THE "ICARUS RALLY" AUTHORS SEES A LITTLE MORE TO GO WITHIN THE "GREAT DISRUPTION"

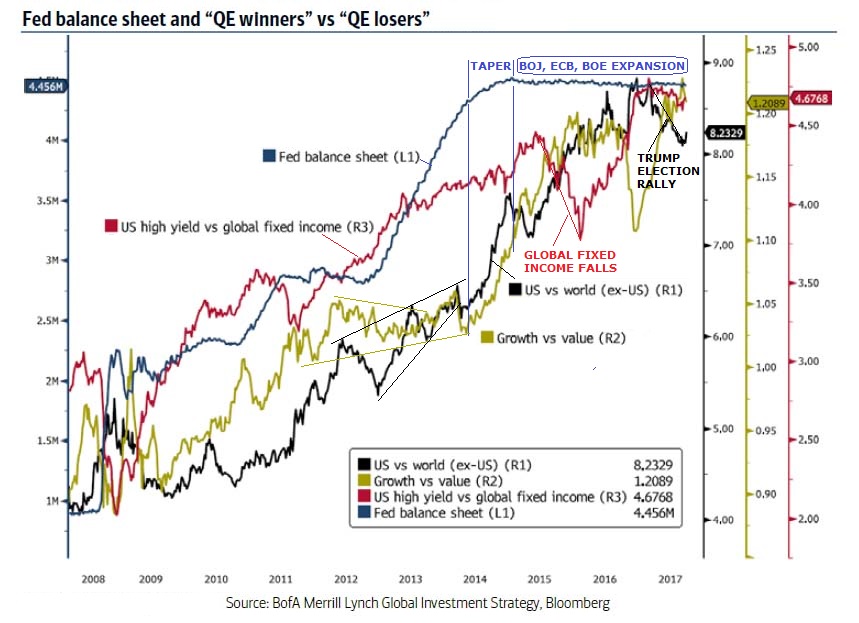

BofA's chief investment strategist Michael Hartnett originally coined the term "Icarus Rally" to define the rally driven by "Big Global QE and Big Global EPS".

The Icarus Rally was based on Disruption, Demographics, Debt continuing to prove deflationary, thereby tying the hands of the central banks & keeping rates low (e.g. 10-year Treasury hugs 2%). if so, speculative bubbles in the bull market leadership of Tech, EM debt, High Yield were likely to occur.

CHART ANNOTATIONS BY MATASII.COM

Hartnett, who two months ago predicted a volatile fall (and winter), now sees that Icarus “long risk” trade extended into autumn

- By low inflation,

- Big liquidity ($2.0tn central bank buying),

- High EPS, and

- Promise of US tax reform."

As a result, Hartnett's "blow off top", or Icarus, targets for Q4 are:

- S&P 2630,

- Nasdaq 6666,

- 10-year Treasury

- 2.85%,

- EUR 1.15.

At this rate, the S&P could hit BofA's target in about 3-4 weeks, and thus Hartnett lays out the following 11th hour trade recommendations for Q4

- Long US$ vs EM FX,

- Long oil,

- Long barbell of uber-growth (IBOTZ, DJECOM) & uber-value (BKX) = Icarus trade;

- Further unwind of extended “long disruptor, short disrupted” trade likely (i.e. death of old Retail, Media, Autos, Advertising by Tech Disruptors);

- Rotational outperformance of oil>credit, EAFE>EM,

- Value/growth