THE ILLUSION OF GROWTH: THE GOVERNMENT'S GAME OF "SMOKE & MIRRORS"

All financial assets are nothing more than CLAIMS on real wealth. They are not themselves actually wealth. It is critically important to understand this reality of "money".

The money we possess has 1- Use and 2- Utility because you can exchange it for something that you value. The value or wealth lies in what you buy, not in the money itself. Real wealth is the "physical" product you receive -- food, clothes, land, oil, and so forth. If you couldn't buy anything with your money/stocks/bonds, their worth would revert to the value of the paper they're printed on (if you're lucky enough to hold an actual certificate). It’s that simple.

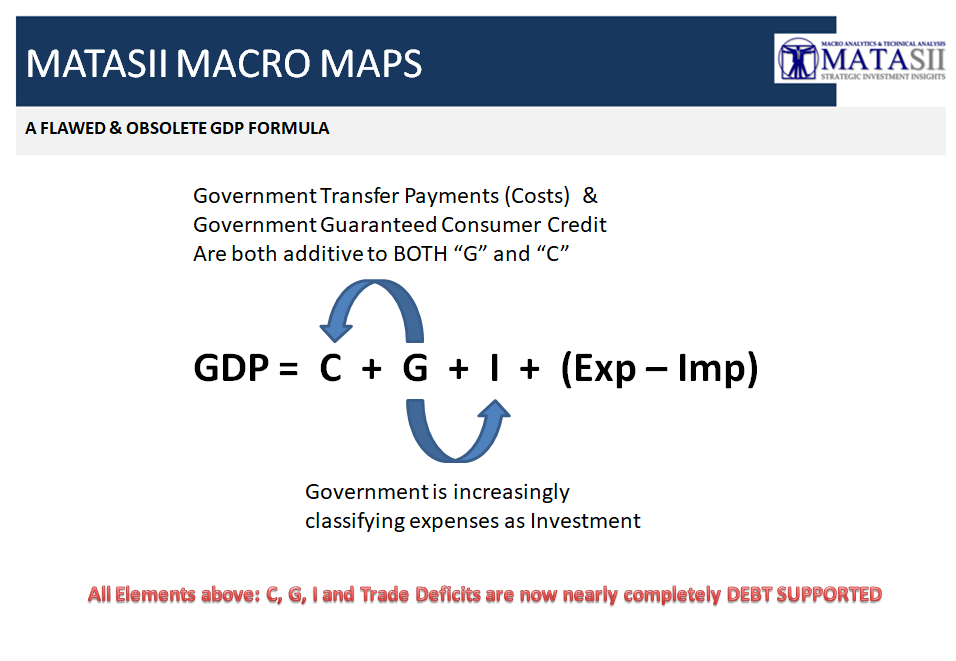

“GDP” is a measure of the amount of goods and services available and financial asset prices represent the claims (it's an absolute terrible measure of real wealth, but it's the one we have been educated by Keynesian economists to accept - read more here and here).

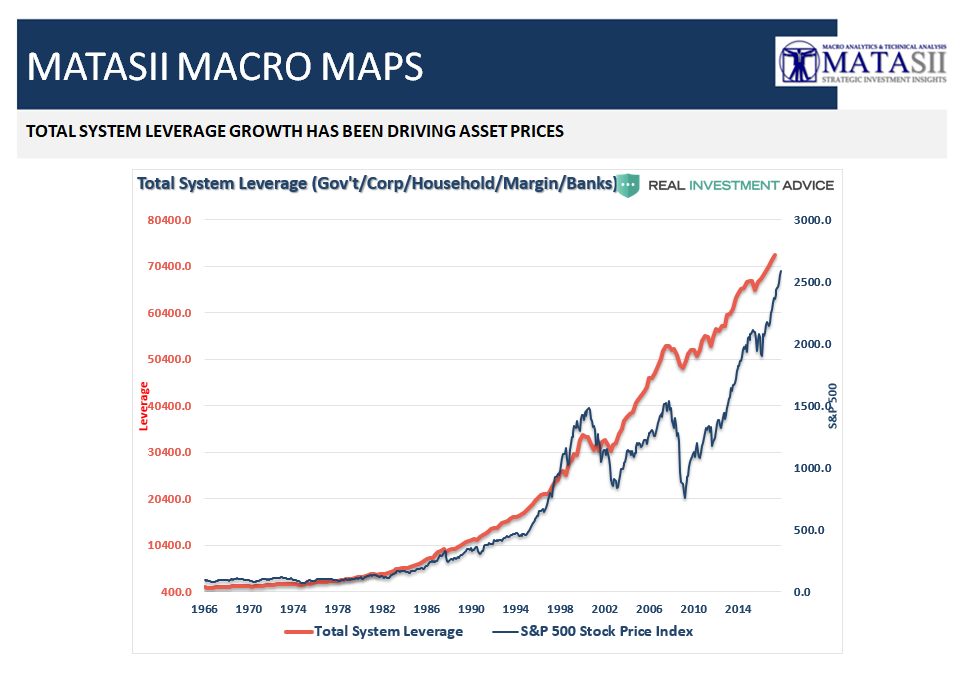

However, look at how divergent asset prices get from even this GDP measure as bubbles develop:

A GRAPHICAL WAY OF CONSIDERING THIS

CREDIT EXPANSION

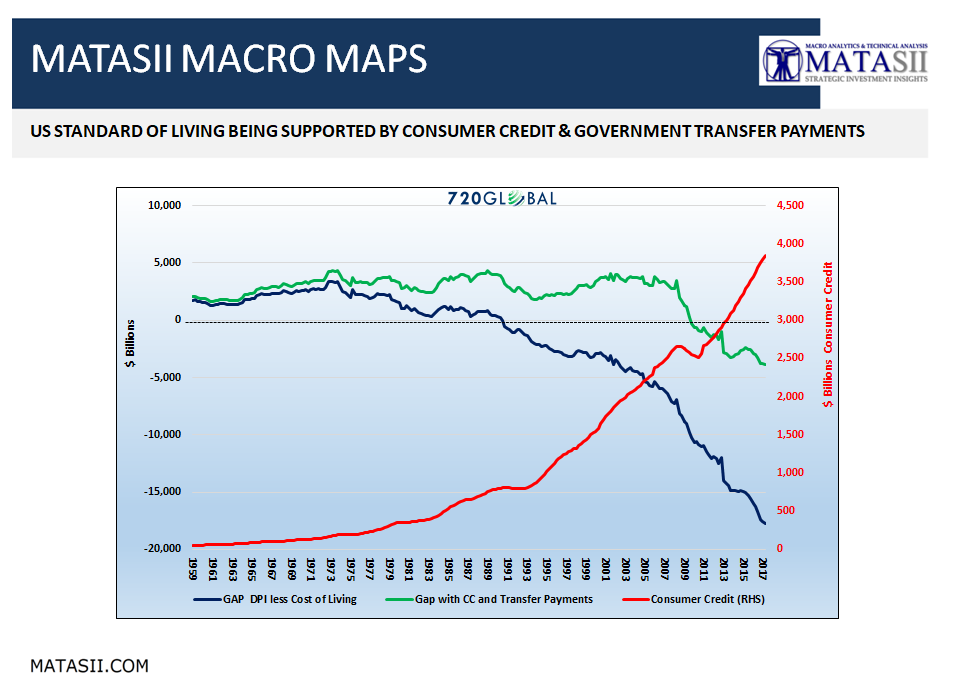

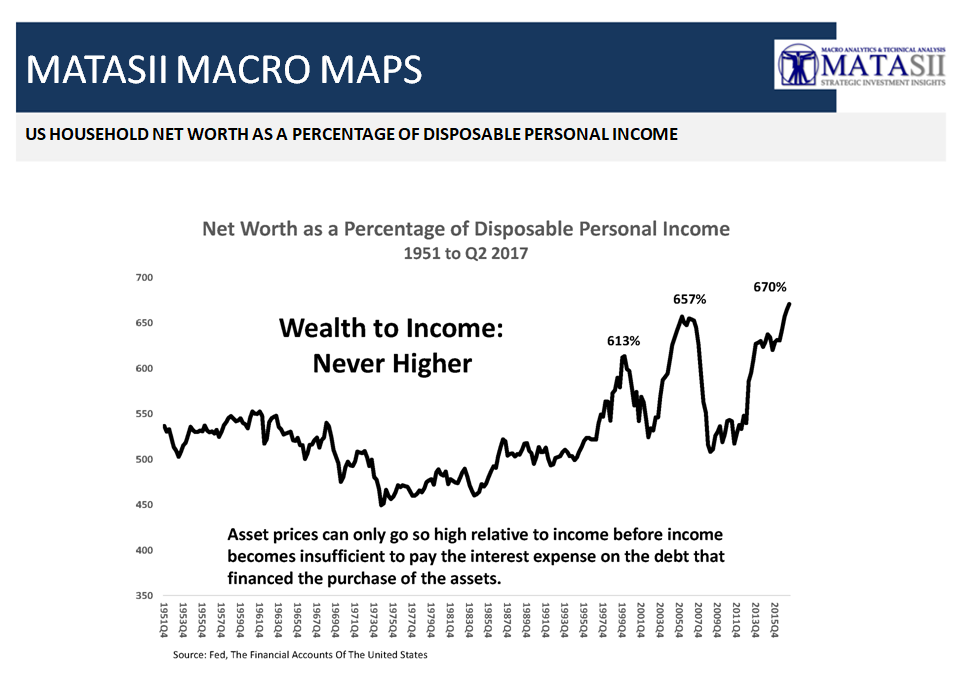

The Asset Prices versus GDP chart at the top of this page fails to illustrate the change that occurs when household assets go up. It doesn't show the liabilities taken on and whether incomes can support the liabilities underlying the assets.

