TWO SMARTEST MARKETS: COPPER & BONDS ARE WARNING

One investor has a history of timing major market turns like no other.

He called the 2011 growth peak before anyone else. He nailed the 2016 bottom in risk assets. And he even timed the December bottom perfectly.

His name is Dr. Copper.

Because of its countless industrial uses, copper is more sensitive to economic growth or stagnation than any other asset class on the planet. Which is why investment legends (among them Stanley Druckenmiller, who is arguably the greatest investor of the last 30 years) watch Copper like a hawk.

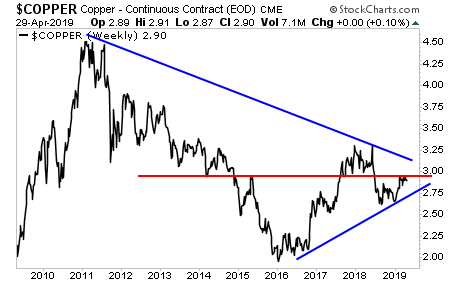

With that in mind, take a look at the long-term Copper chart. You’ll note that Copper hit its peak right at the top of the 2011-growth/inflation cycle. It also caught the bottom of the deflationary drop in January 2016. And it also peaked during the “synchronized growth” cycle of late 2018.

However, since that time, Copper has struggled. The industrial metal has tried repeatedly to mount a sustained rally, but cannot break out over long-term critical resistance (red line).

This is a BAD sign…

Simply put, Copper isn’t “buying” into the current “growth hype narrative” being spun by the media. If a great trade deal was coming between the US and China… if the world was going to re-enter a period of economic growth… if Central Banks were indeed about to bring us back into a new wave of inflation/ growth, Copper should be rallying strongly.

It’s not. In fact it’s struggling badly.

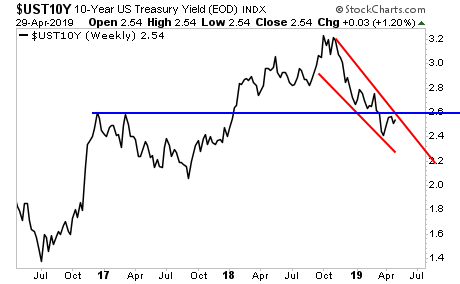

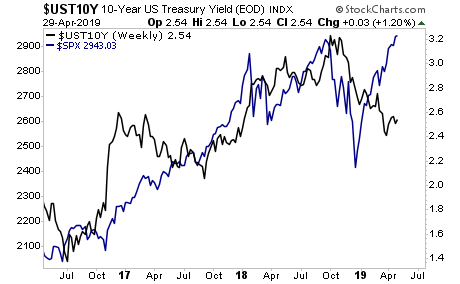

Now throw in the fact that US Treasury yields are in a clear downtrend, and have broken below critical support (blue line), and you’ve got TWO of the most important “growth” identifiers telling you that growth is very very weak right now.

Put simply, the SMART money is warning to WATCH OUT when it comes to growth. Meanwhile, stocks are rallying if an economic utopia is about to hit.

One of these is correct. Given what Copper and Bonds are saying, stocks are in for a VERY rude surprise soon.

And when that surprise hits, it’s going to be too late for investors who weren’t paying attention.

- Did you know the Fed is reviewing monetary policies so extreme that it didn’t use them when the 2008 crisis hit?

- Did you know the IMF is calling for nations around the world to introduce a wealth tax of 10% on NET WEALTH as soon as possible?

It’s all part of a nefarious plan the elites have been implementing for years.

[SITE INDEX -- MATA: DRIVERS - COMMODITIES]

READERS REFERENCE (SUBSCRIBERS-RESEARCH & PUBLIC ACCESS )

MATA: DRIVERS - COMMODITIES

MATASII RESEARCH ANALYSIS & SYNTHESIS WAS SOURCED FROM:

SOURCE: 04-30-19 - Graham Summers - "The Smartest Money in the World Is Warning to Watch Out"

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.