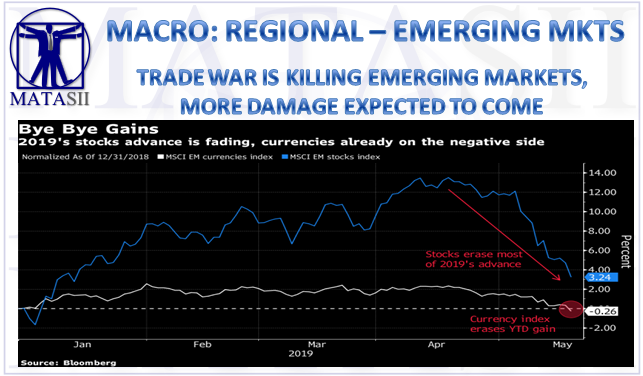

TRADE WAR IS KILLING EMERGING MARKETS - MORE DAMAGE EXPECTED TO COME

Another week, another leg of the emerging-market rout.

It has been a steady decline which has recently began to re-accelerate.

Bloomberg analysts have been reporting the following:

An MSCI gauge of developing-nation stocks slipped 3.7%, setting the stage for the worst month since October. It was even worse for currencies, which capped a fifth straight week of declines, erasing gains for the year.

The direction of emerging-market equities is “hanging in the balance of the global risk environment” and likely dependent on U.S.-China talks at least in the short term (Goldman Sachs strategists Caesar Maasry and Ron Gray wrote in a Friday note). “We continue to see the near-term risks for EM as tilted to the downside, and the risk of additional tariffs being implemented is rising. Comments from China’s state media suggest that the chances of further negotiations with the U.S. over trade issues are unlikely in the near term.” (Morgan Stanley strategists led by James Lord wrote in a Friday note).

“There is more volatility to come. There aren’t a whole lot of things that can support EM right now.” (Brendan McKenna, a currency strategist at Wells Fargo in New York.)

The back-and-forth of trade negotiations between the U.S. and China continues to be the main guide for markets as investors reassess the odds of a deal between the world’s two largest economies. The tone of the talks, which had seemingly improved late last week, soured again over the last few days after the White House barred companies deemed a national security threat from selling to the U.S. and threatened to blacklist Huawei Technologies Co. from buying essential components. On Friday, China’s state media signaled a lack of interest in resuming trade talks with the U.S.

“Investors have not turned significantly more bearish because most believe that the latest escalation in trade war tensions between the U.S. and China is merely a negotiating tactic to extract concessions ahead of a deal.” (Bank of America Merrill Lynch analysts Jane Brauer and Lucas Martin said in a Friday note).

[SITE INDEX -- MACRO: REGIONAL - EMERGING MARKETS]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MACRO: REGIONAL - EMERGING MARKETS

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS ABSTRACTED FROM:

INITIAL SOURCE: 04-12-19 - Bloomberg via Yahoo - "The Trade War Has Sunk Emerging Markets. There's More to Come."

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.