THE KONDRATIEFF 'WINTER' SIGNALS THE END OF THE DEBT SUPER-CYCLE

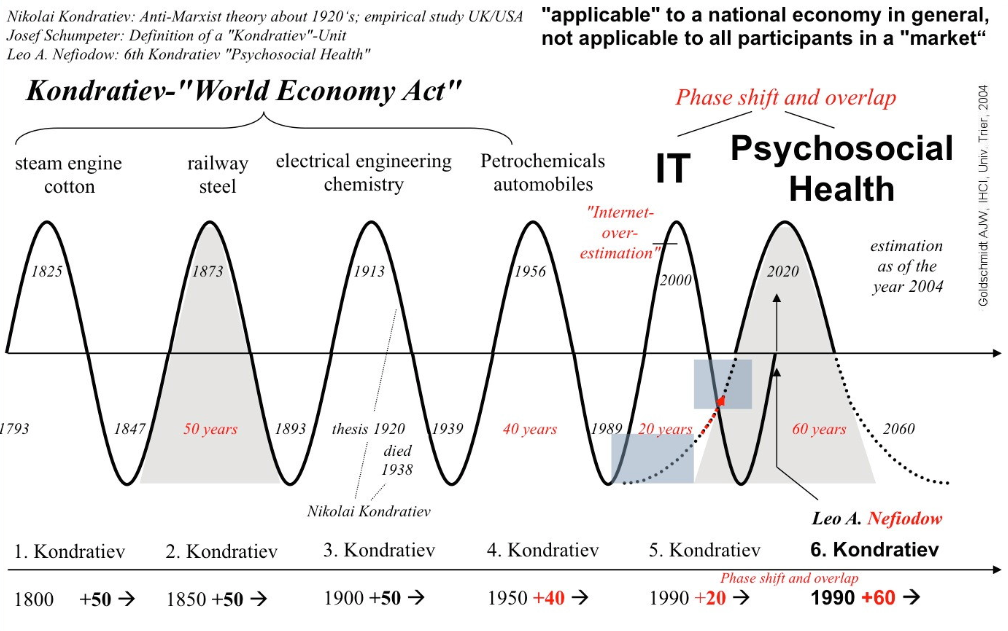

The international economy operates in pulses christened Kondratiev waves after Nicolai Kondratiev (1892-1938), the Russian economist and statistician who first identified them. These K-waves consist of an expansionary upswing lasting normally 15-20 years, followed by a downswing of similar length. We are now in such a downswing that could last till the 2030's.

- Social and economic conditions mature to spark a runaway investment boom in the latest cluster of new technologies.

- After a period, excess investment and increased competition lower rates of profitability, curbing the boom.

- At the same time – because this is as much a sociological as an economic process – growth expands the global workforce, both in numbers and geographically.

- The new, militant workforce launches social struggles to capture some of the wealth created in the boom.

- This, in turn, adds to the squeeze on profits.

- The peak and early down wave are characterized by violent social conflicts, whose outcome determines the length of the contraction.

To date each K-wave has seen a crushing of social protest and a halt to wage growth, if not a fall in real incomes for the working class.

- Thus conditions accumulate for a fresh investment boom, as profitability recovers.

- The ultimate trigger for the new up-cycle is investment in the next bunch of new technologies, which simultaneously provide monopoly profits and a new set of markets.

UPSWING OR DOWNSWING: WHERE ARE WE ON THE K-WAVE?

- The current upswing lasted till the Bank Crash of 2010.

- There were several significant features of the 1985-2010 up-wave.

- First, it was longer than the average, suggesting the current downturn could also be lengthy.

- Second, the neoliberal upswing involved a commercial and political victory for a rejuvenated US capitalism.

- Witness the current dominance of American high-tech. Europe, on the other hand, finds itself in decline, crushed between rival American and Chinese imperialisms.

- The crisis of the EU, Brexit included, results directly from this geopolitical shift.

The new downswing results from more than the 2008/9 financial crisis.

- There has been a wave of Chinese and Asian working-class resistance to exploitation, which has eroded profits.

- In the West, paradoxically, the historic defeat of the unions has flatlined wages. As a result, goods can be sold (and profits maintained) only by bolstering consumption through easy personal debt.

- That makes the Western capitalist model unsustainable and prone to endemic bank failure.

The banks and their tame accounting firms are busy covering up this chronic instability via wholesale fraud. As a result, we are nowhere near the bottom of this K-wave.

[SITE INDEX -- MATA - PATTERNS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: PATTERNS

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

EXTRACTED FROM: 04-05-19 - Bella Caledonia - "Kondratiev – Riding The Economic Wave (Down Until The 2030s)"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.