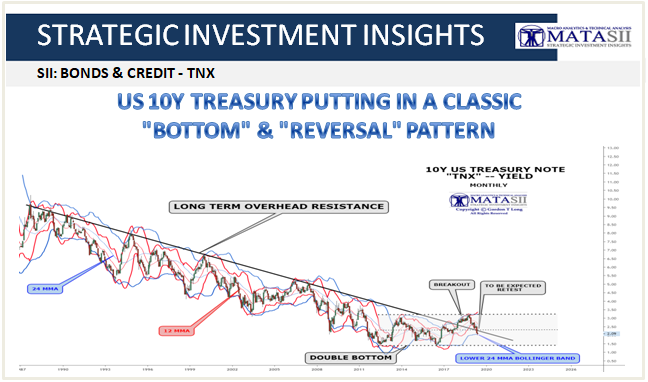

US 10Y TREASURY PUTTING IN A CLASSIC "BOTTOM" & "REVERSAL" PATTERN

After breaking through the TNX's long term overhead resistance we fully expected the long term overhead resistance to be tested since technically what was 'resistance' often becomes support after a breakout. Additionally, since the TNX was coming from its upper 12 & 24 MMA Bollinger bands it is not unusual to complete a "Bollinger Cross" in competing the retest. The TNX is exhibiting all the normal "bottoming" and "reversal" process characteristics.

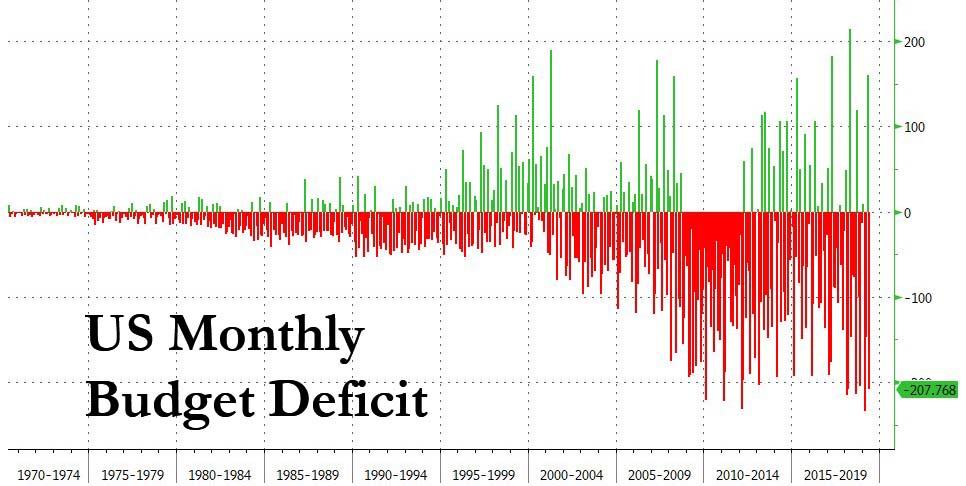

A retracement move of the downward trend since 1987 is both expected and overdue, especially considering the growing US Budget deficit and its dependency on foreign buyers.

Chart Courtesy of ZeroHedge

We see 10Y Note yields rising due to four potential drivers:

- Trade War Inflation Pressures,

- Heavy US Treasury Supply due to growing deficits,

- Weaker Foreign Buying

- Forced Liquidation of Entitlements held in US Treasuries.

There seems little doubt that over the next few years either US Treasury yields rise or the US Dollar falls or some combination of both!

[SITE INDEX -- SII - BONDS & CREDIT]

A PUBLIC SOURCED ARTICLE FOR MATASII

READERS REFERENCE: (SUBSCRIBERS-SII & PUBLIC ACCESS)

SII - BONDS & CREDIT

FAIR USE NOTICE This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a 'fair use' of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

NOTICE Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. MATASII.com does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.