THE POWELL FED HAS INITIATED A FINANCIAL RESET

A PUBLIC SOURCED ARTICLE FOR MATASII (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS ) READERS REFERENCE

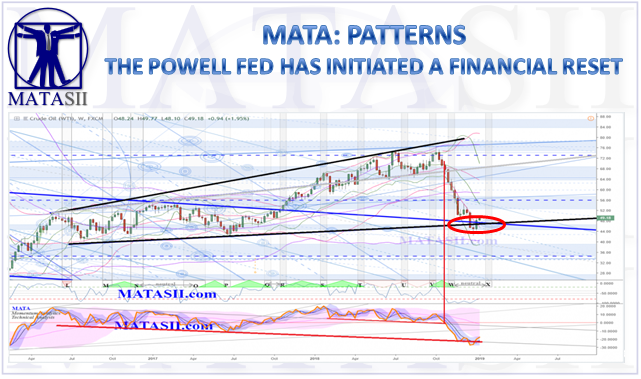

MATA: PATTERNS

SOURCE: 01-04-19 - Phoenix Capital, Graham Summers - "The Powell Fed Has Initiated a Financial "Reset""

MATASII SYNTHESIS:

- Ensure you separate Fed Rate Hikes from Fed's Reduction of it Balance Sheet (QT)

- We expect the Fed to soon HALT rate increases. This will give a boost to the equity markets.

- However, we do not expect any change in QT.

- This should ensure the US$ does not fall significantly near term.

- The Fed is concerned about disruptions in the Currency markets affecting the Carry Trade which is presently supporting foreign US Treasury purchases.

The Powell Fed Has Initiated a Financial "Reset"

..... In December, Jerome Powell confirmed that he is going to implement a financial reset. That reset will crash stocks.

We know this because:

The Fed didn’t even HINT at tapering its Quantitative Tightening program at this latest Fed FOMC despite stocks staging the worst December since the Great Depression.

This tells us that the Powell Fed is going to normalize the Fed’s balance sheet no matter what. And THAT is the real issue for the financial markets (the withdrawal of liquidity) NOT rate hikes/cuts.

This is what the market is reacting to. Stocks now know that the era of easy money is over. The Fed is being run by a man who doesn’t see it has his job to create/sustain asset bubbles.

.....

Think of it this way, the era from 2008-2018 was a time in which stocks got bubbly, disconnecting from economic realities. Once Jerome Powell took the helm at the Fed, the markets slowly began to realize that this era is OVER. As a result, we’ve seen numerous asset classes begin to crash as their respective bubbles burst and they drop to price levels that are fundamentally sound.

Stocks are now going to play catch up. Oil has already broadcast that this stock market bounce won’t last.