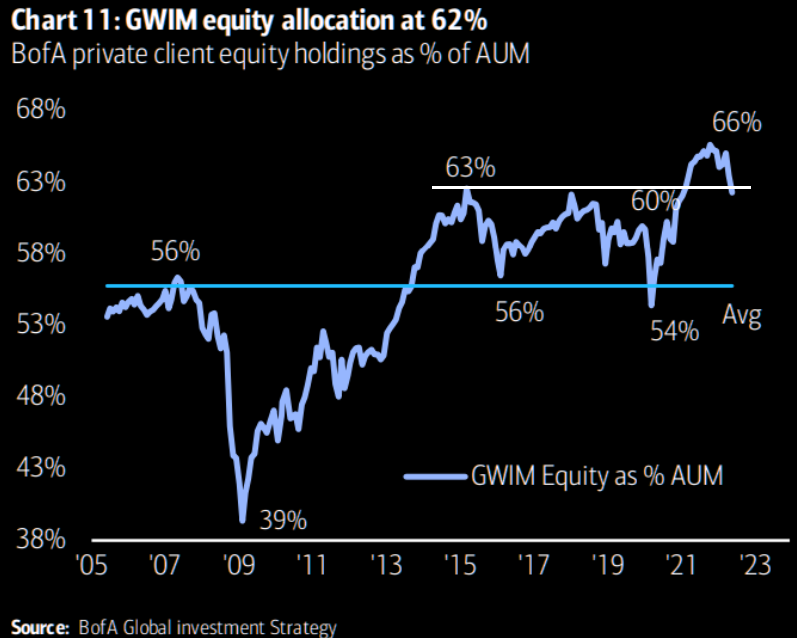

CHART: Right — BofAML private clients have decreased equity holdings to lowest levels since January 2021. Have they now started putting some of that cash back to work as FOMO panic kicks in?

CHART: Below — Equity Inflows abruptly and violently returned.

|

|

|

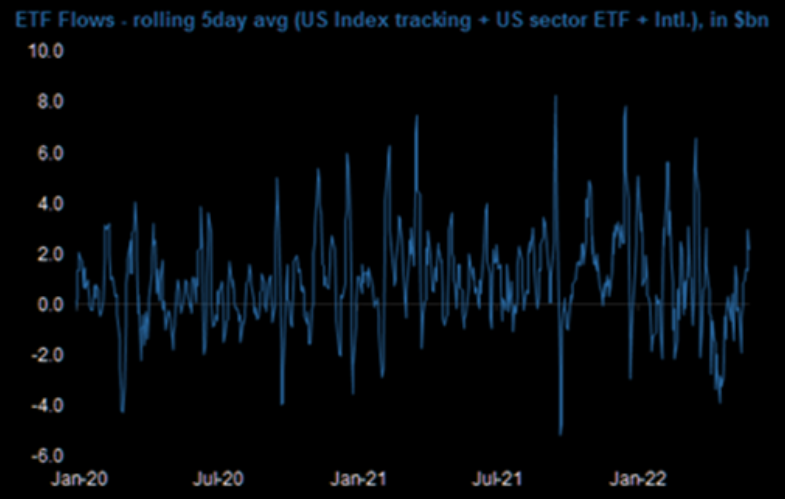

CHART: Below — ETF flows also turned more positive this week, pulling up 20d “rolling flows”

|

|

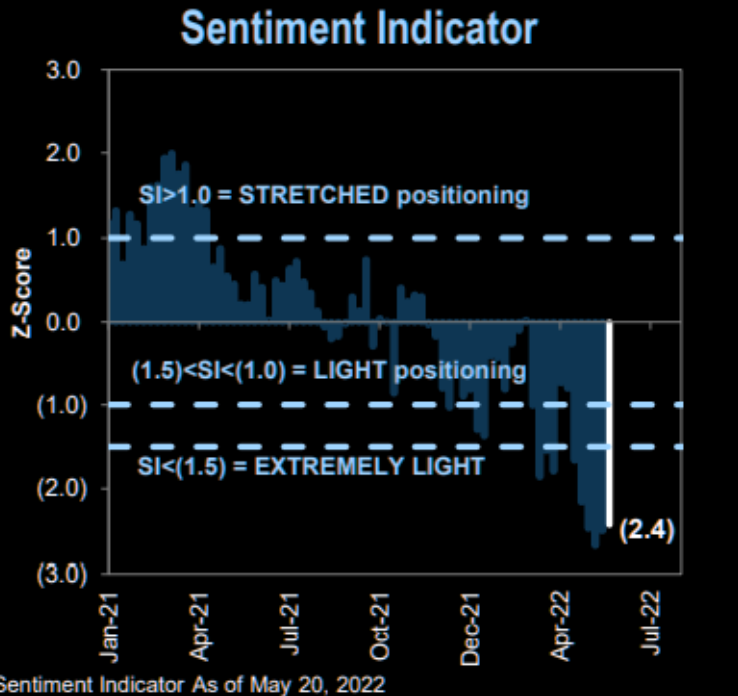

MARKET SENTIMENT

Sentiment hit historic lows and was too attractive for contrarian investors to resist.

CHART: Right — BoAML’s Contrarian Buy indicator as high as ever seen!

CHART: Below — May 20th reading screaming contrarian “BUY”.

|

|

|

CONCLUSION

THE WORST IS STILL IN FRONT OF US

EXPECT A SHORT TERM BEAR MARKET CONTER RALLY

FADE THE UNFOLDING COUNTER RALLY – SELL THE RIPS

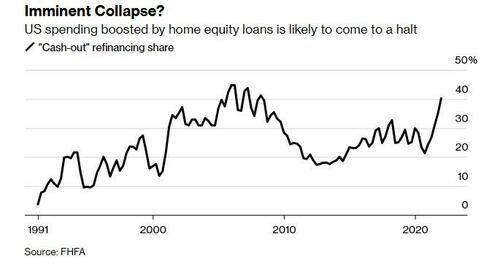

$20T IN LOST NET WORTH IN 2022

US household net worth, which consists almost entirely of financial assets (and real estate) – tracks the S&P with an almost 1.000 correlation. That means that with the S&P briefly entering a bear market on Friday and sliding approximately 20% from its all time high, reached just a few days into 2022 when US net worth hit $150 trillion, US households have seen about $20 trillion in net worth disappear in 2022. This doesn’t count a real estate market on the verge of falling hard from rising mortgage rates and unaffordability.

Latest President Biden poll from CBS News:

-

- 85% of all Americans believe that there will be a recession within the next year,

- 74 percent of Americans believe that things are going badly in this country,

- 69% say economy is “bad”

- 66 percent of Americans “have avoided social events because they’ve felt embarrassed or uncomfortable” about their financial situations

- 65% say Biden is “slow to react” when issues arise”

- 63% describe state of the country as “uneasy” and “worrying”,

- 56 percent of Americans say that their financial situations are getting worse,

- 51 percent of Americans actually believe that Joe Biden is “incompetent”.

|

|