THE MARKET RALLY IS TIED TO CHINA'S CREDIT IMPULSE - HOW WE'RE DOING & WHAT TO WATCH

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

MACRO: REGIONAL - CHINA

MATASII SYNTHESIS:

There are reports on the web that confirm the levels of liquidity that China has started flooding its financial markets with. The numbers are even larger than MATASII first surmised.....

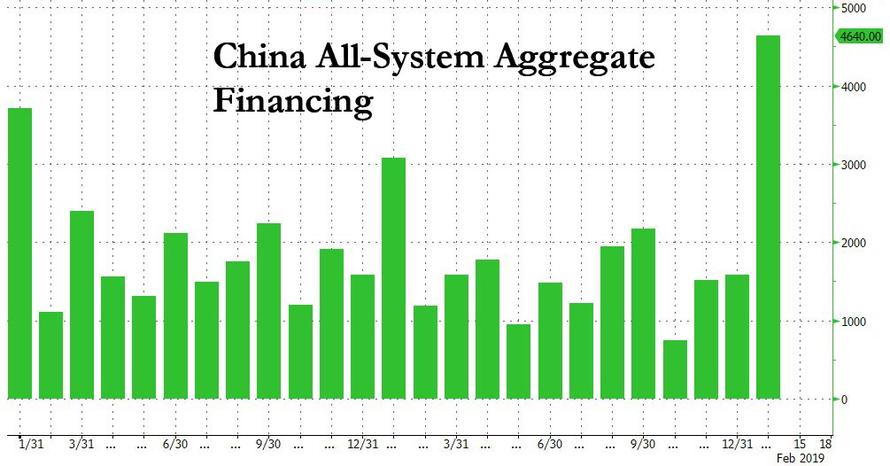

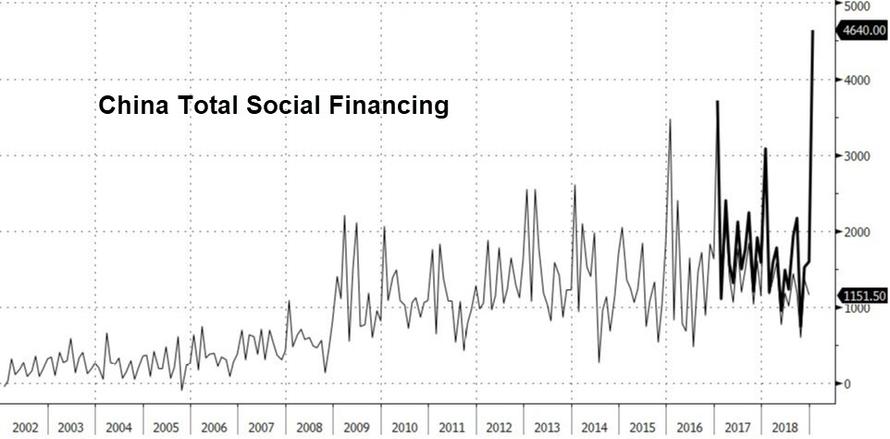

One remarkable aspect of the overnight session that was ignored by some traders was the record surge in China's total aggregate financing, which exploded higher by a record 4.64 trillion yuan in January, far above the 3.31 trillion yuan expected, and nearly three times greater than December's 1.59 trillion total. While New Loans beat expectations only modestly, printing at 3.23 trillion Yuan, the surge in aggregate credit was enough to push M2 from record lows, rising 8.4% from December's 8.1%, and above the 8.2% expected.