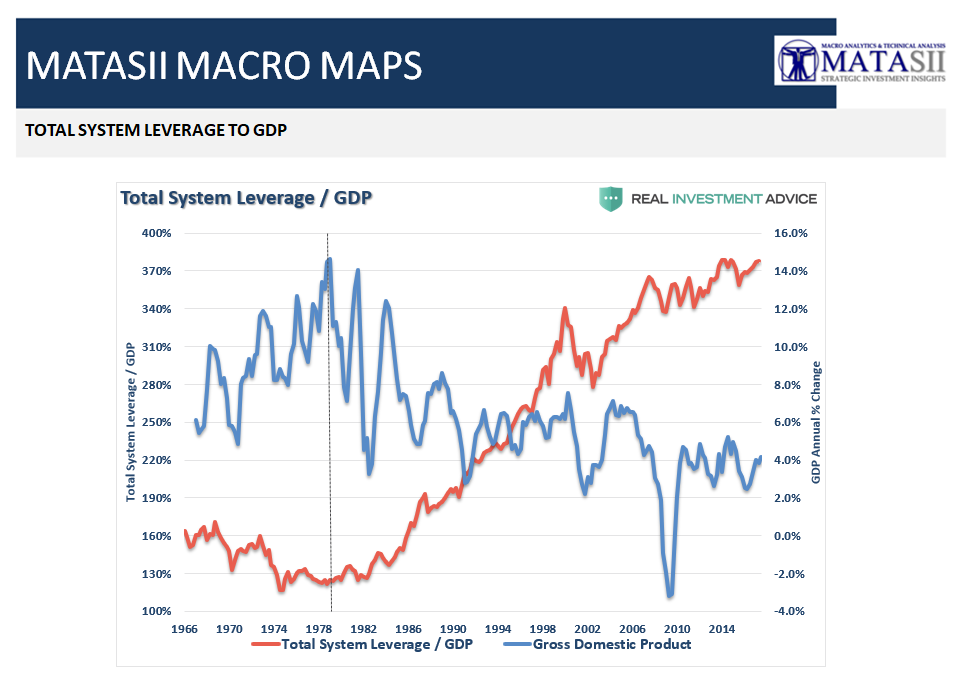

History's largest bubbles have had the exact same root cause: an expansion of credit that causes leverage to go up faster than the income available to service it. Simply put: bubbles exist when asset price inflation rises beyond what incomes can sustain. They are everywhere and always a credit-fueled phenomenon.

What is supporting the GDP formula is a gigantic debt edifice based on the Financialization of the US economy and over-leveraged, rehypothecated collateral values being accepted for further credit creation.

The problem with this chart is the viability of the collateral underlying the build up in total system leverage. If you don't know what "Novation" and "Rehypothecation" are then you simply don't understand the "game" that is going on.

The problem with this chart is the viability of the collateral underlying the build up in total system leverage. If you don't know what "Novation" and "Rehypothecation" are then you simply don't understand the "game" that is going on.

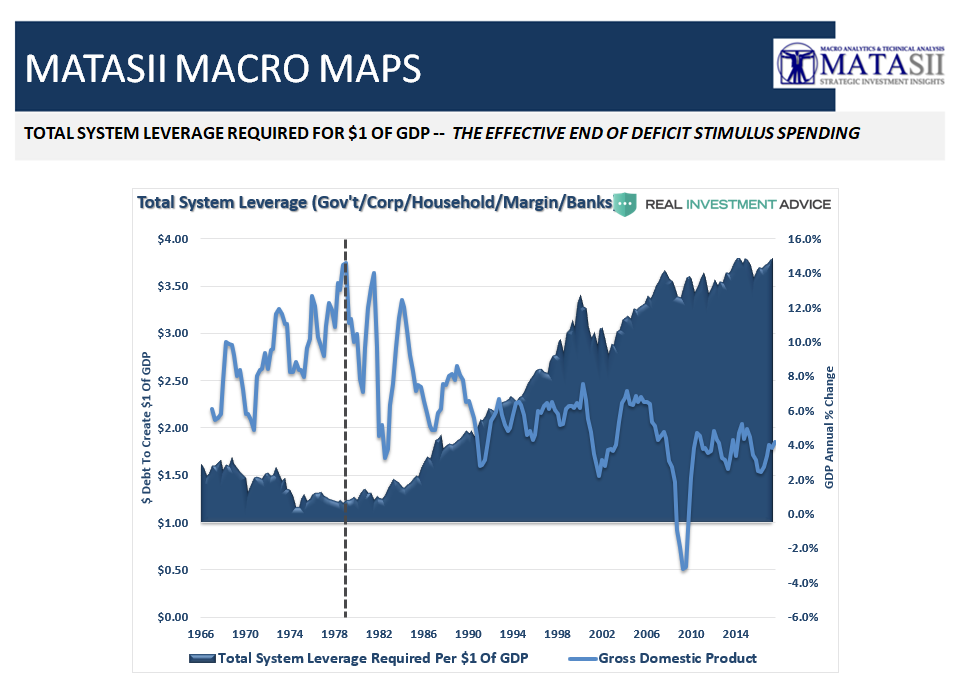

KEYNESIAN (PRE FIAT CURRENCY ERA) DEFICIT STIMULUS SPENDING HAS RUN ITS "USEFULNESS"

The bottom line is that Keynesian economics of "Stimulus Deficit Spending" as run its useful life!

I encourage you to read further in our recent MATASII posts: