THE UNHOLY TRINITY

AN UNHOLY TRINITY

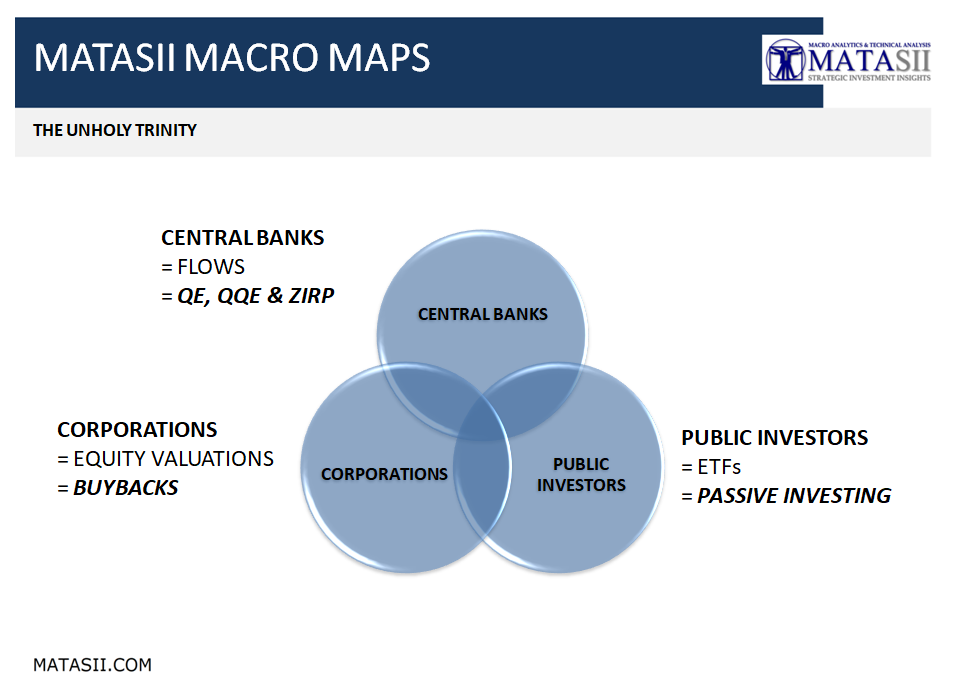

To fully appreciate the conundrum the Fed presently faces we need to understand the importance of three major activities operating independently yet intertwined in three different areas of investment influence.

- CENTRAL BANKS have been heavily committed to QE & ZIRP after the 2008 Financial Crisis. The has produced Credit & Liquidity which I will label FLOWS.

- CORPORATIONS have been heavily committed to Stock Buybacks since the advent of QE & ZIRP. These activities have fostered major movements in EQUITY VALUATIONS.

- PUBLIC INVESTORS have shifted from the use of Active Managers (ie Mutual Funds) to Investments vehicles using quick entry and exit ETF's which have become dominated by those tracking the major indexes or popular assets such as the FAANGS. This shift has fostered PASSIVE INVESTING.