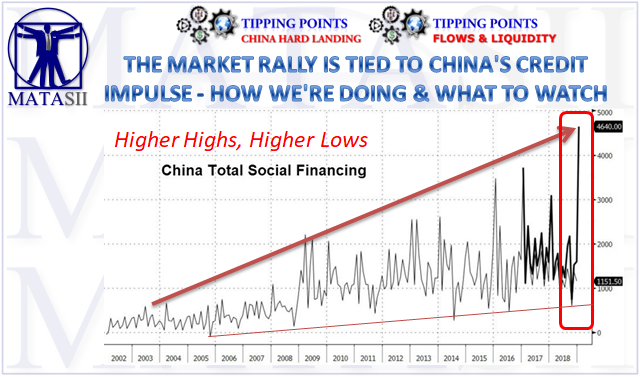

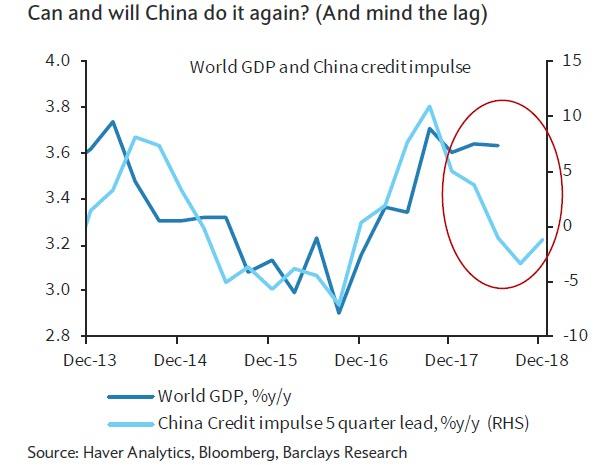

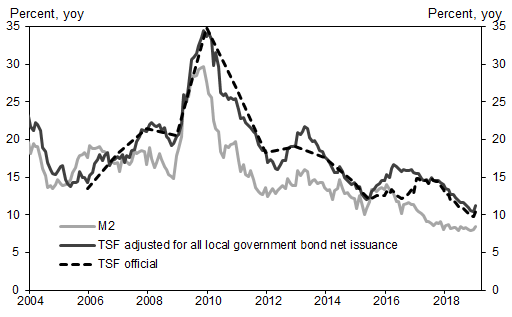

As has been previously outlined, China is without question the most important variable for the global economy and its Credit impulse the single chart to watch.

As this dated chart shows it is quickly approaching going positive.....

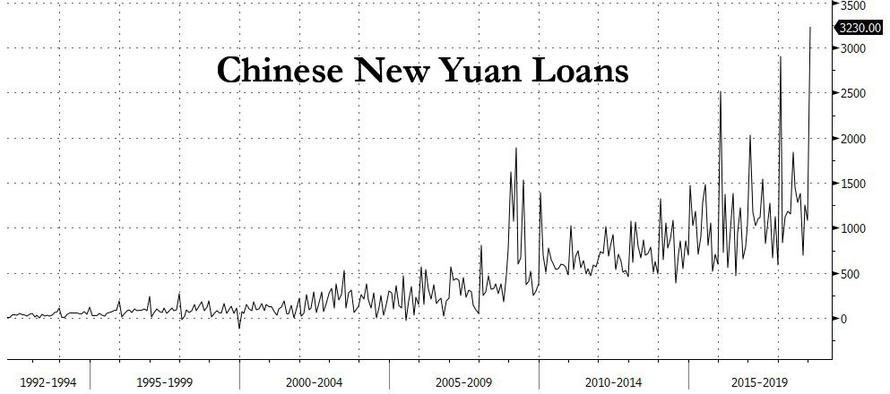

The lastest data comes from the PBOC on their new loan activity and shows that Beijing has indeed decided to massively reflate its (and the global) economy....

China's latest new loan data reported by the PBOC. What it showed was that, whether alone or with others,

Here's what happened in January: Chinese financial institutions made a record 3.23 trillion yuan of new loans, versus a projected 3 trillion yuan. That was the most in any month back to 1992, when the data began, and represented a whopping 13.4% yoy increase in January.

But while the surge in new loans was impressive, it was nothing compared to what China reported in its broader, all-encompassing Aggregate Financing (until recently Total Social Financing), which exploded nearly threefold from December's 1.59 trillion to an unprecedented 4.64 trillion ($685 billion) in the month of January, smashing expectations of 3.31 trillion, and printing far above the highest forecast from 26 economists of 3.9 trillion. This was, as several traders noted, nothing short of a "gargantuan" credit injection, and an obvious greenlight to China's latest attempt to reflate its economy.

According to the PBOC, TSF stock growth was 10.4% yoy in January, vs 9.8% yoy in December. If we add all local government bond net issuance to TSF flow data (excluding special bond issuance to avoid double counting), adjusted TSF stock growth at 11.2% yoy in January, higher than 10.5% in December. The implied month-on-month growth of adjusted TSF was a whopping 17% SA ann, higher than 10.9% in December.

The latest massive TSF injection brought the outstanding social aggregate financing to a record 205.1 trillion, or an unprecedented $30 trillion in aggregate loans, more than double China's entire GDP.

Commenting on the surge, Goldman analyst Yu Song said that overall "TSF surprised the market substantially to the upside in January despite headline RMB loans being fairly close to expectations" noting that there were two main reasons for the surprise:

- First, TSF data include RMB loans to the real economy, which were 3.6tn – actually stronger than headline RMB loans of 3.3tn. The latter figure includes loans between financial institutions, which by implication actually contracted in January.

