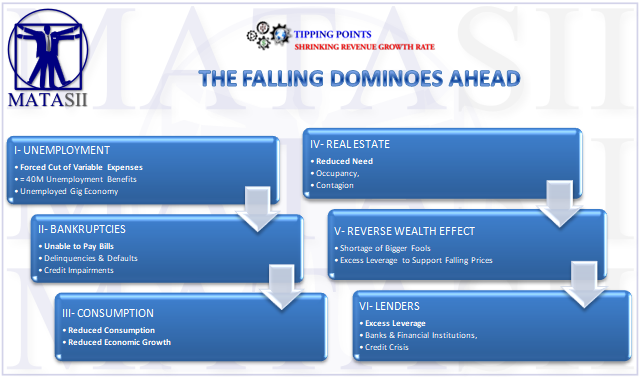

TIPPING POINTS

SHRINKING REVENUE GROWTH RATE

THE FALLING DOMINOES AHEAD

- While the wealth effect can reverse, debts have to be paid regardless. Debt payments are forever while the wealth effect is fleeting..

-

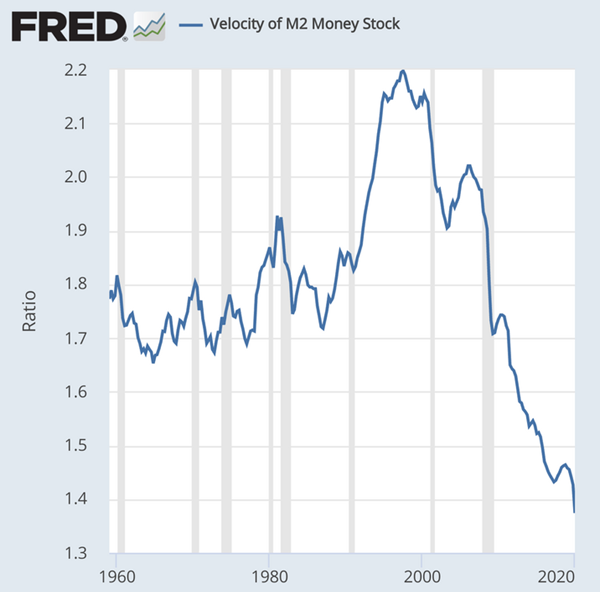

The current mass delusion is that the Fed can bail everyone out with cost-free cash. But we have to keep in mind what my co-host in this video, Charles Hugh Smith emphasizes the Fed can’t do:

- It can’t reverse the unprecedented wealth inequality its policies have pushed to the point of civil breakdown.

- It can’t make people take on the risks and heartaches of starting new businesses.

- It can’t force employers to hire more employees.

- It can’t make unprofitable businesses profitable.

- It can’t force people to buy assets at prices that no longer make financial sense.

- It can’t make insolvent businesses and local governments solvent.

- It can’t force people who now realize their priority is to save money to spend their cash, even if the Fed forces negative interest rates so it costs money to have savings.

- It can’t lower the unaffordable cost structure of the entire economy.

- It can’t de-link all the financial dependencies in the financial system that make it so vulnerable to the first domino falling.

- It can’t stop people from selling their assets.

- In summary, it can’t stop the reverse wealth effect. We are entering The Greatest Depression because there is no exit. Either the phantom wealth of asset bubbles completely vanishes, or the phantom purchasing power of fiat currency vanishes. Both paths lead to the same destination: systemic collapse.

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.