TRADE WAR CONSUMER INFLATION DEAD AHEAD!

Our expectations now are for a bounce in the US 10Y Note towards a potential right shoulder on a yield basis (SEE: SII - BONDS AT CRITICAL TECHNICAL INFLECTION POINT WITH INFLATION PRESSURES LOOMING).

The unexpected reason for this will be inflation pressures, likely associated with:

- Tariff pressures on US Consumers,

- Shortage of foreign Treasury buyers as China and Japan further reduce their holdings,

- Slowing trade reducing currency reserve growth and

- The on-going De-Dollarization factors outlined in this years MATASII Thesis 2019 paper.

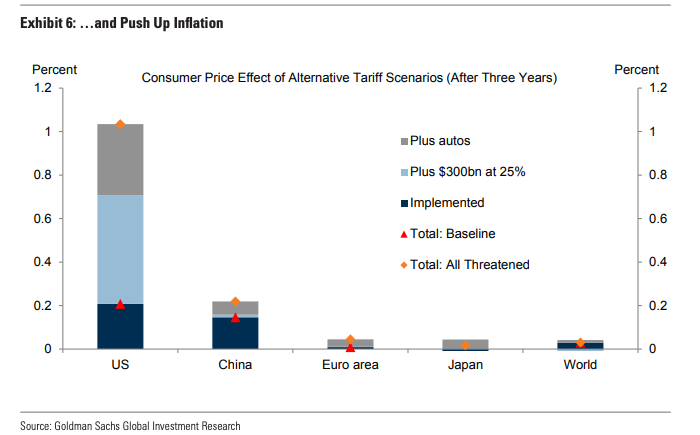

We have posted on all these points but haven't had the level of research detail on point #1 above we were searching for. Thanks to some recent work by Goldman Sachs on the impact of the US-China Trade War escalation we now have better data:

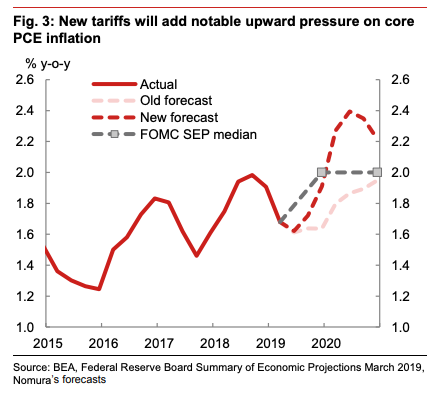

Separately on a trade war update, Nomura's North American economists wrote the following:

"We believe that the impact of the tariffs that are already in place – 25% on $34bn of imports imposed in July 2018; 25% on $16bn imposed in August 2018; and 10% on $200bn imposed in September 2018 – on consumer prices has largely materialized. The combined impact from the increase from 10% to 25% on $200bn in imports (tranche three) and the 25% tariff on the addition $300bn in imports (tranche four) is estimated to be large as the volume of imports subject to those changes accounts for about 20% of total US goods imports. Moreover, the composition of the fourth tranche is weighted more towards consumer goods relative to previous tranches. There appear to be few readily available alternative sources for many of the consumer goods included in the fourth tranche."

The bank does note that the effect on inflation from the tariffs won't be permanent, but it could be "substantial" in the near term.

[SITE INDEX -- MATA: DRIVERS - INFLATION]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: DRIVERS - INFLATION

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 05-25-19 - The Heisenberg Report - "Bonds Could Be The Fade Of A Lifetime"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.