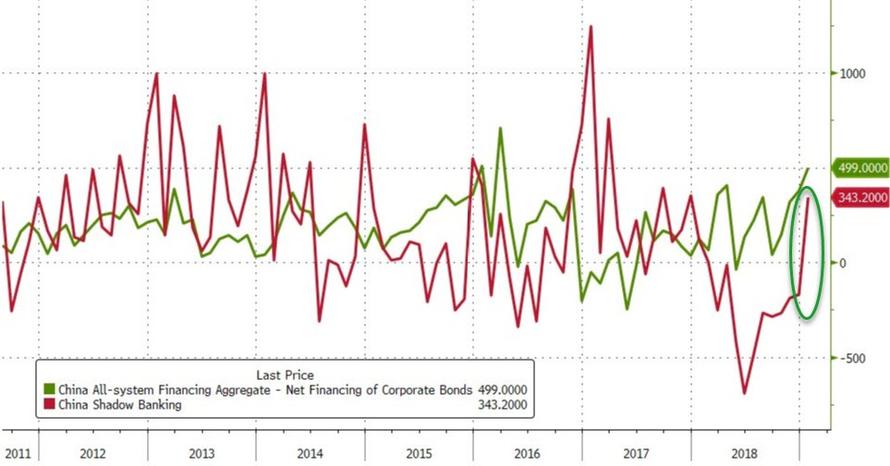

- Second, shadow banking components of TSF grew slightly. Actual data in January suggest new trust, entrust and bank acceptance bills together were 343bn RMB, vs a contraction of 170bn RMB in December. In contrast, consensus expectations imply that forecasters were likely expecting these components to continue to shrink. Corporate bond issuance was strong - net issuance climbed to RMB 499bn in January, vs 376bn in December – but this could be tracked fairly closely in advance given the high frequency data on bond issuance. Lower interbank rates in the month as PBOC stepped up liquidity injection (through RRR cuts, TMLF etc) may have contributed to the increase in non-loan components under TSF.

It's especially notable that a big part of the TSF surge was the result of a fresh shadow banking expansion. Visualizing the bolded text above, the chart below indicates that Beijing may have thrown in the towel on its crackdown in Shadow Banking, which after contracting for almost all of 2018, not only rose for the first time in 11 months, but soared the most in nearly two years as Chinese regulators now appear focused on providing credit using the very same channels they spent the past two years desperately trying to block.

Speaking at a press conference, Ruan Jianhong, director of the PBOC’s statistics and analysis department, surprisingly said that growth in off-balance sheet financing will continue to decline but the pace will decelerate, suggesting once again that Beijing's vendetta with shadow banking is now on "pause" to use the parlance of the Fed.

That said, Goldman does not go so far as to suggest a coordinated global credit injection is taking place (which may be required for a new "accord"), but instead believes that the stronger than expected TSF growth was "mainly because of the administrative pressures the government put on financial institutions. On the budget, fiscal policy stance was largely neutral judging from the change in fiscal deposit levels. But the more broadly defined fiscal position was dovish as the amount of special bond issuance was significantly larger than usual and much of these are not captured by the budget. "

As a result of this massive attempt to trigger China's credit impulse, which as we showed recently is arguably the only thing that matters for the global economy...

... China's M2 rebounded from near record lows, rising 8.4% yoy in January, and up from December: 8.1% yoy.

"China has been encouraging credit supply, and the effect of that is showing in January," said Ding Shuang, chief economist at Standard Chartered Ltd. for Greater China & North Asia, adding that the seasonal lending increase at the start of the year also contributed. "The authorities have been tackling the supply side of the credit, and more proactive fiscal policies will help on the demand side."

China's far more aggressive loosening stance is a response to the widespread concerns that the economy would slow further going into the beginning of 2019, and there is still a risk that the economy may show a sharper decline after the Chinese New Year holiday, according to Goldman. The bank explains that the risk of a post-holiday decline owes to the fact that many labor contracts expire over the holiday, and also because businesses that have closed during the holiday may not reopen right away. Still, Goldman expects February TSF to remain strong, while the massive surge in TSF and better than expected export data should lower the risk of a downside scenario for the Chinese economy significantly.

The question is whether China has now overdone its credit injection, and after keeping the economy subdued through minimized credit creation, it has now careened in the other direction, and unleashed a powerful inflationary impulse.

We'll have to wait for the answer, but one thing we do know is that this is just the start: as a reminder, China's government this week announced new policies to help private and small companies get financing, including further boosting lending, expediting stock listing reviews and supporting bill financing. That’s the latest in a raft of policies - including inventing new central bank policy tools - to relieve the funding pressures faced by those businesses, which are usually less able to access bank loans than bigger, state-owned companies.

Finally, if this indeed is the market manifestation of a new Shanghai Accord, watch out above: the last time finance ministers and central bankers met in China in Jan 2016 to offset the global liquidity contraction that emerged after the Fed started tightening, it unleashed an unprecedented global buying spree sending stocks to all time highs and culminated with the Fed being forced to aggressively hike rates, eventually culminating with the dreaded selloff of Q4 2018. Fast forward three years later, when it appears that "here we go again..."