TRADE WAR REALITY: A LONG TERM BIFURCATED GLOBAL "COLD WAR" ECONOMY

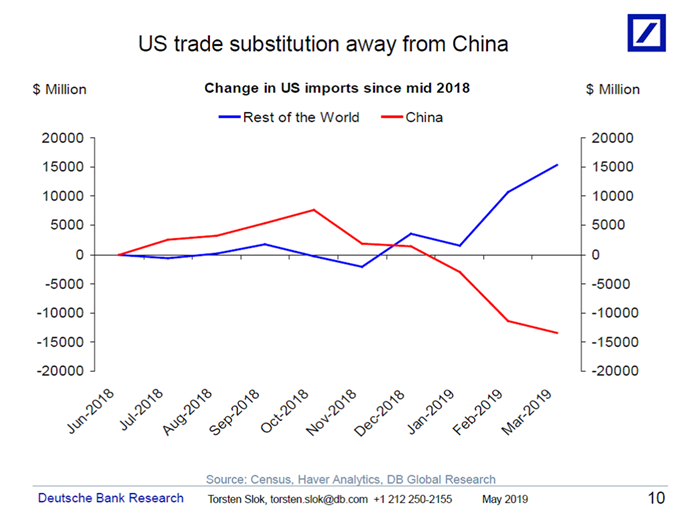

The new long-term reality is an increasingly and deliberately bifurcated global economy!

The US and its allies VERSUS China.

If it sounds familiar – it should in terms of 1945-89. The West won the last Cold War on the same basis – and the economic benefits accrued to the free capitalist states, a theme the Neocons are increasingly banding around. You just imagine the scene in the war room: “This is time Mr President..”

Expect to see this theme develop in coming months. This is no longer a trade spat – this is morphing into full economic war.

- The US is willing to take a short-term hit in the form of higher consumer prices, and welcome inflation, from Chinese imports until global supply chains re-adjust and new domestic and international lines open, knowing the long-term damage is limited.

- Meanwhile, the hit to China is long-term and directly on production, thus right across the economy right at the most difficult phase of economic transition. Chinese economists are talking about a 1-2% hit to GDP. I suspect much more plus increased domestic social and political tension. Xi is in more trouble than we think.

It may take longer than we think!

The two largest US imports from China left un-tariffed are Laptops and Mobiles – many now assume they are next on the list as the US strategy to Chinese pilfer of IP now seems to be driving a wedge between Occidental and Oriental tech. Maybe not – the damage has already been done… Firms are cancelling tech orders from Chinese firms.

But if you think how lucky you are not to own a Huawei, remember where your i-Phone was built.

[SITE INDEX -- TIPPING POINTS - CHINESE HARD LANDING]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS & PUBLIC ACCESS)

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS EXTRACTED FROM:

SOURCE: 05-23-19 - "Blain's Morning Porridge - May 23rd 2019 - Vote?"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.