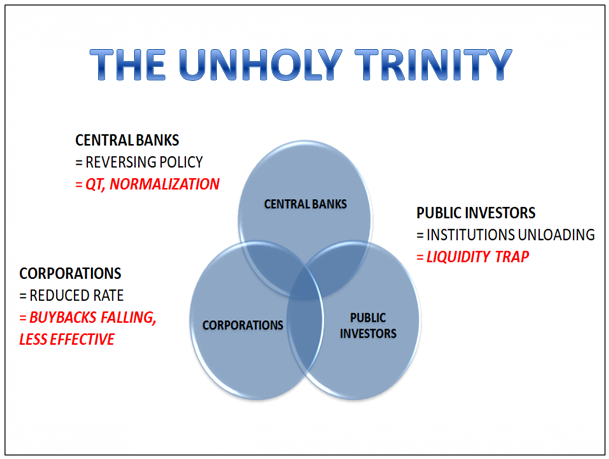

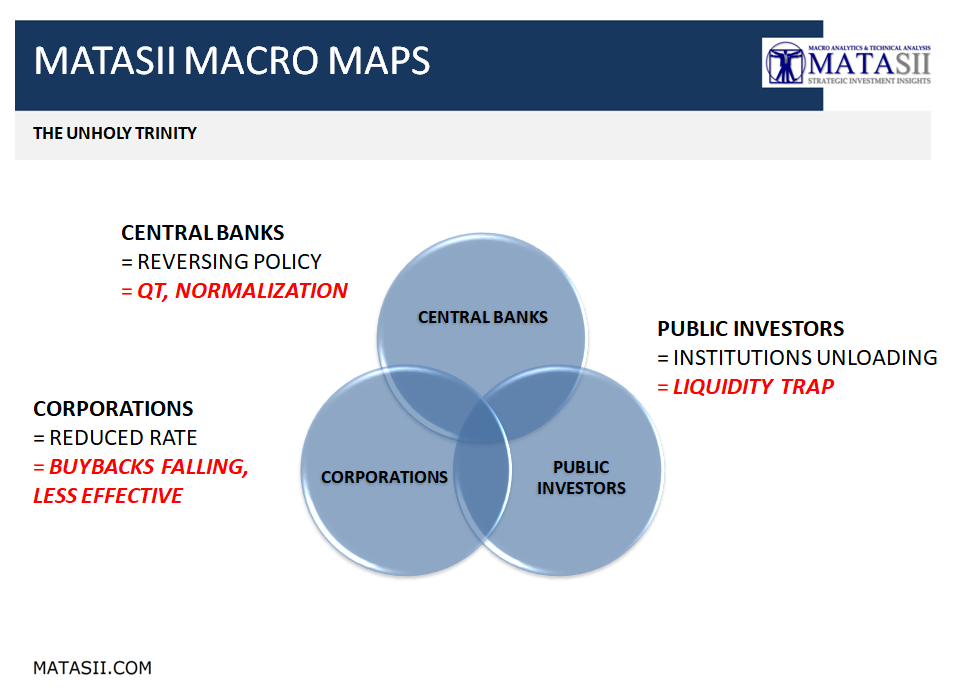

Unfortunately, the Unintended Consequences of these three entities has the potential to now create a perfect storm.

- CENTRAL BANKS are REVERSING POLICY to Quantitative Tightening (QT)

- CORPORATIONS are REDUCING THE RATE of Stock Buybacks,

- PUBLIC INVESTORS are heavily into Passive Instruments that may LACK LIQUIDITY if aggressive selling occurs which is specifically the reason they were bought in the first instance.

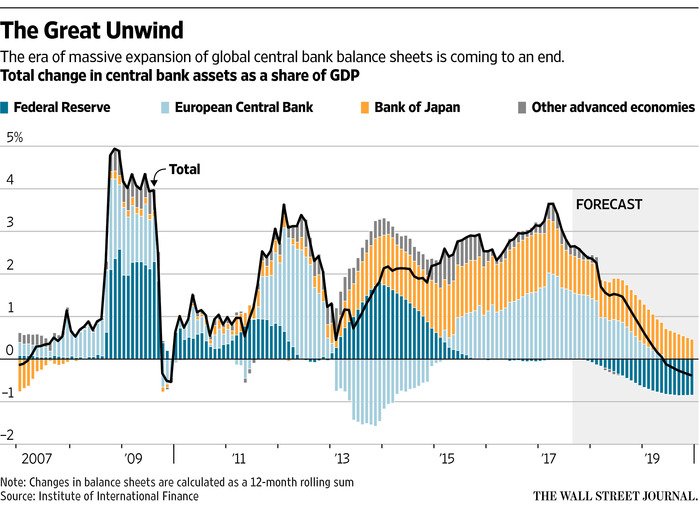

Consider the degree which these shifts are occurring:

- CENTRAL BANKERS: QE, QQE & ZIRP going to QT, Normalization

- CORPORATIONS: SHARE BUYBACKS now Falling & Affect being Reduced