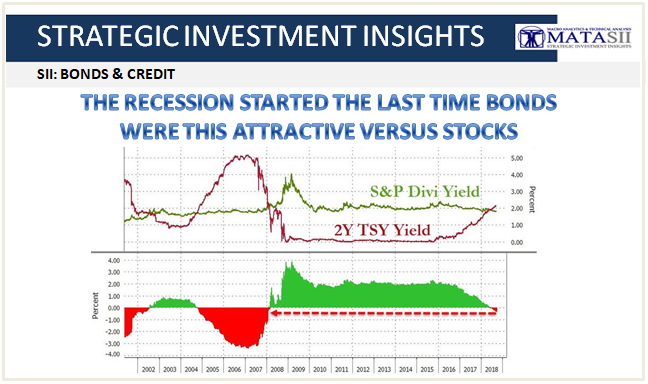

THE RECESSION STARTED THE LAST TIME BONDS WERE THIS ATTRACTIVE VERSUS STOCKS

-- SOURCE: 09-18-18 - "The Last Time Bonds Were This Attractive Vs Stocks, The Recession Started" --

The long-end of the Treasury yield curve is blowing out today: whether due to technicals, now that the 3% level has been breached, or amid expectations that (even more) Chinese stimulus in the coming weeks -arguably to offset the $200BN in tariffs slapped by Trump on China overnight - will prompt another modest reflationary wave around the globe, the 10Y yield has just hit session highs of 3.04%, and as Bloomberg's Andrew Cinko notes, the spread between the S&P's dividend yield and the 10Y yield has hit 124bps, the highest since July 2011 as the rise in the S&P has further pressured equity yields.

But it's not just the long end: the short end is looking increasingly attractive, with yields on 4, 13 and 26 week bills all trading above 2.00% for the first time since the financial crisis, after today's 4-week auction printed at 2.02%, the highest since February 2008.

Yet the one place on the yield curve where things are most interesting is the a little further to the right from "cash equivalent" Bills, namely the first coupon bond available, i.e., the 2Y note, whose yield today rose to 2.79%, the highest since January 2008. But more importantly, looking at the relative attraction of 2Y notes vs the S&P shows that with a spread of 36bps, the short end of the curve is now a better yield proposition than the S&P (which yields 1.81%).

In fact, as the chart below shows, the last time the yield spread was this generous in favor of bonds, was December 2007, which as some traders still around today may recall, is when the recession officially started.

To be sure, there is one key difference: in 2007 the TSY-S&P yield delta hit with 2Y Treasurys rising and the S&P sliding. This time around it's the opposite. On the other hand, with even front-end now increasingly more attractive than stocks to yield hunters, how long before there is a "great unrotation" - by pension and sovereign wealth funds - out of equities and into rates? With the S&P about to hit a new all time high, the answer probably won't be today.